A synthetic collateralized debt obligation (CDO) is a financial instrument that uses credit default swaps (CDS) to gain exposure to a portfolio of assets without owning them directly. Instead of holding underlying loans or bonds, synthetic CDOs transfer credit risk from the reference entities to investors through swaps. This structure allows investors to speculate on or hedge against the credit performance of corporate bonds, mortgage-backed securities, or other debt instruments. In a synthetic CDO, the entity issuing the CDO does not hold physical assets. The payments received from the CDS premiums are passed to the investors, who in turn bear the risk of credit events such as defaults. Synthetic CDOs became prominent during the 2007-2008 financial crisis due to their complexity and the high leverage involved in replicating exposure to vast pools of debt.

Table of Comparison

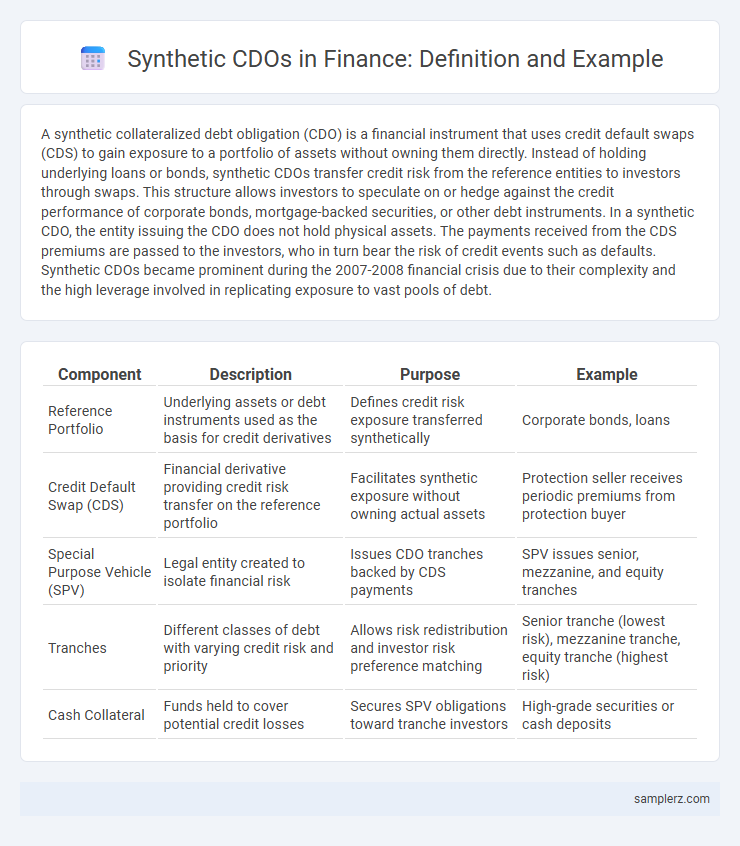

| Component | Description | Purpose | Example |

|---|---|---|---|

| Reference Portfolio | Underlying assets or debt instruments used as the basis for credit derivatives | Defines credit risk exposure transferred synthetically | Corporate bonds, loans |

| Credit Default Swap (CDS) | Financial derivative providing credit risk transfer on the reference portfolio | Facilitates synthetic exposure without owning actual assets | Protection seller receives periodic premiums from protection buyer |

| Special Purpose Vehicle (SPV) | Legal entity created to isolate financial risk | Issues CDO tranches backed by CDS payments | SPV issues senior, mezzanine, and equity tranches |

| Tranches | Different classes of debt with varying credit risk and priority | Allows risk redistribution and investor risk preference matching | Senior tranche (lowest risk), mezzanine tranche, equity tranche (highest risk) |

| Cash Collateral | Funds held to cover potential credit losses | Secures SPV obligations toward tranche investors | High-grade securities or cash deposits |

Definition and Overview of Synthetic CDOs

Synthetic Collateralized Debt Obligations (CDOs) are structured financial instruments that use credit default swaps and other derivatives to replicate the cash flow and risk profile of traditional CDOs without owning the underlying bonds or loans. These instruments provide investors exposure to credit risk by transferring losses from a reference portfolio of debt securities to protection sellers. Synthetic CDOs enable greater flexibility in managing credit exposure and can amplify market leverage through derivatives rather than direct asset ownership.

