A Collateralized Debt Obligation (CDO) in mortgage finance is a structured financial product that pools together various mortgage-backed securities (MBS) and redistributes them into different tranches with varying risk levels. These tranches are sold to investors based on their risk appetite and desired return, allowing banks and financial institutions to manage mortgage credit risk more effectively. Mortgage CDOs played a significant role in the 2008 financial crisis due to their complexity and the underlying risky mortgage loans. An example of a mortgage CDO includes a pool of residential mortgage loans originated by lenders, which are then securitized into MBS. These MBS are further repackaged into a CDO where senior, mezzanine, and equity tranches are created. Investors in the senior tranche receive lower risk and lower returns, while those in the equity tranche take on higher risk but have potential for higher returns, with cash flows dependent on the performance of the underlying mortgage loans.

Table of Comparison

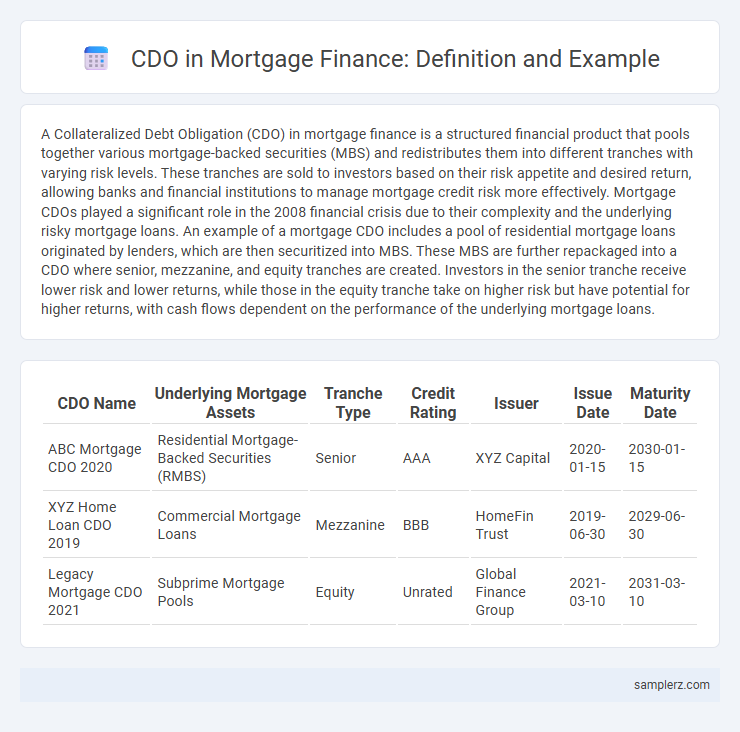

| CDO Name | Underlying Mortgage Assets | Tranche Type | Credit Rating | Issuer | Issue Date | Maturity Date |

|---|---|---|---|---|---|---|

| ABC Mortgage CDO 2020 | Residential Mortgage-Backed Securities (RMBS) | Senior | AAA | XYZ Capital | 2020-01-15 | 2030-01-15 |

| XYZ Home Loan CDO 2019 | Commercial Mortgage Loans | Mezzanine | BBB | HomeFin Trust | 2019-06-30 | 2029-06-30 |

| Legacy Mortgage CDO 2021 | Subprime Mortgage Pools | Equity | Unrated | Global Finance Group | 2021-03-10 | 2031-03-10 |

Introduction to Mortgage-Backed CDOs

Mortgage-backed collateralized debt obligations (CDOs) pool various tranches of mortgage-backed securities (MBS) to redistribute risk and enhance returns for investors. These structured finance instruments slice mortgage payments into different risk layers, enabling higher-rated tranches to attract conservative investors while lower-rated tranches offer potential for greater yields. By repurposing cash flows from residential or commercial mortgages, mortgage-backed CDOs play a critical role in liquidity and risk management within the financial markets.

