An escrow in finance is a financial arrangement where a third party holds and regulates payment of funds required for two parties involved in a transaction. For instance, in real estate, an escrow agent holds the buyer's deposit until all sale conditions are met, ensuring secure and transparent fund transfer. This process protects both the buyer and seller from fraud by guaranteeing that money changes hands only after contractual obligations are fulfilled. Escrow accounts are also commonly used in mergers and acquisitions to hold a portion of the purchase price in reserve. This ensures that any potential post-sale liabilities or disputes are covered before the seller receives full payment. Data from multiple transactions shows that escrow arrangements reduce financial risk and build trust in complex commercial deals by providing a neutral platform for fund management.

Table of Comparison

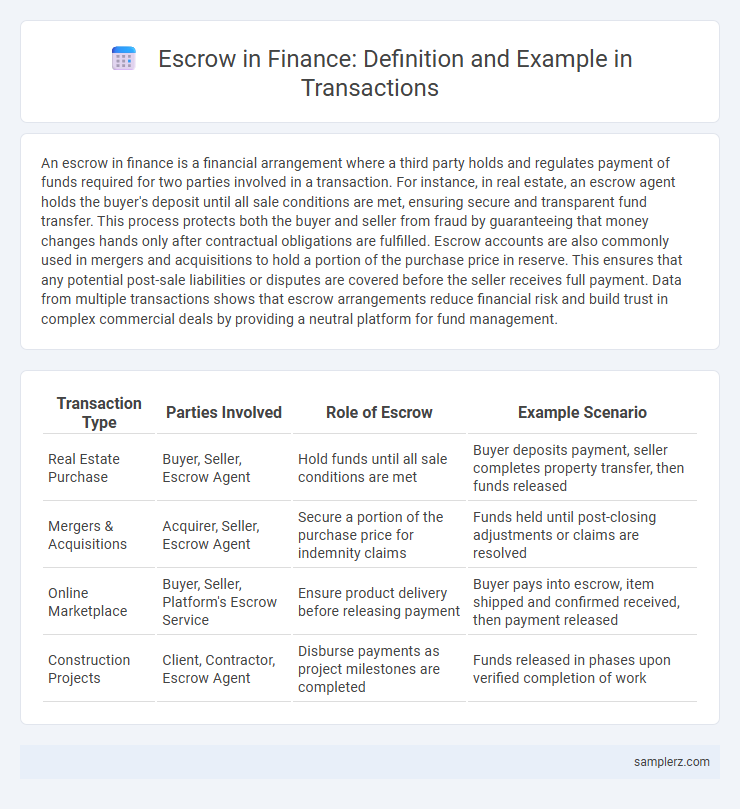

| Transaction Type | Parties Involved | Role of Escrow | Example Scenario |

|---|---|---|---|

| Real Estate Purchase | Buyer, Seller, Escrow Agent | Hold funds until all sale conditions are met | Buyer deposits payment, seller completes property transfer, then funds released |

| Mergers & Acquisitions | Acquirer, Seller, Escrow Agent | Secure a portion of the purchase price for indemnity claims | Funds held until post-closing adjustments or claims are resolved |

| Online Marketplace | Buyer, Seller, Platform's Escrow Service | Ensure product delivery before releasing payment | Buyer pays into escrow, item shipped and confirmed received, then payment released |

| Construction Projects | Client, Contractor, Escrow Agent | Disburse payments as project milestones are completed | Funds released in phases upon verified completion of work |

Understanding Escrow in Financial Transactions

Escrow in financial transactions involves a neutral third party holding funds or assets until all contractual conditions are met, ensuring security and trust for both buyer and seller. Commonly used in real estate deals, mergers, and online marketplaces, escrow protects parties from fraud by releasing payments only after verification of obligations. This mechanism reduces risk, enhances transparency, and facilitates smoother, more reliable transactions.

Key Parties Involved in an Escrow Agreement

In an escrow agreement, key parties typically include the buyer, seller, and the escrow agent who holds funds or assets securely until contract conditions are met. The escrow agent, often a bank or a specialized third party, ensures impartial management of the transaction by safeguarding the payment or documents until all obligations are fulfilled. This arrangement minimizes risk for both buyer and seller by verifying terms before releasing funds or property ownership.

Step-by-Step Example of Escrow in Real Estate Deals

In a real estate transaction, the buyer deposits the earnest money into an escrow account managed by a neutral third party, ensuring funds are securely held. The escrow agent verifies that all conditions, such as property inspections and title searches, are satisfied before releasing the funds. Upon closing, the escrow company disburses the purchase amount to the seller and transfers the property title to the buyer, protecting both parties throughout the process.

How Escrow Protects Buyers and Sellers

Escrow in financial transactions secures funds by holding them with a neutral third party until all contract terms are verified and met by both buyers and sellers. This mechanism safeguards buyers from receiving defective or unfulfilled goods while protecting sellers from premature loss of payment. By ensuring mutual compliance, escrow reduces fraud risk and builds trust in high-value transactions.

Escrow Services in Online Marketplaces

Escrow services in online marketplaces secure transactions by holding buyer payments until the seller delivers the product or service as agreed, minimizing the risk of fraud. Platforms like eBay and Alibaba integrate escrow accounts to protect both parties, ensuring funds are only released after verified delivery. This method increases trust and reduces disputes in high-value or international online transactions.

Escrow Accounts in Stock Trading Transactions

Escrow accounts in stock trading transactions serve as a secure intermediary where funds or shares are held until the terms of the trade agreement are fulfilled. These accounts ensure that buyer payments and seller securities are exchanged simultaneously, minimizing counterparty risk. By using escrow, investors gain protection against fraud and non-performance during the settlement of stock purchases or private equity deals.

Role of Escrow in Mergers and Acquisitions

In mergers and acquisitions, escrow accounts secure funds, ensuring sellers meet post-closing obligations such as indemnity claims or adjustments. These accounts protect buyers by holding a portion of the purchase price until specific conditions are fulfilled, mitigating risks associated with undisclosed liabilities. Escrow arrangements streamline transaction trust, enhancing deal security and facilitating smoother closing processes.

Common Conditions Attached to Escrow Agreements

Common conditions attached to escrow agreements in finance include verification of funds, fulfillment of contractual obligations, and approval of documentation before the release of assets. These conditions ensure transaction security, protect buyer and seller interests, and facilitate compliance with regulatory requirements. Escrow agents oversee these conditions to manage risk and maintain trust throughout the transaction process.

Potential Risks and Solutions in Escrow Transactions

Escrow transactions, while providing security by holding funds until contractual obligations are met, pose potential risks such as fraud, mismanagement of funds, or delayed releases that can disrupt deal timelines. Implementing robust verification processes, using reputable escrow services with transparent protocols, and establishing clear dispute resolution mechanisms mitigate these risks effectively. Technology-driven solutions like blockchain escrow platforms enhance transparency and reduce settlement risks through immutable transaction records.

Best Practices for Secure Escrow Management

Escrow accounts hold transaction funds securely until all contractual conditions are met, ensuring trust between buyers and sellers. Best practices for secure escrow management include verifying the credibility of all parties involved, using regulated escrow services, and maintaining transparent communication throughout the transaction process. Employing multi-factor authentication and regular audits protects escrow accounts from fraud and unauthorized access.

example of escrow in transaction Infographic

samplerz.com

samplerz.com