Negative convexity in mortgage-backed securities (MBS) occurs when prepayment risk increases as interest rates decline, causing changes in cash flow patterns. An example is when homeowners refinance their mortgages during falling interest rates, leading to early repayment of principal and reducing the MBS duration. This behavior causes the price of MBS to rise less than comparable bonds, reflecting the negative convexity characteristic. Investors face challenges in managing portfolios with MBS due to this negative convexity, as traditional bond price-yield relationships do not apply clearly. When interest rates fall, the increased prepayment risk limits price appreciation, while rising rates extend the duration, increasing exposure to interest rate risk. Understanding this entity-specific data allows for better risk assessment and strategic hedging in fixed-income investments.

Table of Comparison

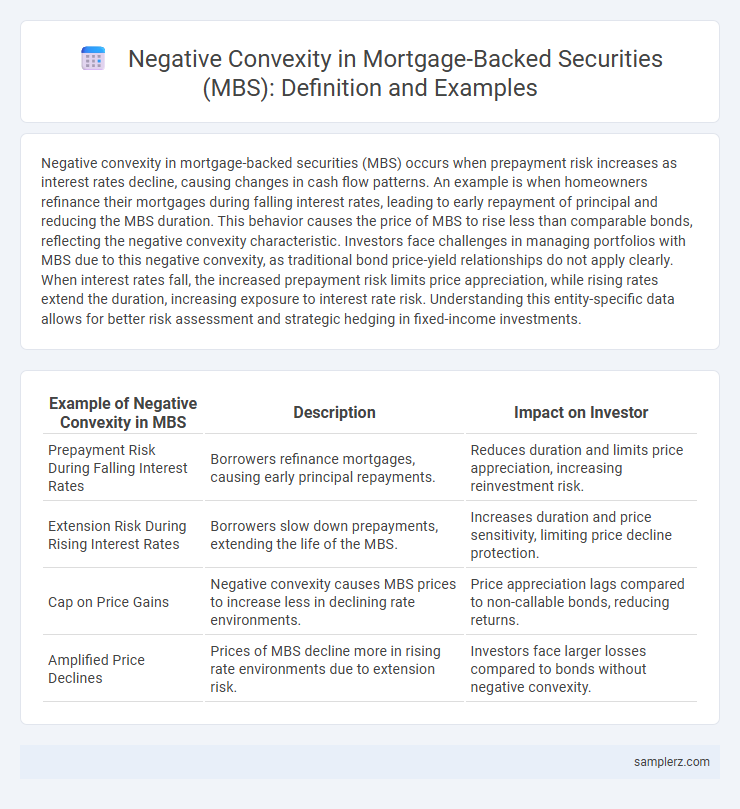

| Example of Negative Convexity in MBS | Description | Impact on Investor |

|---|---|---|

| Prepayment Risk During Falling Interest Rates | Borrowers refinance mortgages, causing early principal repayments. | Reduces duration and limits price appreciation, increasing reinvestment risk. |

| Extension Risk During Rising Interest Rates | Borrowers slow down prepayments, extending the life of the MBS. | Increases duration and price sensitivity, limiting price decline protection. |

| Cap on Price Gains | Negative convexity causes MBS prices to increase less in declining rate environments. | Price appreciation lags compared to non-callable bonds, reducing returns. |

| Amplified Price Declines | Prices of MBS decline more in rising rate environments due to extension risk. | Investors face larger losses compared to bonds without negative convexity. |

Understanding Negative Convexity in Mortgage-Backed Securities (MBS)

Negative convexity in mortgage-backed securities (MBS) arises when prepayment risks cause the price of the security to increase at a decreasing rate as interest rates fall. This occurs because borrowers tend to refinance or prepay their mortgages when rates decline, reducing the expected duration and limiting price appreciation. Investors face the risk that cash flows will be returned early, diminishing yield and complicating hedging strategies due to the asymmetric price behavior.

How Prepayment Risk Leads to Negative Convexity in MBS

Prepayment risk in mortgage-backed securities (MBS) causes negative convexity because homeowners often refinance or prepay their mortgages when interest rates decline, shortening the expected duration of the security. This behavior reduces potential price appreciation in falling rate environments while limiting price decline when rates rise, resulting in a non-linear price-yield relationship. Consequently, MBS investors face challenges in hedging and managing interest rate risk due to this negative convexity characteristic.

