An inverse floater in mortgage finance is a type of bond or loan security where the interest rate moves inversely with a benchmark rate, such as the LIBOR or Treasury rates. For example, if the benchmark rate rises, the coupon rate on the inverse floater decreases; conversely, if the benchmark rate falls, the coupon rate increases. This structure is often used to hedge against falling interest rates or to amplify returns in a declining rate environment. A common example involves a mortgage-backed security (MBS) tranche that includes an inverse floater component. Suppose an inverse floater is tied to the 5-year Treasury yield with a leverage factor of 2; if the yield drops from 3% to 2%, the coupon on the inverse floater could increase by twice the fall, enhancing income for the investor. Investors use such instruments to gain exposure to mortgage assets while strategically managing interest rate risk.

Table of Comparison

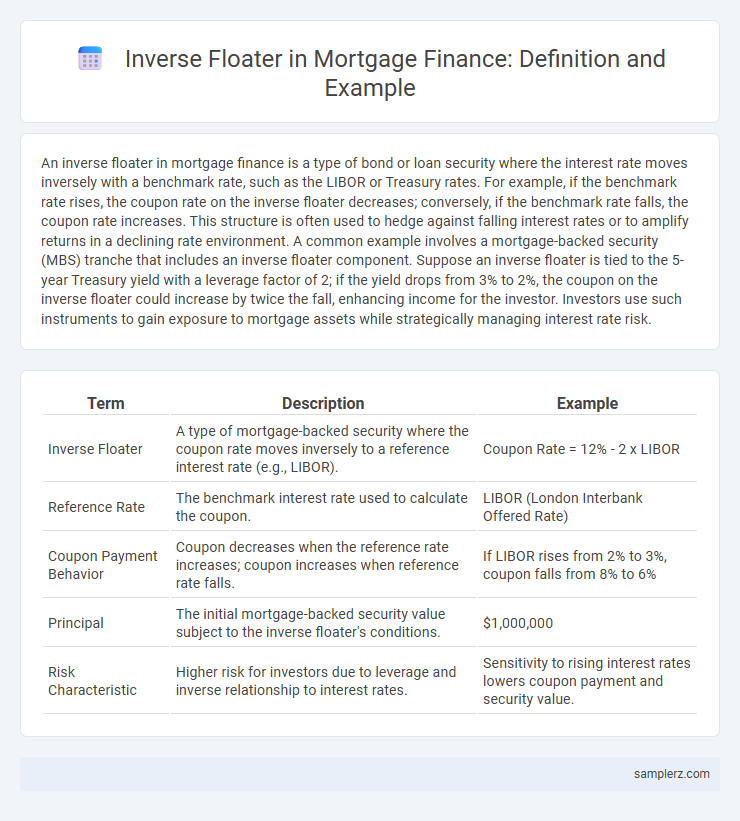

| Term | Description | Example |

|---|---|---|

| Inverse Floater | A type of mortgage-backed security where the coupon rate moves inversely to a reference interest rate (e.g., LIBOR). | Coupon Rate = 12% - 2 x LIBOR |

| Reference Rate | The benchmark interest rate used to calculate the coupon. | LIBOR (London Interbank Offered Rate) |

| Coupon Payment Behavior | Coupon decreases when the reference rate increases; coupon increases when reference rate falls. | If LIBOR rises from 2% to 3%, coupon falls from 8% to 6% |

| Principal | The initial mortgage-backed security value subject to the inverse floater's conditions. | $1,000,000 |

| Risk Characteristic | Higher risk for investors due to leverage and inverse relationship to interest rates. | Sensitivity to rising interest rates lowers coupon payment and security value. |

Understanding Inverse Floaters in Mortgage Finance

Inverse floaters in mortgage finance are specialized debt securities where the interest rate moves inversely to a benchmark rate, often tied to mortgage-backed securities (MBS) or Treasury yields. For example, an inverse floater with a coupon formula of 12% minus two times the LIBOR rate means that if LIBOR rises by 1%, the coupon rate decreases by 2%, increasing the bond's price sensitivity to interest rate declines. These instruments are used to hedge or speculate on falling interest rates, offering higher yields during rate drops but elevated risk when rates rise, which affects mortgage investors' cash flow stability.

Key Features of Mortgage Inverse Floaters

Mortgage inverse floaters feature interest rates that increase as benchmark rates decline, creating leveraged exposure to interest rate movements. These securities often have a fixed principal amount with coupon payments that vary inversely with a reference index, such as LIBOR or Treasury yields. Investors benefit from higher yields during falling rate environments but face increased payment risk when rates rise, making them suitable for sophisticated investors seeking interest rate hedging or speculative opportunities.

