A contingent value right (CVR) in a merger is a financial instrument that provides shareholders with additional compensation based on the achievement of specific future events or milestones. In the merger between Pfizer and BioNTech, shareholders of BioNTech received CVRs tied to the successful development and approval of new vaccine variants. These CVRs ensured that investors could benefit from the potential upside linked to the ongoing innovation and market performance of the combined entity. CVRs often depend on quantitative targets such as revenue thresholds, regulatory approvals, or clinical trial results, which influence the final payout. In the acquisition of Allergan by AbbVie, CVRs were structured to reward Allergan shareholders if certain drug sales or patent approvals were realized within a defined period. This approach aligns the interests of both companies and shareholders by linking post-merger compensation to measurable business outcomes.

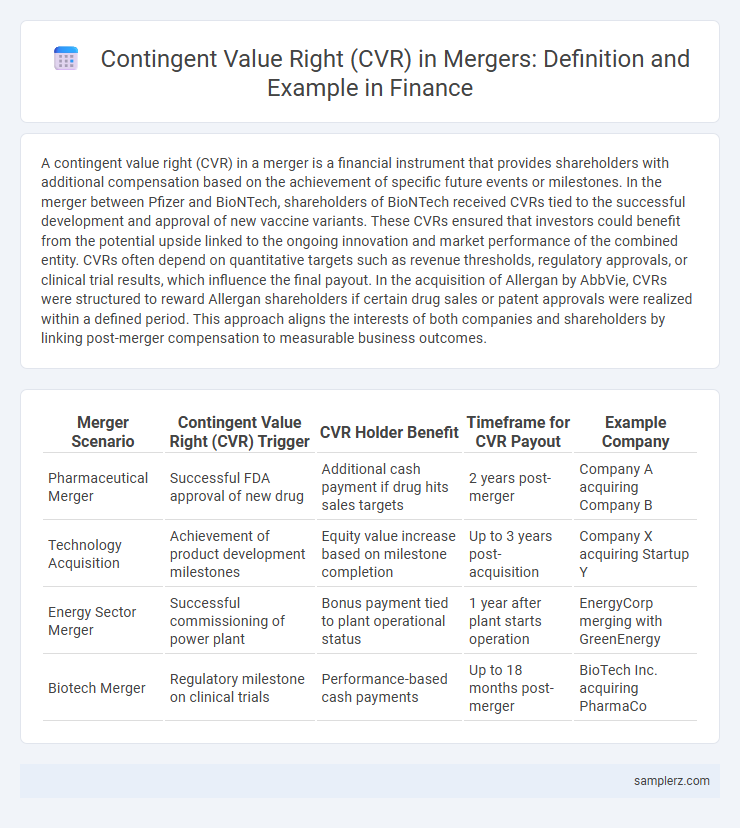

Table of Comparison

| Merger Scenario | Contingent Value Right (CVR) Trigger | CVR Holder Benefit | Timeframe for CVR Payout | Example Company |

|---|---|---|---|---|

| Pharmaceutical Merger | Successful FDA approval of new drug | Additional cash payment if drug hits sales targets | 2 years post-merger | Company A acquiring Company B |

| Technology Acquisition | Achievement of product development milestones | Equity value increase based on milestone completion | Up to 3 years post-acquisition | Company X acquiring Startup Y |

| Energy Sector Merger | Successful commissioning of power plant | Bonus payment tied to plant operational status | 1 year after plant starts operation | EnergyCorp merging with GreenEnergy |

| Biotech Merger | Regulatory milestone on clinical trials | Performance-based cash payments | Up to 18 months post-merger | BioTech Inc. acquiring PharmaCo |

Definition and Overview of Contingent Value Rights (CVRs)

Contingent Value Rights (CVRs) are financial instruments issued in mergers or acquisitions to provide shareholders with potential future compensation based on specific post-transaction events or milestones. CVRs offer a structured way to bridge valuation gaps by tying additional payments to outcomes like regulatory approvals, revenue targets, or product development achievements. This mechanism helps balance risk between buyers and sellers, ensuring fair value realization contingent on uncertain future conditions.

