A carry trade in currency involves borrowing funds in a low-interest-rate currency and investing them in a high-interest-rate currency to profit from the interest rate differential. For example, an investor might borrow Japanese yen, which typically has near-zero interest rates, and convert the funds into Australian dollars, where interest rates are higher. The profit comes from earning more interest on the Australian dollars than the cost of borrowing yen, assuming exchange rates remain stable. Investors closely monitor data such as interest rate levels set by central banks like the Bank of Japan and the Reserve Bank of Australia. Exchange rate fluctuations between the Japanese yen and Australian dollar also play a critical role in the risk-return profile of a carry trade. Economic indicators including inflation rates, GDP growth, and trade balances influence both interest rates and currency values, impacting the carry trade's profitability.

Table of Comparison

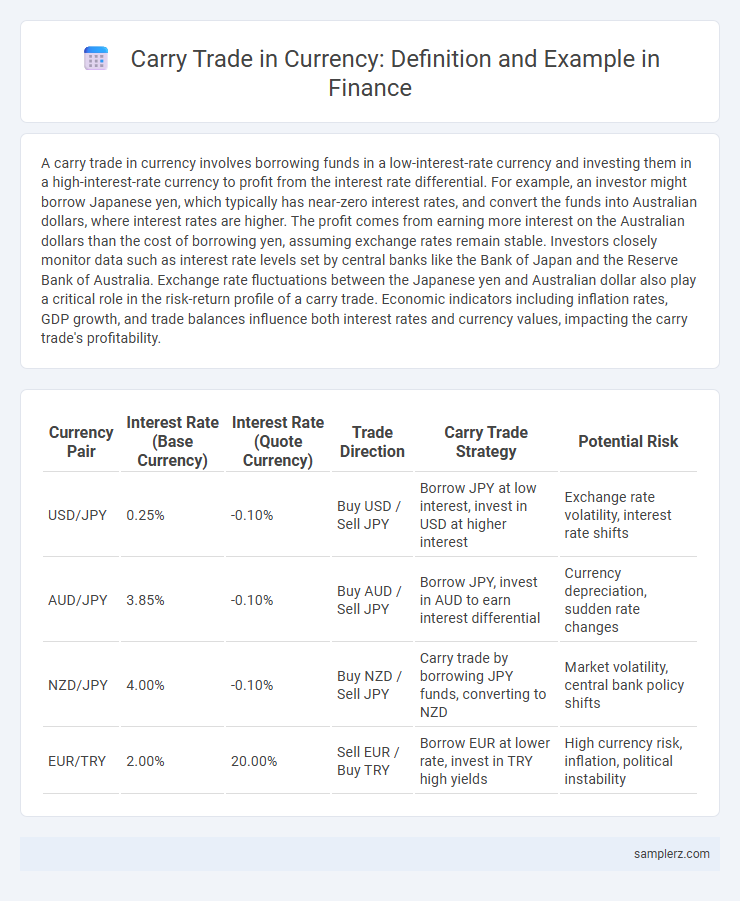

| Currency Pair | Interest Rate (Base Currency) | Interest Rate (Quote Currency) | Trade Direction | Carry Trade Strategy | Potential Risk |

|---|---|---|---|---|---|

| USD/JPY | 0.25% | -0.10% | Buy USD / Sell JPY | Borrow JPY at low interest, invest in USD at higher interest | Exchange rate volatility, interest rate shifts |

| AUD/JPY | 3.85% | -0.10% | Buy AUD / Sell JPY | Borrow JPY, invest in AUD to earn interest differential | Currency depreciation, sudden rate changes |

| NZD/JPY | 4.00% | -0.10% | Buy NZD / Sell JPY | Carry trade by borrowing JPY funds, converting to NZD | Market volatility, central bank policy shifts |

| EUR/TRY | 2.00% | 20.00% | Sell EUR / Buy TRY | Borrow EUR at lower rate, invest in TRY high yields | High currency risk, inflation, political instability |

Introduction to Currency Carry Trade

Currency carry trade involves borrowing funds in a low-interest-rate currency and investing in a high-interest-rate currency to capture the interest rate differential. For example, investors often borrow Japanese yen, known for its historically low rates, and convert it into Australian dollars, which typically offer higher yields. This strategy aims to profit from the spread while also being exposed to exchange rate fluctuations.