Example: Negative Convexity During Falling Interest Rates

Mortgage-backed securities (MBS) exhibit negative convexity when interest rates fall, as homeowners are more likely to refinance or prepay their loans, shortening the MBS duration. This prepayment risk reduces the expected cash flows, causing the MBS price to increase less than comparable bonds with positive convexity. Investors face diminished price appreciation potential during declining rates, reflecting the inherent negative convexity of MBS in these conditions.

Case Study: Homeowner Refinancing Impact on MBS Prices

Homeowner refinancing in mortgage-backed securities (MBS) leads to negative convexity as prepayments increase when interest rates decline, causing early return of principal and reducing expected cash flows. This prepayment risk compresses the duration of MBS, resulting in price declines despite falling yields, unlike traditional bonds. Analysis of the 2009 refinancing wave demonstrates significant price volatility due to accelerated principal repayments affecting MBS valuation metrics.

Scenario Analysis: MBS Returns in a Declining Rate Environment

In a declining rate environment, mortgage-backed securities (MBS) exhibit negative convexity as homeowners refinance their loans, accelerating prepayments and reducing the expected life of the MBS. This prepayment behavior diminishes the bond's duration extension benefits and caps price appreciation, leading to lower returns compared to traditional bonds. Scenario analysis shows that unexpected rapid declines in interest rates can significantly erode MBS returns due to this negative convexity effect.

The Role of Embedded Options in MBS Negative Convexity

Embedded options in mortgage-backed securities (MBS), such as the borrower's prepayment option, cause negative convexity by altering cash flow patterns when interest rates fluctuate. As rates decline, prepayments increase, reducing the expected duration and limiting price appreciation, while rising rates slow prepayments and extend duration, leading to higher price sensitivity. This negative convexity impacts MBS valuation and risk management, requiring sophisticated models to account for the exercise behavior embedded in these securities.

Negative Convexity vs. Positive Convexity: A Comparative Example

Mortgage-backed securities (MBS) often exhibit negative convexity because prepayment risk increases as interest rates decline, causing cash flows to shorten unexpectedly. Unlike positive convexity instruments such as traditional bonds, where price sensitivity to interest rates increases, MBS prices may rise less when rates fall and drop more sharply when rates rise. This asymmetric price behavior complicates hedging and risk management strategies for investors holding MBS.

Impact of Negative Convexity on Portfolio Duration Management

Negative convexity in mortgage-backed securities (MBS) causes portfolio duration to shorten unpredictably when interest rates decline due to increased prepayment risk. This prepayment risk reduces expected cash flows, complicating duration matching and hedging strategies for fixed-income portfolios. Portfolio managers must adjust duration targets dynamically to mitigate interest rate sensitivity and preserve portfolio stability amid negative convexity effects.

Hedging Strategies for Negative Convexity in MBS Investments

Negative convexity in Mortgage-Backed Securities (MBS) occurs when the price of the MBS rises less as interest rates fall and falls more as rates rise, complicating risk management. Hedging strategies typically involve using interest rate swaps or swaptions to offset the heightened exposure to rising rates, protecting the portfolio from losses due to prepayment risk. Dynamic hedging adjusts the hedge ratio frequently to account for the changing duration and convexity characteristics associated with negative convexity in MBS investments.

Lessons Learned from Historical Episodes of MBS Negative Convexity

Historical episodes of negative convexity in mortgage-backed securities (MBS) highlight the impact of prepayment risk where declining interest rates prompt homeowners to refinance, reducing expected cash flows and causing price drops in MBS. The 2007-2008 financial crisis exemplified this, as MBS prices plummeted due to increased prepayment uncertainty and credit losses, revealing the critical importance of accurate prepayment modeling and robust risk management. Lessons learned emphasize the need for enhanced hedging strategies and stress testing frameworks to mitigate negative convexity effects in future market downturns.

example of negative convexity in MBS Infographic

samplerz.com

samplerz.com