How Inverse Floater Structures Work in Mortgages

Inverse floater structures in mortgages involve securities with interest rates that move opposite to benchmark rates, typically created by splitting a fixed-rate mortgage pool into multiple tranches. One tranche, the inverse floater, has an interest rate calculated as a fixed rate minus a leveraged multiple of a floating benchmark, such as LIBOR or the Treasury yield, causing its coupon to rise when interest rates fall. These structures attract investors seeking higher yields in declining rate environments but carry increased risk due to their sensitivity to interest rate fluctuations and mortgage prepayment speeds.

Real-World Example: Inverse Floater in Mortgage-Backed Securities

An inverse floater in mortgage-backed securities (MBS) is often structured by splitting a fixed-rate MBS into a floating-rate tranche and an inverse floater tranche, where the inverse floater's coupon moves inversely to a benchmark interest rate such as LIBOR or SOFR. A real-world example includes the 2006 issuance by a major investment bank where the inverse floater tranche provided higher yields when rates declined, attracting investors betting on falling interest rates amidst volatile housing markets. These securities are highly sensitive to interest rate changes and prepayment risks, making them suitable for sophisticated investors seeking leveraged exposure to mortgage cash flows.

Rate Movements and Inverse Mortgage Floaters Explained

An inverse floater in mortgage finance is a security whose interest rate moves inversely with a benchmark rate, such as the LIBOR or Treasury yield, making its coupon rise when interest rates fall and decline when rates rise. This structure benefits investors anticipating declining interest rates, as the floating rate adjusts downward, increasing the effective coupon paid by the inverse floater. Understanding rate movements is crucial because inverse mortgage floaters amplify interest rate risk, impacting yield and price volatility in mortgage-backed securities portfolios.

Investor Perspective: Risks and Returns of Mortgage Inverse Floaters

Mortgage inverse floaters present investors with amplified interest rate risk due to their leveraged sensitivity to rate fluctuations, causing coupon payments to increase when rates fall and decrease when rates rise. These securities can offer higher yields compared to traditional fixed-rate mortgage-backed securities but carry the risk of significant principal volatility and potential negative amortization. Investors must carefully assess market interest rate trends and prepayment risks to balance the potential for enhanced returns against heightened exposure to credit and liquidity challenges.

Comparison: Standard vs. Inverse Mortgage Floaters

Standard mortgage floaters have interest rates that rise and fall with benchmark indices, maintaining a direct correlation with market interest rates. Inverse floaters, by contrast, have interest rates that move inversely to benchmark indices, decreasing when market rates rise and increasing when they fall, offering potential benefits in declining rate environments. This inverse relationship can make inverse floaters more volatile and complex but attractive for investors seeking gains during periods of falling interest rates in the mortgage market.

Case Study: Inverse Floater Impact on Mortgage Payments

In a case study involving a $300,000 mortgage with an inverse floater structured at 8% minus 1.5 times the LIBOR rate, monthly payments fluctuated significantly as LIBOR shifted from 1% to 3%. When LIBOR was at 1%, the effective interest rate dropped to 6.5%, resulting in lower monthly payments of approximately $1,889, whereas at a 3% LIBOR, the interest rate rose to 5%, increasing the borrower's monthly payments to nearly $2,146. This inverse relationship between the reference rate and the interest rate highlights the payment volatility borrowers face under inverse floater mortgage structures.

Regulatory Considerations for Mortgage Inverse Floaters

Mortgage inverse floaters require careful regulatory consideration due to their complex interest rate structures and potential impact on borrower risk profiles. Financial institutions must comply with capital adequacy requirements under Basel III and ensure transparent disclosure under the Dodd-Frank Act to protect investors. Stress testing and enhanced risk reporting are essential to meet regulatory standards and prevent systemic risks associated with interest rate volatility in inverse floater mortgage products.

Practical Applications of Inverse Floaters in Mortgage Portfolios

Inverse floaters in mortgage portfolios offer effective tools for managing interest rate risk by increasing yields when rates decline, commonly structured with a leverage factor that amplifies rate movements. These instruments are often used by mortgage investors seeking enhanced income streams in declining rate environments, particularly in adjustable-rate mortgage (ARM) pools. Their practical application involves balancing leveraged exposure with hedging strategies to optimize portfolio performance and mitigate volatility.

example of inverse floater in mortgage Infographic

samplerz.com

samplerz.com