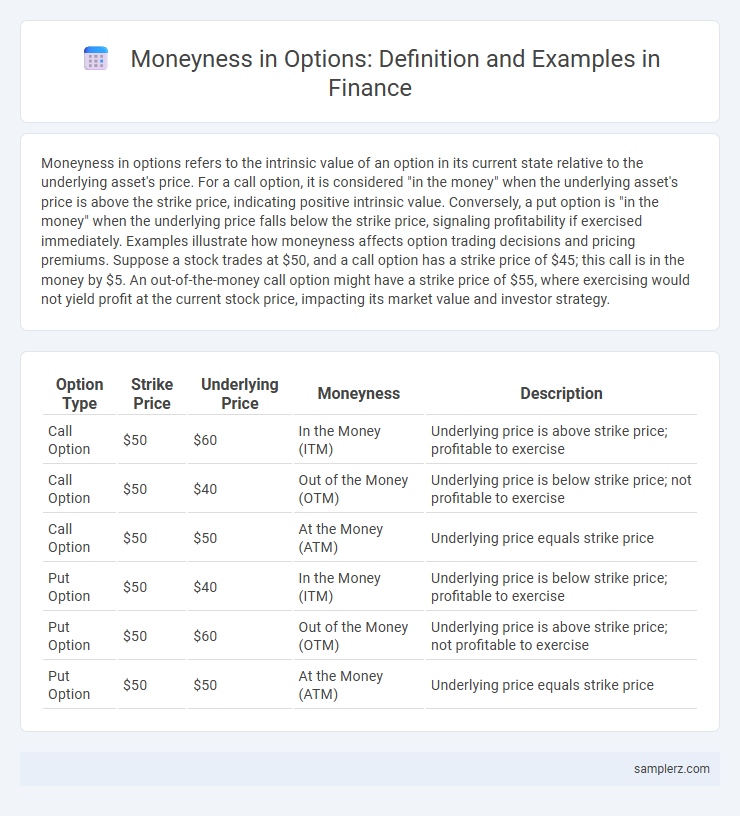

Moneyness in options refers to the intrinsic value of an option in its current state relative to the underlying asset's price. For a call option, it is considered "in the money" when the underlying asset's price is above the strike price, indicating positive intrinsic value. Conversely, a put option is "in the money" when the underlying price falls below the strike price, signaling profitability if exercised immediately. Examples illustrate how moneyness affects option trading decisions and pricing premiums. Suppose a stock trades at $50, and a call option has a strike price of $45; this call is in the money by $5. An out-of-the-money call option might have a strike price of $55, where exercising would not yield profit at the current stock price, impacting its market value and investor strategy.

Table of Comparison

| Option Type | Strike Price | Underlying Price | Moneyness | Description |

|---|---|---|---|---|

| Call Option | $50 | $60 | In the Money (ITM) | Underlying price is above strike price; profitable to exercise |

| Call Option | $50 | $40 | Out of the Money (OTM) | Underlying price is below strike price; not profitable to exercise |

| Call Option | $50 | $50 | At the Money (ATM) | Underlying price equals strike price |

| Put Option | $50 | $40 | In the Money (ITM) | Underlying price is below strike price; profitable to exercise |

| Put Option | $50 | $60 | Out of the Money (OTM) | Underlying price is above strike price; not profitable to exercise |

| Put Option | $50 | $50 | At the Money (ATM) | Underlying price equals strike price |

Understanding Moneyness: A Key Concept in Options

Moneyness in options quantifies the intrinsic value by comparing the underlying asset's current price to the option's strike price, crucial for determining potential profitability. Call options are "in the money" when the underlying asset price exceeds the strike price, while put options gain value when the strike price surpasses the asset price. Understanding moneyness guides traders in strategy selection and risk assessment, directly impacting option premiums and expected returns.

Real-World Examples of Option Moneyness

An example of option moneyness can be seen in Tesla stock options where a call option with a strike price of $700 is in the money when Tesla's stock trades at $750, providing intrinsic value. Conversely, a put option on Apple stock with a strike price of $150 is in the money when Apple's stock drops to $140, allowing the holder to sell at a higher price than the market. These real-world instances highlight how option moneyness directly affects profitability and strategic decision-making in options trading.

In the Money (ITM): Practical Scenarios

In options trading, In the Money (ITM) refers to a call option whose strike price is below the current market price of the underlying asset, or a put option whose strike price is above the market price. For example, a call option with a strike price of $50 on a stock trading at $60 is ITM, offering intrinsic value and potential for immediate exercise profit. ITM options demonstrate higher premiums and lower risk compared to Out of the Money (OTM) options, making them attractive for conservative investors seeking intrinsic value protection.

At the Money (ATM): Illustrative Case Studies

At the Money (ATM) options have a strike price equal to the underlying asset's current market price, making them highly sensitive to volatility and time decay. For example, if a stock trading at $100 has a call option with a $100 strike price, the option is ATM, and its premium primarily reflects the expected volatility and time until expiration. Traders often use ATM options for hedging or speculative strategies due to their balanced risk-reward profile.

Out of the Money (OTM): Example Situations

Out of the Money (OTM) options occur when a call option's strike price exceeds the underlying asset's current market price, or a put option's strike price is below the current market price, resulting in zero intrinsic value. For instance, a call option with a $100 strike price on a stock trading at $90 is OTM, as exercising it yields no profit. Traders often use OTM options for speculation or hedging due to their lower premium relative to at-the-money or in-the-money options.

Moneyness and Option Pricing Explained

Moneyness measures the intrinsic value of an option by comparing the underlying asset's current price to the option's strike price, directly influencing option pricing models such as Black-Scholes. In-the-money options have intrinsic value, resulting in higher premiums, while out-of-the-money options rely mainly on time value and volatility for their price. Understanding moneyness helps traders assess risk and potential profit, optimizing strategies in a dynamic financial market.

Moneyness Impact on Option Strategies

Moneyness significantly affects option strategies by determining potential profitability and risk exposure; for instance, in-the-money (ITM) options offer intrinsic value and higher premium costs, making them suitable for conservative investors seeking lower risk. Out-of-the-money (OTM) options, while cheaper, carry higher risk and are often used in speculative strategies aiming for leveraged gains. At-the-money (ATM) options strike a balance, frequently utilized in volatility plays and hedging due to their sensitivity to underlying asset price movements.

Visualizing Moneyness: Simple Examples

Moneyness in options is typically visualized by comparing the underlying asset's current price to the option's strike price, where a call option is in-the-money if the asset price exceeds the strike price, and out-of-the-money if below. For example, a call option with a strike price of $50 is in-the-money when the stock trades at $55, indicating intrinsic value, while a put option at the same strike is in-the-money if the stock price falls to $45. Simple visual tools like payoff diagrams or moneyness grids effectively illustrate how the relationship between asset price and strike price impacts option value and potential profitability.

Moneyness in Call vs. Put Options

Moneyness in options measures the intrinsic value of call and put options relative to the underlying asset's current price. A call option is considered "in the money" when the asset price exceeds the strike price, while a put option is in the money when the asset price falls below the strike price. This distinction directly affects the likelihood of option exercise and premium valuation in financial markets.

Moneyness Changes Over Time: Dynamic Demonstrations

Moneyness in options fluctuates as the underlying asset price moves relative to the strike price, illustrating dynamic changes over time. For instance, an option initially at-the-money may become in-the-money or out-of-the-money as stock prices rise or fall, directly influencing the option's intrinsic value and premium. Tracking these transitions provides critical insights for traders assessing risk, potential profit, and timing strategies.

example of moneyness in option Infographic

samplerz.com

samplerz.com