Mezzanine financing in capital structure represents a hybrid form of capital that blends debt and equity characteristics. It typically involves subordinated debt or preferred equity instruments that rank below senior debt but above common equity. This form of capital is often used by companies seeking growth capital without diluting existing ownership significantly. A common example of mezzanine financing is a company issuing subordinated convertible notes to investors, which provide fixed interest payments along with the option to convert into equity. Such instruments offer higher returns compared to senior debt due to increased risk and typically include warrants or equity kickers. Mezzanine capital plays a crucial role in leveraged buyouts, acquisitions, and expansion projects by bridging the gap between senior debt and equity financing.

Table of Comparison

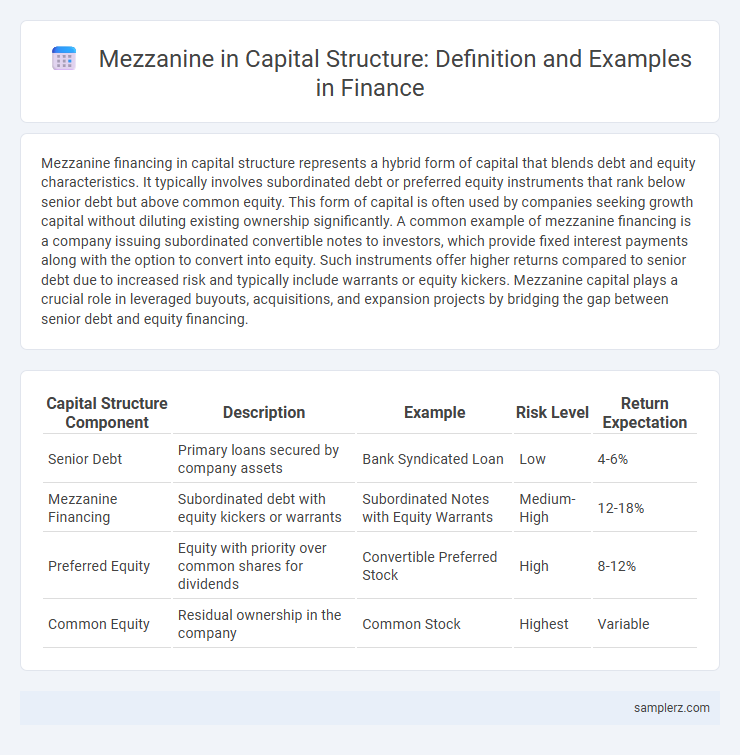

| Capital Structure Component | Description | Example | Risk Level | Return Expectation |

|---|---|---|---|---|

| Senior Debt | Primary loans secured by company assets | Bank Syndicated Loan | Low | 4-6% |

| Mezzanine Financing | Subordinated debt with equity kickers or warrants | Subordinated Notes with Equity Warrants | Medium-High | 12-18% |

| Preferred Equity | Equity with priority over common shares for dividends | Convertible Preferred Stock | High | 8-12% |

| Common Equity | Residual ownership in the company | Common Stock | Highest | Variable |

Introduction to Mezzanine Financing in Capital Structures

Mezzanine financing in capital structures typically involves subordinated debt or preferred equity that bridges the gap between senior debt and common equity, offering higher returns due to increased risk. This form of capital is often used by companies during expansion or acquisitions when traditional loans do not fully cover funding needs. Its placement in the capital stack allows mezzanine investors to receive interest payments and potential equity upside through warrants or conversion rights, enhancing overall portfolio diversification.

Core Components of a Typical Capital Structure

Mezzanine financing typically occupies the capital structure between senior debt and equity, blending characteristics of both through subordinated debt or preferred equity instruments. Core components of a typical capital structure include senior secured loans, mezzanine debt, and common equity, where mezzanine financing offers higher yields due to increased risk and often includes equity conversion features or warrants. This hybrid instrument supports growth funding while minimizing dilution, crucial for companies seeking expansion without sacrificing control.

