Alpha in a portfolio measures the excess return generated by an investment relative to a benchmark index. For example, if a mutual fund achieves a 12% return while its benchmark index returns 8%, the portfolio's alpha is 4%. This indicates the portfolio manager's skill in selecting securities that outperform the market. Investors use alpha to evaluate the effectiveness of active management strategies in generating returns above market expectations. A positive alpha signifies successful stock picking or market timing, while a negative alpha suggests underperformance. Portfolio analysis tools quantify alpha alongside beta and other metrics to assess risk-adjusted returns comprehensively.

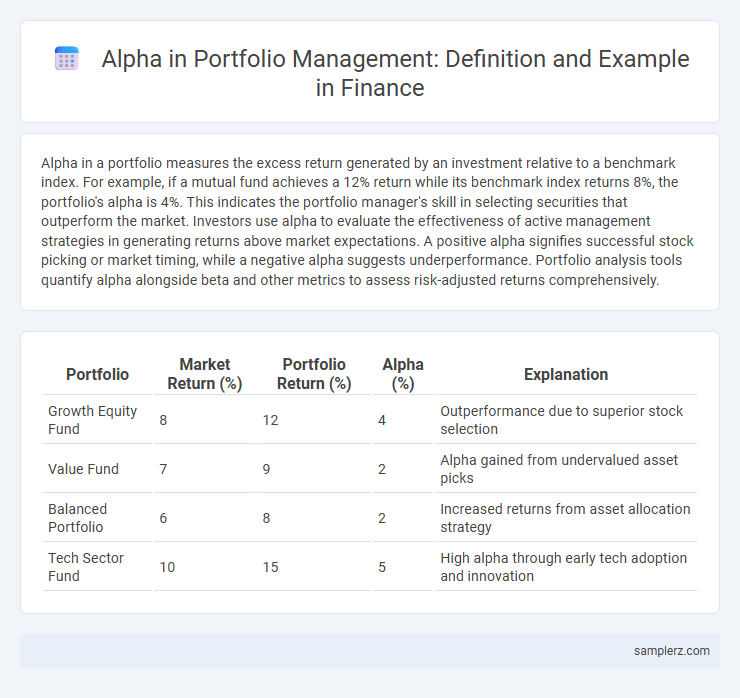

Table of Comparison

| Portfolio | Market Return (%) | Portfolio Return (%) | Alpha (%) | Explanation |

|---|---|---|---|---|

| Growth Equity Fund | 8 | 12 | 4 | Outperformance due to superior stock selection |

| Value Fund | 7 | 9 | 2 | Alpha gained from undervalued asset picks |

| Balanced Portfolio | 6 | 8 | 2 | Increased returns from asset allocation strategy |

| Tech Sector Fund | 10 | 15 | 5 | High alpha through early tech adoption and innovation |

Understanding Alpha: Definition and Importance in Finance

Alpha in finance measures a portfolio's excess return relative to a benchmark index, indicating the manager's ability to generate profits beyond market movements. For example, a portfolio generating a 12% return when the S&P 500 returns 8% achieves an alpha of 4%, demonstrating superior performance. Understanding alpha helps investors assess active management effectiveness and make informed decisions about risk-adjusted returns.

How Alpha Measures Portfolio Performance

Alpha quantifies a portfolio's excess return relative to a benchmark index, isolating the value added by active management beyond market movements. A positive alpha indicates outperformance after adjusting for systematic risk, often measured by the Capital Asset Pricing Model (CAPM). Investors use alpha to evaluate fund managers' skill in generating superior risk-adjusted returns compared to passive strategies.

Real-World Example of Alpha in Investment Portfolios

A well-known real-world example of alpha is Warren Buffett's Berkshire Hathaway, which consistently outperforms the S&P 500 index by leveraging deep fundamental analysis and long-term value investing. This alpha generation stems from Buffett's ability to identify undervalued companies, strong management teams, and durable competitive advantages that the broader market often overlooks. Over decades, Berkshire Hathaway's compounded returns have significantly surpassed passive index funds, showcasing sustained alpha through active portfolio management.

Alpha Calculation: Step-by-Step Example

Alpha calculation in portfolio management involves measuring the excess return of an investment relative to its expected benchmark return. For example, if a portfolio's actual return is 12% and the expected return based on the CAPM model is 8%, the alpha is 4%, indicating the manager outperformed the market. This step-by-step calculation includes identifying the portfolio return, determining the benchmark return, and subtracting the benchmark return from the portfolio return to quantify alpha.

Interpreting Positive and Negative Alpha

Positive alpha in a portfolio indicates the investment has outperformed its expected risk-adjusted return, demonstrating skillful asset selection or market timing by the portfolio manager. Negative alpha signals underperformance relative to the benchmark, suggesting potential inefficiencies or increased risk exposure without adequate return compensation. Analyzing alpha alongside beta and R-squared values helps to interpret whether deviations from expected performance arise from unique asset allocation or broader market movements.

Strategies for Generating Alpha in a Portfolio

Quantitative models leveraging factor analysis can identify mispriced assets, generating alpha by exploiting market inefficiencies. Active management strategies such as tactical asset allocation adjust portfolio weights based on economic cycles to capture excess returns. Incorporating alternative data sources like social sentiment analytics enhances alpha generation through improved stock selection.

Alpha vs. Beta: Key Differences Explained

Alpha represents the excess return a portfolio generates beyond its expected benchmark performance, indicating the value added by active management. In contrast, Beta measures a portfolio's sensitivity to market movements, quantifying systematic risk relative to a benchmark index. Understanding Alpha versus Beta helps investors distinguish between skill-driven gains and market-driven fluctuations in their portfolio.

Role of Alpha in Active and Passive Investing

Alpha measures the excess return of a portfolio relative to its benchmark, highlighting a manager's skill in active investing. In active portfolios, generating positive alpha indicates successful security selection and timing, whereas passive investing aims to replicate the benchmark, resulting in alpha close to zero. Investors seeking to outperform markets often prioritize alpha as a key performance metric in portfolio management strategies.

Case Study: Achieving Alpha in Equity Portfolios

A notable case study in achieving alpha in equity portfolios involves the investment strategy of Renaissance Technologies, which consistently outperformed the S&P 500 by leveraging quantitative models to identify mispriced stocks. By using advanced algorithms and extensive data analysis, Renaissance captured alpha through exploiting market inefficiencies and minimizing systematic risk exposure. Their Medallion Fund demonstrated annualized alpha exceeding 40%, showcasing the power of sophisticated quantitative techniques in generating superior risk-adjusted returns.

Limitations and Risks of Chasing Alpha

Chasing alpha in portfolio management often leads to increased exposure to market volatility and higher transaction costs, which can erode overall returns. Investors may face model risk due to reliance on imperfect quantitative strategies that fail under unexpected market conditions. Overemphasis on alpha generation can result in reduced diversification, amplifying portfolio risk and potential drawdowns.

example of alpha in portfolio Infographic

samplerz.com

samplerz.com