A step-up bond is a type of fixed-income security where the interest rate increases at predetermined intervals throughout the bond's life. For example, a company might issue a 10-year bond starting with a 3% coupon rate for the first three years, then stepping up to 4% for the next four years, and finally increasing to 5% for the last three years. This structured increase in interest payments helps issuers attract investors by matching rising market rates or inflation expectations. Investors benefit from step-up bonds because rising coupon payments provide a hedge against interest rate risk and inflation. These bonds often appeal to investors seeking predictable income growth over time. Data shows that step-up bonds can offer higher yields compared to standard fixed-rate bonds, making them a valuable addition to a diversified portfolio in changing economic conditions.

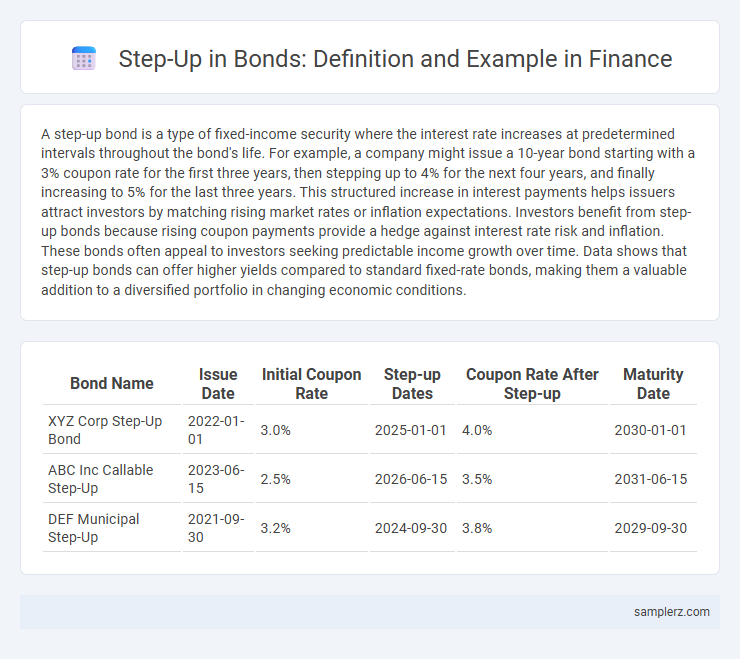

Table of Comparison

| Bond Name | Issue Date | Initial Coupon Rate | Step-up Dates | Coupon Rate After Step-up | Maturity Date |

|---|---|---|---|---|---|

| XYZ Corp Step-Up Bond | 2022-01-01 | 3.0% | 2025-01-01 | 4.0% | 2030-01-01 |

| ABC Inc Callable Step-Up | 2023-06-15 | 2.5% | 2026-06-15 | 3.5% | 2031-06-15 |

| DEF Municipal Step-Up | 2021-09-30 | 3.2% | 2024-09-30 | 3.8% | 2029-09-30 |

Understanding Step-Up Bonds: Definition and Key Features

Step-up bonds feature a coupon rate that increases at predetermined intervals, providing investors with gradually rising interest payments over the bond's life. This structure helps issuers attract investors by offering protection against rising interest rates and inflation. Understanding the fixed schedule of coupon increases and the impact on bond yield is crucial for evaluating investment potential in step-up bonds.

How Step-Up Bonds Work: A Practical Overview

Step-up bonds feature coupon rates that increase at predetermined intervals, providing investors with rising income aligned to market interest rates. Issuers often structure these bonds with fixed initial coupons, followed by step-ups that compensate for inflation or credit risk changes over time. This mechanism enhances bond attractiveness by offering predictable payment growth, reducing reinvestment risk for bondholders.

Real-World Examples of Step-Up Bond Structures

Step-up bonds issued by companies like General Electric and Ford demonstrate practical applications of gradually increasing coupon rates to attract investors in volatile interest rate environments. These bonds typically start with a lower interest rate that steps up annually, aligning with market expectations and offering rising income streams to bondholders. Real-world step-up structures enhance issuer flexibility by managing refinancing risks while providing investors with predictable, improving yields over the bond's life.

Step-Up Bond vs. Fixed-Rate Bond: A Comparative Analysis

Step-up bonds feature interest rates that increase at predetermined intervals, providing investors with rising income streams aligned with inflation or credit improvements, unlike fixed-rate bonds which pay a consistent interest rate throughout the term. This structure allows step-up bonds to potentially offer higher yields over time while managing reinvestment risk and inflation exposure. Investors seeking predictable cash flows may prefer fixed-rate bonds, whereas those anticipating rate hikes might benefit from the incremental coupon increases inherent in step-up bonds.

Typical Scenarios for Issuing Step-Up Bonds

Step-up bonds are typically issued in scenarios where issuers anticipate rising interest rates, allowing them to start with lower coupon payments that increase over time, aligning with future market conditions. Corporations use step-up bonds to manage cash flow flexibility during initial periods, gradually increasing interest costs as earnings stabilize. Governments may issue step-up bonds to attract investors seeking progressive income, especially in uncertain economic environments where gradual rate increases mitigate refinancing risks.

Investor Advantages: Why Choose Step-Up Bonds?

Step-up bonds offer investors increasing interest rates over time, providing protection against rising inflation and interest rates. These bonds enhance cash flow predictability and potential yield, making them attractive for long-term income planning. The incremental coupon payments improve portfolio diversification and reduce reinvestment risk compared to fixed-rate bonds.

Step-Up Bond Risks and Considerations

Step-up bonds carry interest rate risk as their coupons increase over time, potentially leading investors to hold lower-yielding bonds initially and face reinvestment risk at higher rates later. Credit risk is also critical since issuer creditworthiness may deteriorate, affecting bond value despite rising coupons. Market liquidity can be limited for step-up bonds, complicating timely sales and impacting returns.

Case Study: Corporate Step-Up Bond Example

A corporate step-up bond issued by XYZ Corporation features a coupon rate starting at 3% for the first three years, increasing to 4% for the subsequent two years, and finally reaching 5% for the remaining five years, incentivizing investors with rising income over time. This structured increase aligns with the company's projected earnings growth and interest rate environment, reducing refinancing risk while maintaining investor appeal. The bond's pricing reflected market expectations, trading at par value due to its competitive step-up schedule and strong corporate credit rating of BBB+.

Step-Up Bonds in Government Debt Instruments

Step-up bonds in government debt instruments feature gradually increasing coupon rates over the bond's tenure, providing investors with rising interest payments that counteract inflation and interest rate risks. For instance, a 10-year government step-up bond may start with a 2% coupon rate, stepping up by 0.5% every two years, incentivizing long-term investment while enabling predictable cash flow. This structure enhances government borrowing flexibility by attracting diverse investor profiles seeking stable yet growing returns in fixed income portfolios.

Interest Rate Environments Favoring Step-Up Bonds

Step-up bonds perform well in rising interest rate environments where issuers increase coupon payments at predetermined intervals, providing investors with higher yields compared to fixed-rate bonds. These bonds attract investors seeking protection against inflation and interest rate risk by gradually adjusting returns in response to economic shifts. In volatile markets, step-up bonds offer enhanced income potential without exposing holders to the full impact of immediate rate hikes.

example of step-up in bond Infographic

samplerz.com

samplerz.com