Importance of CVRs in Mergers and Acquisitions

Contingent value rights (CVRs) play a crucial role in mergers and acquisitions by providing a mechanism to bridge valuation gaps between buyers and sellers, especially when future performance of the target company is uncertain. CVRs align interests by granting shareholders additional compensation contingent on achieving specific financial milestones, such as revenue targets or regulatory approvals. This risk-sharing tool enhances deal flexibility and can facilitate smoother negotiations in complex transactions.

Notable Examples of CVRs in Recent Merger Deals

Notable examples of contingent value rights (CVRs) in recent merger deals include the AbbVie-Allergan acquisition, where CVRs were issued to address potential outcomes related to product approvals. In the Bristol-Myers Squibb and Celgene merger, CVRs provided additional compensation contingent on the successful commercialization of pipeline drugs. These CVRs help bridge valuation gaps by linking part of the deal consideration to future performance metrics and regulatory milestones.

Case Study: Bristol-Myers Squibb and Celgene Merger CVR

The Bristol-Myers Squibb and Celgene merger included a Contingent Value Right (CVR) designed to compensate Celgene shareholders if future drug approvals met specific revenue milestones. This CVR structure tied payouts to the commercial success of key oncology drugs like luspatercept and liso-cel, aligning shareholder interests with post-merger performance. The deal highlighted how CVRs can manage valuation uncertainties in pharmaceutical mergers by linking compensation to clinical and regulatory outcomes.

How Contingent Value Rights Protect Shareholders

Contingent Value Rights (CVRs) in mergers provide shareholders with additional compensation if the acquiring company's future performance meets specified milestones, protecting them from undervaluation risks at the deal's closing. CVRs align shareholder interests with post-merger success by offering payouts contingent on financial targets, regulatory approvals, or product developments. This mechanism ensures shareholders capture potential upside while limiting downside exposure in uncertain merger outcomes.

Structuring CVRs in Merger Agreements

Structuring Contingent Value Rights (CVRs) in merger agreements typically involves setting clear performance milestones, such as revenue targets or regulatory approvals, that trigger future payments to sellers. CVRs often include specific payout formulas tied to these milestones, ensuring alignment of interests between parties and mitigating buyer risk. Legal provisions also address dispute resolution and timelines for CVR claims, optimizing clarity and enforceability in post-merger financial arrangements.

Regulatory Considerations for CVRs in M&A Transactions

In M&A transactions, contingent value rights (CVRs) often face scrutiny from regulatory bodies like the SEC and antitrust authorities to ensure compliance with securities laws and fair market practices. Regulatory considerations include disclosure requirements for CVR terms, valuation transparency, and the potential impact on shareholder rights during the merger process. Proper regulatory adherence mitigates legal risks and supports smooth transaction approval by addressing issues such as CVR transferability and tax implications.

Potential Risks and Rewards Associated with CVRs

Contingent Value Rights (CVRs) in mergers present potential rewards such as additional payments tied to future performance milestones or regulatory approvals, aligning seller and buyer interests. However, CVRs carry risks including valuation uncertainty, dependence on unpredictable market conditions, and the challenge of enforcing payout terms if performance targets are not met. Investors must carefully assess the probability of achieving specified milestones and the legal enforceability of CVR agreements to balance these risks and benefits.

Market Impact of Announcing CVR-Protected Mergers

The announcement of contingent value right (CVR)-protected mergers often leads to significant market reactions, reflecting investor sentiment about the deal's future value. Stock prices of the acquiring company may experience volatility as the market assesses the potential payouts linked to CVRs, which depend on achieving specified milestones or financial targets. Studies show that CVR-protected mergers can increase deal attractiveness by reducing risk for shareholders, thereby impacting market capitalization and trading volume around the announcement date.

Future Trends in the Use of CVRs in Finance

Contingent value rights (CVRs) are increasingly integrated into merger agreements to address valuation uncertainties and align interests between buyers and sellers. Emerging trends indicate a rise in performance-based CVRs linked to milestone achievements, especially in biotechnology and tech sectors, enhancing risk sharing and potential upside. Enhanced regulatory clarity and the adoption of blockchain technology for CVR administration are expected to streamline tracking and enforcement in future financial transactions.

example of contingent value right in merger Infographic

samplerz.com

samplerz.com