Defining Mezzanine Debt: Key Characteristics

Mezzanine debt in a capital structure is a hybrid financing tool that combines elements of both debt and equity, typically subordinated to senior debt but senior to common equity. It often carries higher interest rates and includes warrants or conversion options, reflecting its increased risk and potential for equity upside. This form of capital fills the gap between debt and equity, providing companies with flexible funding for expansion or acquisitions without immediate dilution of ownership.

Common Examples of Mezzanine Instruments

Mezzanine financing typically includes subordinated debt, preferred equity, and convertible bonds, which bridge the gap between senior debt and common equity in a company's capital structure. Common examples of mezzanine instruments are subordinated notes that provide higher interest rates due to increased risk, preferred stock offering fixed dividends with limited voting rights, and convertible bonds that allow conversion into common shares under specific conditions. These instruments offer flexible financing solutions with equity upside potential, often used by private equity firms in leveraged buyouts or growth capital transactions.

Mezzanine Financing vs. Senior Debt: Critical Differences

Mezzanine financing in capital structure typically complements senior debt by providing subordinated capital with higher interest rates and equity-like features such as warrants or options. Unlike senior debt, which holds priority claims on assets and cash flows in case of default, mezzanine debt ranks below senior obligations but above equity, carrying increased risk and potential returns. This hybrid instrument bridges the gap between debt and equity, offering flexible terms that support growth while preserving ownership control.

Case Study: Real-World Application of Mezzanine Capital

Mezzanine capital played a pivotal role in the acquisition of Dell Technologies in 2013, where Michael Dell and Silver Lake Partners utilized a $1.4 billion mezzanine tranche to bridge the financing gap between senior debt and equity. This subordinated debt included equity warrants, offering lenders upside potential while maintaining manageable interest rates, enabling the leveraged buyout without excessive dilution. The Dell case exemplifies mezzanine financing's ability to leverage moderate risk for substantial returns in large-scale capital structuring.

Role of Mezzanine in Leveraged Buyouts (LBOs)

Mezzanine financing in leveraged buyouts (LBOs) typically bridges the gap between senior debt and equity, providing lenders with higher returns through subordinated debt or preferred equity instruments. This capital layer enhances the overall leverage capacity by offering flexible repayment terms and interest payments often structured as payment-in-kind (PIK) notes. Mezzanine debt plays a crucial role in optimizing the capital structure by reducing equity dilution while maintaining the necessary risk-adjusted returns for investors in buyout transactions.

Advantages and Risks of Using Mezzanine Financing

Mezzanine financing in capital structure offers companies the advantage of accessing substantial capital without diluting equity ownership, providing flexible repayment options and subordinated debt that enhances leverage capacity. However, it carries higher interest rates compared to senior debt and increases financial risk due to its unsecured nature and potential for triggering default clauses if cash flows decline. The balance between elevated returns for lenders and increased cost and complexity for borrowers requires careful assessment to optimize capital structure and growth potential.

Typical Investors in Mezzanine Capital Structures

Typical investors in mezzanine capital structures include private equity firms, hedge funds, and specialized mezzanine funds seeking higher returns through subordinated debt or preferred equity with equity kicker features. These investors accept higher risk than senior lenders in exchange for interest payments, equity participation, or warrants, often targeting returns ranging from 12% to 20% annually. Mezzanine financing bridges the gap between senior debt and equity, offering flexible capital solutions for mid-market companies undergoing growth or acquisitions.

Trends and Future Outlook for Mezzanine Financing

Mezzanine financing, positioned between senior debt and equity in capital structures, is increasingly favored for its flexible risk-return profile, particularly in middle-market buyouts and growth capital. Recent trends show a rise in institutional investor participation and tailored mezzanine debt structures that cater to companies seeking non-dilutive capital. Looking ahead, the mezzanine financing market is expected to grow as businesses pursue alternatives to traditional bank loans amid evolving economic uncertainties and regulatory changes.

example of mezzanine in capital structure Infographic

samplerz.com

samplerz.com