Bonds are fixed-income securities that represent loans made by investors to borrowers, typically corporations or governments. Each bond has key attributes such as face value, coupon rate, maturity date, and credit rating provided by agencies like Moody's or S&P. Investors receive periodic interest payments, known as coupons, until the bond matures and the principal is repaid. Bond markets include various types such as treasury bonds, municipal bonds, and corporate bonds, each with different risk and return profiles. Key metrics for bond analysis include yield to maturity (YTM), duration, and convexity, which help measure returns and sensitivity to interest rate changes. Trading volumes, credit spreads, and macroeconomic indicators like inflation and GDP growth also significantly impact bond pricing and investor demand.

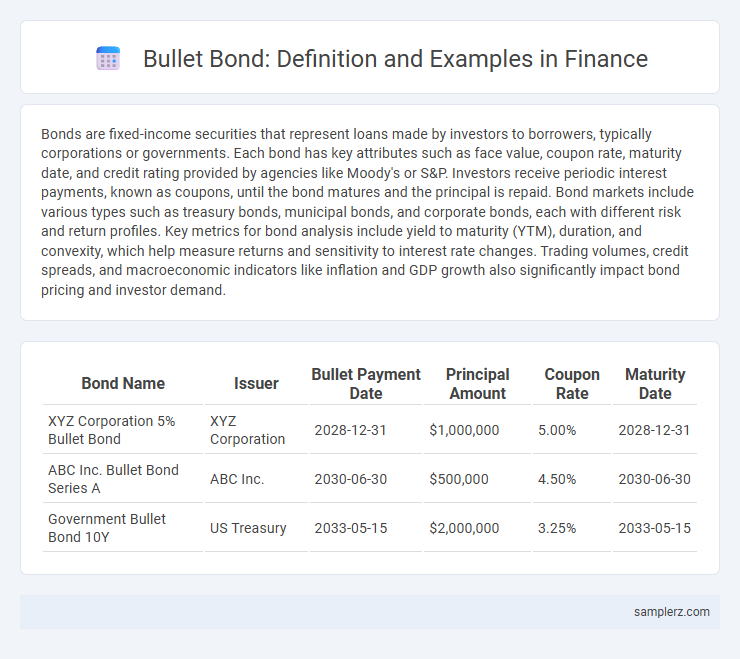

Table of Comparison

| Bond Name | Issuer | Bullet Payment Date | Principal Amount | Coupon Rate | Maturity Date |

|---|---|---|---|---|---|

| XYZ Corporation 5% Bullet Bond | XYZ Corporation | 2028-12-31 | $1,000,000 | 5.00% | 2028-12-31 |

| ABC Inc. Bullet Bond Series A | ABC Inc. | 2030-06-30 | $500,000 | 4.50% | 2030-06-30 |

| Government Bullet Bond 10Y | US Treasury | 2033-05-15 | $2,000,000 | 3.25% | 2033-05-15 |

Definition of Bullet Bonds in Finance

Bullet bonds are fixed-income securities with a single principal repayment at maturity, without any interim principal amortization. They typically offer periodic interest payments, known as coupons, throughout the bond's life, providing predictable cash flows for investors. Bullet bonds contrast with amortizing bonds, as all principal is returned in one lump sum at the bond's maturity date.

Key Features of Bullet Bonds

Bullet bonds feature a fixed principal repayment at maturity without interim principal payments, providing predictable cash flow to investors. They typically offer fixed interest rates paid periodically, reducing reinvestment risk during the bond's life. These bonds are favored for their simplicity and stability, making them suitable for long-term investment strategies and liability matching.

How Bullet Bonds Differ from Amortizing Bonds

Bullet bonds require the full principal repayment at maturity, resulting in no periodic principal payments during the bond's life. Amortizing bonds involve scheduled principal repayments along with interest throughout the term, reducing the outstanding balance over time. This key difference affects cash flow patterns and risk profiles for investors and issuers.

Typical Structure of a Bullet Bond

A bullet bond features a typical structure where the principal is repaid in a single lump sum at maturity, without any interim principal repayments throughout the bond's life. Interest payments, commonly called coupons, are made periodically, often semiannually, providing steady income to investors. This structure minimizes reinvestment risk since the principal is returned at once, making bullet bonds a preferred choice for fixed-income portfolios seeking predictable cash flows.

Real-World Examples of Bullet Bonds

Bullet bonds, characterized by a single lump-sum principal repayment at maturity, are exemplified by U.S. Treasury bonds, which pay semi-annual interest and return the face value at the end of the term without any amortization. Corporate bullet bonds issued by companies like IBM and Johnson & Johnson typically feature fixed coupon rates and fixed maturities, appealing to investors seeking predictable income streams without early principal payments. Municipal bullet bonds, such as those issued by New York City, fund specific projects with defined timelines, offering tax-exempt interest that enhances their attractiveness to individual investors.

Advantages of Bullet Bonds for Investors

Bullet bonds offer fixed interest payments over a specified term without principal repayment until maturity, providing predictable cash flow for investors. Their structure reduces reinvestment risk since the principal is returned in a lump sum at maturity, simplifying investment planning. These bonds also typically exhibit lower interest rate risk compared to callable bonds, enhancing portfolio stability during volatile market conditions.

Risks Associated with Bullet Bonds

Bullet bonds carry significant interest rate risk since the entire principal is repaid at maturity, exposing investors to price volatility if rates fluctuate. There is also credit risk, as issuer default at maturity results in the loss of the entire principal amount invested. Lack of intermediate coupon payments limits cash flow, reducing income stability compared to callable or amortizing bonds.

Suitable Investors for Bullet Bond Investments

Bullet bonds are ideal for investors seeking predictable income streams and low reinvestment risk, such as retirees and conservative portfolios. These fixed-coupon bonds ensure principal repayment at maturity without interim principal repayments, aligning with long-term financial planning. Institutional investors like pension funds and insurance companies also favor bullet bonds for their stable cash flow matching liabilities.

Bullet Bonds vs Callable and Putable Bonds

Bullet bonds have a fixed maturity date with no options for early redemption, providing predictable cash flows and minimizing reinvestment risk. Callable bonds give issuers the right to redeem before maturity, potentially exposing investors to reinvestment uncertainty and capped upside. Putable bonds offer investors the option to sell back to the issuer before maturity, enhancing downside protection and flexibility in changing interest rate environments.

Common Sectors Issuing Bullet Bonds

Common sectors issuing bullet bonds include government agencies, financial institutions, and corporate sectors such as utilities, telecommunications, and energy companies. These entities favor bullet bonds due to their fixed maturity date and predictable repayment structure, making them attractive for funding long-term projects or refinancing existing debt. The stable cash flow and creditworthiness of these sectors enhance investor confidence, supporting liquidity and marketability in bond markets.

example of bullet in bond Infographic

samplerz.com

samplerz.com