How Carry Trade Works in Forex Markets

Carry trade in forex markets involves borrowing a currency with a low-interest rate and investing in a currency offering a higher yield, capitalizing on the interest rate differential. Traders earn profit through the positive carry, where the interest earned from the higher-yielding currency exceeds the cost of the borrowed currency. This strategy thrives in stable market conditions with low volatility, but exposes investors to exchange rate risk that can offset gains if the target currency depreciates.

Key Currency Pairs Used in Carry Trade

The most popular currency pairs used in carry trade involve high-yield currencies such as the Australian Dollar (AUD), New Zealand Dollar (NZD), and Japanese Yen (JPY) as the funding currency due to their respective interest rate differentials. Traders typically borrow in low-interest rate currencies like JPY or Swiss Franc (CHF) and invest in higher-yield currencies such as AUD/USD or NZD/USD to capture the interest rate spread. The effectiveness of carry trades depends on stable exchange rates and economic conditions in the key currency pairs to maximize profit potential.

Historical Examples of Successful Carry Trades

The Japanese yen has frequently served as a funding currency in successful carry trades, especially during the low-interest-rate environment of the 1990s and early 2000s, where investors borrowed yen to invest in higher-yielding currencies like the Australian dollar and New Zealand dollar. The carry trade peaked before the 2008 financial crisis, generating substantial profits as interest rate differentials favored currencies with higher returns. Historical data reveals that periods of stable global economic growth and low volatility tend to enhance carry trade profitability by minimizing exchange rate risks.

The Yen Carry Trade: Case Study

The Yen Carry Trade involves borrowing Japanese yen at low interest rates to invest in higher-yielding foreign currencies, capitalizing on the interest rate differential. A notable case study is the mid-2000s when investors borrowed yen to purchase Australian dollars, profiting from Australia's higher rates and stable economy. Currency fluctuations and adjustments in interest rates remain critical risk factors impacting the profitability of the Yen Carry Trade.

Risks Associated with Currency Carry Trade

Currency carry trade involves borrowing in low-interest-rate currencies such as the Japanese yen to invest in higher-yielding currencies like the Australian dollar, aiming to profit from the interest rate differential. Risks associated with this strategy include exchange rate volatility, which can lead to significant losses if the funding currency appreciates sharply against the target currency. Interest rate fluctuations and sudden shifts in market sentiment may also trigger forced unwinding of positions, exacerbating financial exposure.

2008 Financial Crisis and Carry Trade Unwinding

During the 2008 Financial Crisis, the carry trade saw a massive unwinding as investors rapidly closed positions in high-yielding currencies like the Australian dollar and Brazilian real, shifting funds back to safe-haven currencies such as the US dollar and Japanese yen. This forced liquidation amplified currency volatility and caused sharp depreciations in emerging market currencies. Central banks responded with coordinated interventions and monetary easing to stabilize exchange rates and restore market liquidity.

Strategies for Implementing Carry Trade

Implementing carry trade strategies involves borrowing in low-interest-rate currencies like the Japanese yen or Swiss franc and investing in higher-yielding currencies such as the Australian dollar or New Zealand dollar. Effective risk management techniques include setting stop-loss orders and using options to hedge against currency volatility. Monitoring macroeconomic indicators like interest rate differentials and central bank policies enhances the timing and success of carry trade positions.

Impact of Central Bank Policies on Carry Trade

Central bank policies, such as interest rate decisions and quantitative easing, directly influence carry trade profitability by altering interest rate differentials between currencies. For example, if the Federal Reserve raises US interest rates while the Bank of Japan maintains ultra-low rates, investors borrow in yen and invest in higher-yielding dollar assets, amplifying carry trade flows. Unexpected shifts in central banks' monetary stance often trigger rapid unwinding of carry trades, leading to increased currency market volatility.

Future Trends in Currency Carry Trading

Currency carry trading involves borrowing low-interest-rate currencies and investing in higher-yielding ones, exemplified by historically popular pairs like the Japanese yen funded carry to the Australian dollar. Future trends in currency carry trading suggest increased volatility due to shifting central bank policies and geopolitical risks, prompting sophisticated risk management strategies. Emerging market currencies may present both opportunities and risks, influenced by evolving macroeconomic fundamentals and capital flow dynamics.

example of carry trade in currency Infographic

samplerz.com

samplerz.com