Key Features of Synthetic CDO Structures

Synthetic CDO structures primarily use credit default swaps (CDS) to transfer credit risk without actual asset ownership, enabling efficient risk distribution. These instruments typically comprise a special purpose vehicle (SPV) that issues tranches with varying risk and return profiles, attracting different investor appetites. Enhanced flexibility and reduced transaction costs are key features, allowing synthetic CDOs to replicate exposure to credit portfolios with greater customization and leverage.

How Synthetic CDOs Differ from Cash CDOs

Synthetic CDOs use credit default swaps (CDS) and other derivatives to gain exposure to collateralized debt obligations without owning the underlying assets, while cash CDOs directly invest in bonds or loans. This structure allows synthetic CDOs to transfer credit risk and leverage exposure more flexibly, often resulting in higher returns and complex risk profiles. Unlike cash CDOs, synthetic CDOs have quicker creation and unwinding processes, which can impact liquidity and counterparty risk differently.

The Role of Credit Default Swaps in Synthetic CDOs

Credit Default Swaps (CDS) are integral to synthetic Collateralized Debt Obligations (CDOs), serving as tools for transferring credit risk without the exchange of physical debt assets. In synthetic CDOs, CDS contracts allow investors to assume credit exposure to a portfolio of reference entities, enabling the creation of tranches that reflect different risk levels and returns. This mechanism enhances market liquidity and provides opportunities for risk diversification by isolating credit risk from actual bond holdings.

Example Transaction: Creating a Synthetic CDO

A synthetic CDO example involves a special purpose vehicle (SPV) entering into credit default swap (CDS) contracts to gain exposure to a reference portfolio of debt without owning the actual assets. The SPV receives periodic premiums from investors while assuming the default risk of the underlying portfolio, effectively transferring credit risk. This structure allows for enhanced leverage and tailored risk-return profiles compared to traditional CDOs holding physical assets.

Participants in a Synthetic CDO Deal

Participants in a synthetic CDO deal include the special purpose vehicle (SPV), which issues the CDO securities and manages the portfolio of credit default swaps (CDS). The protection seller, typically the SPV, receives premiums from protection buyers, such as hedge funds or institutional investors, who seek credit exposure without owning the underlying assets. Investment banks often act as arrangers, structuring the synthetic CDO and facilitating the CDS contracts between counterparties.

Risk and Return Profile of Synthetic CDOs

Synthetic CDOs use credit default swaps to gain exposure to a portfolio of reference assets without owning them, allowing for tailored risk and return profiles. Their risk stems primarily from counterparty default and the potential for correlation between reference entities causing simultaneous losses. Investors in synthetic CDO tranches receive higher yields compared to traditional CDOs, reflecting increased credit risk and market volatility.

Real-World Case Studies of Synthetic CDOs

Synthetic Collateralized Debt Obligations (CDOs) use credit default swaps to replicate exposure to underlying assets without owning them directly, illustrated by the 2007 ABCP Synthetic CDO involving Gaussian Copula model misestimations, which contributed to significant losses during the financial crisis. Another example includes the Dallas Police and Fire Pension System's synthetic CDO investments, where complex tranche structures amplified risk unnoticed until credit events triggered rapid devaluation. These real-world cases highlight the importance of accurate risk modeling and transparency in synthetic CDO transactions.

Benefits and Criticisms of Synthetic CDOs

Synthetic CDOs offer benefits such as enhanced liquidity and risk transfer by using credit default swaps instead of actual debt securities, allowing investors to gain exposure to credit risk without owning the underlying assets. They also enable better portfolio diversification and can be tailored to specific risk appetites, improving capital efficiency. However, criticisms include increased complexity and opacity, which contributed to the 2008 financial crisis by obscuring true risk levels and amplifying systemic risk through interconnected derivatives.

Regulatory Impact on Synthetic CDO Markets

Synthetic CDOs use credit default swaps to gain exposure to credit risk without owning the underlying assets, significantly influencing regulatory frameworks post-2008 financial crisis. Regulatory changes, such as the Dodd-Frank Act and Basel III standards, have tightened capital requirements and increased transparency, limiting the issuance and complexity of synthetic CDOs. These regulations aim to reduce systemic risk by enforcing stricter oversight on counterparty exposures and enhancing market stability in synthetic CDO transactions.

example of synthetic in CDO Infographic

samplerz.com

samplerz.com