Anatomy of a Mortgage-Backed CDO

A mortgage-backed CDO (Collateralized Debt Obligation) is structured by pooling various tranches of mortgage-backed securities (MBS) into a single vehicle, which then issues multiple tranches of notes to investors. These tranches are categorized by risk, including senior, mezzanine, and equity layers, each with different priorities for interest payments and loss absorption. The cash flow from underlying mortgage payments is distributed according to tranche seniority, optimizing risk-return profiles for diversified investors.

How Mortgage CDOs Work in Practice

Mortgage CDOs pool tranches of mortgage-backed securities, dividing them into slices with varying risk and return profiles sold to investors based on credit ratings. Cash flows from homeowners' mortgage payments are used to pay investors sequentially, with senior tranches receiving priority and lower tranches absorbing initial losses. The structuring allows for redistribution of default risk, enabling investors to select exposure levels aligned with their risk appetite and market conditions.

Real-World Example: The Role of CDOs in the 2008 Crisis

Collateralized Debt Obligations (CDOs) played a central role in the 2008 financial crisis by repackaging pools of subprime mortgage loans into complex securities sold to investors worldwide. The widespread issuance of mortgage-backed CDOs, often based on low-quality loans, amplified credit risk and obscured the true level of default exposure. As housing prices plummeted, mortgage delinquencies surged, triggering massive CDO losses that cascaded through the financial system and led to severe liquidity shortages.

Structure of a Typical Mortgage CDO

A typical mortgage CDO (Collateralized Debt Obligation) is structured into multiple tranches, each with varying degrees of risk and return, including senior, mezzanine, and equity tranches. The senior tranches receive priority on cash flows and have higher credit ratings, often backed by mortgage-backed securities (MBS) pools, while mezzanine and equity tranches absorb initial losses. This hierarchical framework allows investors to select exposure according to their risk appetite, with the underlying mortgages generating the cash flow that services the CDO's debt obligations.

Key Players in Mortgage-Backed CDO Transactions

Key players in mortgage-backed CDO transactions include investment banks that structure and underwrite the deals, rating agencies that assess credit risk and assign ratings to tranches, and institutional investors who purchase CDO securities to diversify portfolios and seek higher yields. Servicers manage the underlying mortgage loans, ensuring timely payments and handling defaults, while trustees oversee the trust's legal and financial administration. These roles collectively impact the performance and risk profile of mortgage-backed CDOs in the finance market.

Subprime Mortgages and CDO Formation

Collateralized Debt Obligations (CDOs) in mortgages often involve pooling subprime mortgage loans, which are high-risk loans given to borrowers with lower credit ratings. These subprime mortgages are securitized into different tranches within the CDO, distributing varying levels of risk and return to investors. The formation of CDOs enables financial institutions to transfer mortgage credit risk while providing liquidity to the mortgage market.

Risk Assessment in Mortgage CDOs

Risk assessment in mortgage Collateralized Debt Obligations (CDOs) involves analyzing the credit quality of underlying mortgage-backed securities (MBS) and borrower default probabilities to estimate potential losses. Quantitative models incorporate factors such as loan-to-value ratios, borrower credit scores, and delinquency rates to categorize tranches by risk levels and expected returns. Stress testing scenarios simulate economic downturns affecting housing prices and unemployment, providing insights into tranche vulnerability and overall portfolio stability.

Impact of Mortgage CDOs on Financial Markets

Mortgage collateralized debt obligations (CDOs) played a significant role in the 2007-2008 financial crisis by amplifying risks through repackaging subprime mortgage loans into complex securities. These CDOs increased market liquidity but also obscured the underlying asset quality, leading to widespread mispricing and heightened systemic risk. The resulting losses and defaults triggered a credit crunch, severely impacting global financial markets and prompting regulatory reforms.

Lessons Learned from Mortgage-Backed CDO Failures

Mortgage-backed CDO failures revealed the critical importance of accurate risk assessment and the dangers of over-reliance on flawed credit ratings. Many CDOs were structured with tranches containing subprime mortgage loans, leading to cascading defaults once housing prices declined. Improved transparency and stricter regulatory oversight are essential lessons to mitigate risks in future mortgage-backed securitizations.

example of CDO in mortgage Infographic

samplerz.com

samplerz.com