Prepayment in mortgage refers to the early repayment of a loan or part of the principal before the scheduled due date. This financial action allows borrowers to reduce their outstanding loan balance, decreasing the overall interest paid over the loan term. Lenders may charge a prepayment penalty to compensate for the loss of anticipated interest income. An example of mortgage prepayment occurs when a homeowner decides to pay an extra $500 monthly towards their loan principal. If the original mortgage balance was $200,000 with a 30-year term, the added payments can significantly shorten the loan duration. This strategy helps accumulate equity faster and lowers total interest expenses, providing financial flexibility to the borrower.

Table of Comparison

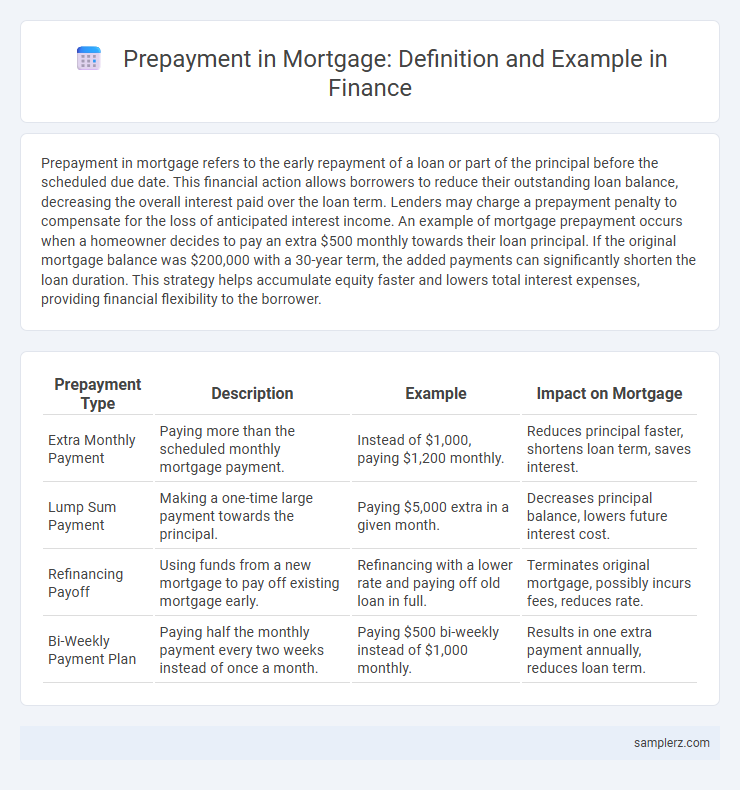

| Prepayment Type | Description | Example | Impact on Mortgage |

|---|---|---|---|

| Extra Monthly Payment | Paying more than the scheduled monthly mortgage payment. | Instead of $1,000, paying $1,200 monthly. | Reduces principal faster, shortens loan term, saves interest. |

| Lump Sum Payment | Making a one-time large payment towards the principal. | Paying $5,000 extra in a given month. | Decreases principal balance, lowers future interest cost. |

| Refinancing Payoff | Using funds from a new mortgage to pay off existing mortgage early. | Refinancing with a lower rate and paying off old loan in full. | Terminates original mortgage, possibly incurs fees, reduces rate. |

| Bi-Weekly Payment Plan | Paying half the monthly payment every two weeks instead of once a month. | Paying $500 bi-weekly instead of $1,000 monthly. | Results in one extra payment annually, reduces loan term. |

Understanding Prepayment in Mortgages

Prepayment in mortgages occurs when a borrower pays off part or all of their loan ahead of schedule, reducing the principal balance and interest costs over time. For example, if a homeowner makes an extra $5,000 payment towards their mortgage principal, they shorten the loan term and lower total interest paid. Understanding prepayment benefits borrowers by highlighting opportunities to save money and build equity faster in home financing.

Common Examples of Mortgage Prepayment

Common examples of mortgage prepayment include making extra monthly payments beyond the required amount, paying a lump sum toward the principal balance, and refinancing to a shorter loan term. These strategies reduce the total interest paid over the life of the loan and shorten the mortgage duration. Borrowers often use bonuses, tax refunds, or savings to accelerate mortgage payoff.

Lump Sum Payment: An Effective Prepayment Method

Lump sum payments allow mortgage borrowers to reduce their principal balance significantly, resulting in lower interest costs over the loan term. By applying a large, one-time payment directly to the outstanding mortgage, homeowners can shorten the amortization period and increase equity faster. This prepayment strategy is particularly effective for high-interest mortgages or when receiving unexpected funds like bonuses or tax refunds.

Biweekly Payments vs. Monthly Payments

Making biweekly payments on a mortgage accelerates loan repayment by effectively making one extra monthly payment each year, reducing interest costs and shortening the loan term. Compared to monthly payments, biweekly payments decrease the outstanding principal more rapidly, leading to substantial interest savings over the life of the loan. Homeowners utilizing biweekly payment plans can pay off a 30-year mortgage in approximately 25 years, enhancing financial flexibility and equity accumulation.

Extra Principal Payments Each Month

Making extra principal payments each month on a mortgage reduces the loan's principal balance faster, decreasing the total interest paid over the life of the loan. For example, adding $200 to the regular monthly payment on a $300,000 mortgage with a 4% interest rate can cut years off the loan term and save tens of thousands in interest costs. This strategy accelerates equity buildup and can lead to significant financial savings.

Refinancing as a Form of Prepayment

Refinancing a mortgage is a common form of prepayment where borrowers replace an existing loan with a new one, often to secure a lower interest rate or better terms. This process effectively reduces the outstanding principal balance more rapidly than scheduled monthly payments. Refinancing can lead to significant interest savings over the life of the loan and shorten the mortgage term.

Impact of Prepayment on Mortgage Interest

Prepayment on a mortgage reduces the principal balance faster, directly decreasing the total interest paid over the life of the loan. This accelerated payment shortens the loan term, resulting in significant savings by minimizing future interest accrual. Borrowers can leverage prepayments to build equity more quickly and improve their overall financial flexibility.

Case Study: Early Mortgage Payoff Success Stories

Homeowners who made substantial prepayments on their mortgage principal significantly reduced interest costs and shortened loan terms. Case studies reveal that borrowers committing to biweekly payments or lump-sum contributions accelerated mortgage payoff by 5 to 7 years, saving thousands in interest. These early payoff strategies improve financial stability and free up funds for investment or other priorities.

Prepayment Penalties: What Borrowers Should Know

Prepayment penalties in mortgage agreements are fees charged to borrowers who pay off their loan early, often within the first few years of the loan term. These penalties can range from 2% to 5% of the remaining principal balance, significantly impacting borrowers' ability to save on interest costs through early repayment. Understanding the specific terms and duration of prepayment penalties is crucial for borrowers to avoid unexpected expenses and make informed financial decisions regarding refinancing or selling their property.

Tips for Maximizing Mortgage Prepayment Benefits

Making extra payments toward your mortgage principal can significantly reduce the loan term and total interest paid. Prioritize prepayments on high-interest loans and confirm with your lender that there are no prepayment penalties. Consistently allocating additional funds or making biweekly payments enhances equity building and accelerates mortgage payoff.

example of prepayment in mortgage Infographic

samplerz.com

samplerz.com