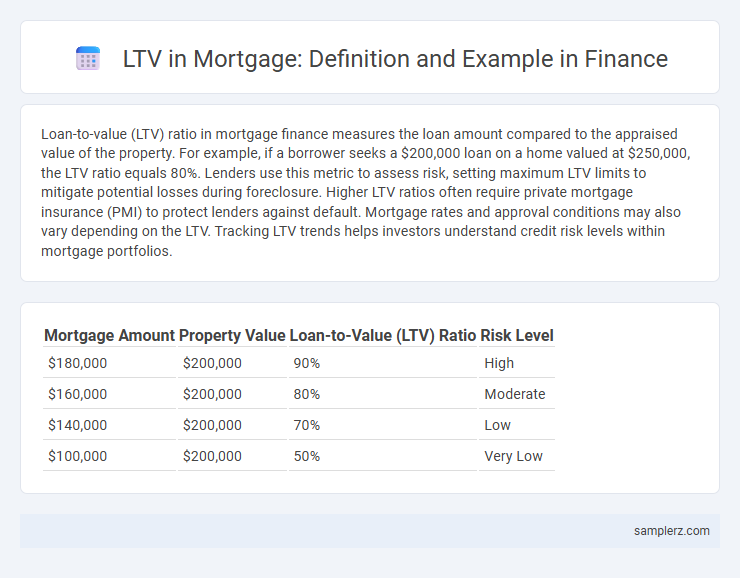

Loan-to-value (LTV) ratio in mortgage finance measures the loan amount compared to the appraised value of the property. For example, if a borrower seeks a $200,000 loan on a home valued at $250,000, the LTV ratio equals 80%. Lenders use this metric to assess risk, setting maximum LTV limits to mitigate potential losses during foreclosure. Higher LTV ratios often require private mortgage insurance (PMI) to protect lenders against default. Mortgage rates and approval conditions may also vary depending on the LTV. Tracking LTV trends helps investors understand credit risk levels within mortgage portfolios.

Table of Comparison

| Mortgage Amount | Property Value | Loan-to-Value (LTV) Ratio | Risk Level |

|---|---|---|---|

| $180,000 | $200,000 | 90% | High |

| $160,000 | $200,000 | 80% | Moderate |

| $140,000 | $200,000 | 70% | Low |

| $100,000 | $200,000 | 50% | Very Low |

Understanding LTV in Mortgage Financing

Loan-to-Value (LTV) in mortgage financing measures the ratio of the loan amount to the appraised value of the property, typically expressed as a percentage. For example, a $180,000 mortgage on a home valued at $200,000 results in a 90% LTV, indicating the borrower is financing 90% of the property's value. Understanding LTV helps lenders assess risk and determines eligibility for various loan programs and interest rates.

Basic Calculation of LTV: A Mortgage Example

Loan-to-Value (LTV) in a mortgage is calculated by dividing the loan amount by the property's appraised value or purchase price, whichever is lower. For instance, if a borrower takes a $180,000 mortgage to buy a home valued at $200,000, the LTV ratio is 90% ($180,000 / $200,000). This ratio helps lenders assess risk, with lower LTVs typically qualifying for better interest rates.

Real-World Mortgage LTV Scenario

A real-world mortgage loan-to-value (LTV) ratio example involves a borrower purchasing a home valued at $400,000 with a $80,000 down payment and a $320,000 mortgage loan, resulting in an LTV of 80%. This LTV ratio is crucial for lenders to assess risk, as lower LTVs often qualify for better interest rates and reduce the likelihood of mortgage insurance requirements. Monitoring changes in property value and outstanding loan balance regularly influences refinancing decisions and portfolio risk management.

How Down Payments Impact LTV Ratios

Down payments directly influence Loan-to-Value (LTV) ratios by reducing the loan amount relative to the property's appraised value. For instance, a $20,000 down payment on a $200,000 home results in a 90% LTV ratio, indicating less risk for lenders. Lower LTV ratios often lead to better mortgage rates and reduced private mortgage insurance (PMI) costs, emphasizing the financial benefits of significant down payments.

LTV Example: Conventional vs. FHA Loans

Loan-to-Value (LTV) ratio for conventional mortgages typically maxes out at 80% without private mortgage insurance, meaning borrowers must make a down payment of 20%. FHA loans allow higher LTVs, often up to 96.5%, requiring a much lower down payment of 3.5%, which benefits buyers with limited savings. This contrast highlights how LTV impacts borrowing capacity and insurance requirements in mortgage financing.

Sample LTV Calculation for First-Time Homebuyers

A first-time homebuyer with a $250,000 property price and a $50,000 down payment has a Loan-to-Value (LTV) ratio of 80%, calculated by dividing the loan amount ($200,000) by the property value ($250,000). An LTV ratio of 80% is typically the maximum limit for conventional mortgage loans without private mortgage insurance (PMI). Understanding this ratio helps buyers determine eligibility and potential mortgage costs.

LTV Example: Refinancing an Existing Mortgage

A borrower with an existing mortgage balance of $150,000 and a current home value of $250,000 has an LTV ratio of 60%. When refinancing, lenders assess this LTV to determine loan eligibility and interest rates, often requiring the ratio to stay below 80% for favorable terms. For example, refinancing for $180,000 results in an LTV of 72%, reflecting lower risk compared to higher ratios.

Impact of Home Appraisal on Mortgage LTV

Home appraisal directly influences mortgage loan-to-value (LTV) by determining the property's market value, which serves as the denominator in the LTV ratio calculation. A higher appraisal value reduces the LTV, potentially qualifying borrowers for better interest rates or eliminating the need for private mortgage insurance (PMI). Conversely, a lower appraisal increases the LTV, which may lead to higher borrowing costs or require a larger down payment to meet lender requirements.

Mortgage Insurance Requirements by LTV Example

Mortgage insurance requirements typically become mandatory when the loan-to-value (LTV) ratio exceeds 80%. For example, a borrower with a $200,000 home value and a $170,000 loan has an LTV of 85%, triggering private mortgage insurance (PMI) obligations. Lenders use this threshold to mitigate risk, ensuring coverage when the down payment falls below 20% of the property's appraised value.

LTV Example: Loan Denial and Approval Thresholds

A loan-to-value (LTV) ratio of 80% or below often meets mortgage approval thresholds because it indicates lower risk for lenders, while an LTV above 95% typically triggers loan denial due to higher default probability. For example, a $300,000 home with a $240,000 mortgage results in an 80% LTV, meeting common approval requirements. Lenders use these LTV thresholds to balance potential losses and compliance with underwriting standards.

example of LTV in mortgage Infographic

samplerz.com

samplerz.com