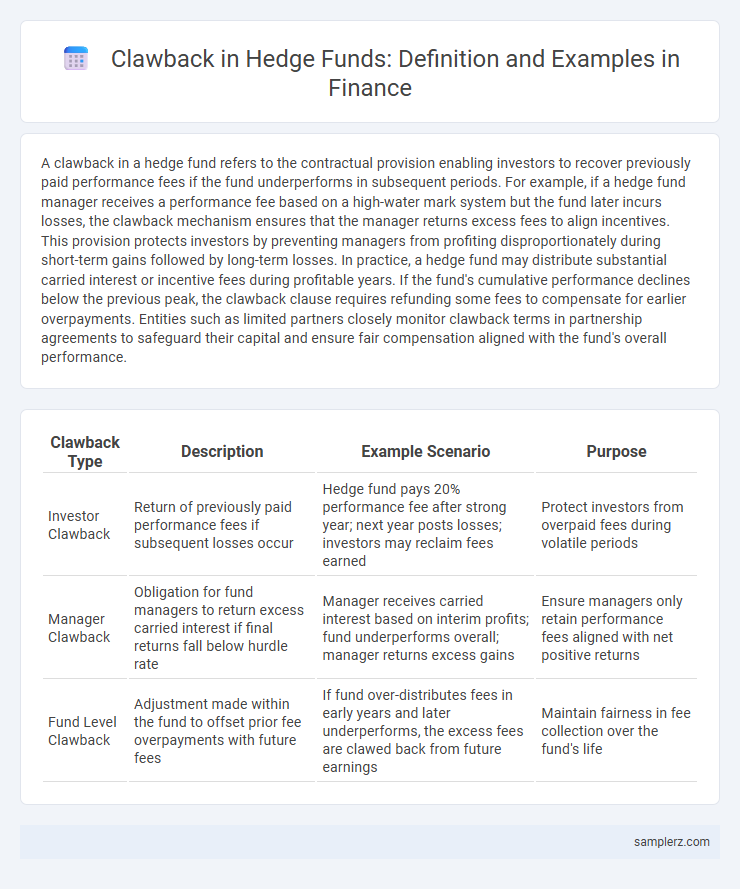

A clawback in a hedge fund refers to the contractual provision enabling investors to recover previously paid performance fees if the fund underperforms in subsequent periods. For example, if a hedge fund manager receives a performance fee based on a high-water mark system but the fund later incurs losses, the clawback mechanism ensures that the manager returns excess fees to align incentives. This provision protects investors by preventing managers from profiting disproportionately during short-term gains followed by long-term losses. In practice, a hedge fund may distribute substantial carried interest or incentive fees during profitable years. If the fund's cumulative performance declines below the previous peak, the clawback clause requires refunding some fees to compensate for earlier overpayments. Entities such as limited partners closely monitor clawback terms in partnership agreements to safeguard their capital and ensure fair compensation aligned with the fund's overall performance.

Table of Comparison

| Clawback Type | Description | Example Scenario | Purpose |

|---|---|---|---|

| Investor Clawback | Return of previously paid performance fees if subsequent losses occur | Hedge fund pays 20% performance fee after strong year; next year posts losses; investors may reclaim fees earned | Protect investors from overpaid fees during volatile periods |

| Manager Clawback | Obligation for fund managers to return excess carried interest if final returns fall below hurdle rate | Manager receives carried interest based on interim profits; fund underperforms overall; manager returns excess gains | Ensure managers only retain performance fees aligned with net positive returns |

| Fund Level Clawback | Adjustment made within the fund to offset prior fee overpayments with future fees | If fund over-distributes fees in early years and later underperforms, the excess fees are clawed back from future earnings | Maintain fairness in fee collection over the fund's life |

Understanding Clawbacks in Hedge Fund Structures

Clawbacks in hedge fund structures ensure that fund managers return any excess performance fees if overall returns fall below a previously achieved high watermark, aligning interests between managers and investors. This mechanism typically activates when subsequent losses erode profits that triggered earlier incentive fees, protecting limited partners from overpayment. Understanding clawbacks is crucial for investors assessing hedge fund compensation terms and the long-term net performance of their investments.

Common Scenarios Triggering Hedge Fund Clawbacks

Hedge fund clawbacks commonly occur when performance fees previously paid out exceed the fund's net profits after subsequent losses, prompting a recovery of excess fees from fund managers. Typical triggers include significant fund underperformance following a strong earning period, realized losses that erase prior gains, and the failure to meet high-water marks required for incentive fee eligibility. These scenarios ensure alignment of interests between investors and managers by preventing overpayment during volatile market fluctuations.

Real-World Examples of Hedge Fund Clawback Provisions

Hedge fund clawback provisions are exemplified by the Long-Term Capital Management (LTCM) case, where investors reclaimed previously paid profits after the fund suffered massive losses in 1998. Another instance involves the Tiger Global Management fund, which enforced clawbacks to realign fees with actual performance during periods of underperformance. These real-world examples illustrate how clawback mechanisms protect investors by recapturing excessive incentive fees following adverse market outcomes.

Case Study: Clawback Application in Private Equity Hedge Funds

In private equity hedge funds, clawback provisions ensure limited partners are reimbursed if the general partner's carried interest payments exceed their entitled share after final fund liquidation. A notable case study involves a hedge fund where initial distributions favored the general partner, but post-liquidation analysis revealed overpayments; thus, the clawback mechanism required repayment to restore the agreed profit split. This enforcement promotes fair profit allocation and aligns the interests of fund managers and investors.

Clawback Clauses in Hedge Fund Limited Partnership Agreements

Clawback clauses in hedge fund limited partnership agreements are designed to ensure that fund managers do not receive compensation exceeding their entitled share, especially after losses or underperformance in later periods. These provisions require managers to return previously paid carried interest if the fund's cumulative profits fall below a specified hurdle rate, aligning incentives with long-term investor returns. Such clauses protect limited partners by promoting accountability and preventing overpayment during volatile market conditions.

Impact of Clawbacks on Hedge Fund Manager Compensation

Clawbacks in hedge funds typically require managers to return previously received performance fees if subsequent losses erode earlier gains, aligning manager compensation with long-term investor returns. This mechanism ensures hedge fund managers are incentivized to maintain consistent performance instead of pursuing short-term profits that may later be reversed. The impact of clawbacks on compensation reduces excessive risk-taking and enhances fiduciary responsibility, ultimately protecting investor interests.

Classic Hedge Fund Clawback Example: Overpaid Performance Fees

A classic hedge fund clawback example occurs when investors receive overpaid performance fees due to prior high returns not sustained in subsequent periods. If the hedge fund outperforms in initial years, the manager earns performance fees, but if losses follow, clawback provisions require the manager to return a portion of those fees to align net returns with agreed hurdles. This mechanism ensures fair distribution of profits by adjusting fees in favor of investors when cumulative gains do not justify earlier payouts.

Investor Protections Through Clawback Mechanisms

Clawback mechanisms in hedge funds serve as critical investor protections by ensuring that fund managers return previously distributed profits if overall fund performance declines or fails to meet specified hurdles. These provisions typically require managers to reimburse investors for excess performance fees paid during profitable periods until losses are fully offset. By aligning manager incentives with long-term fund success, clawbacks help safeguard investors against premature or disproportionate fee extractions.

Legal Precedents Involving Hedge Fund Clawbacks

Legal precedents involving hedge fund clawbacks often highlight cases where limited partners successfully reclaimed overpaid performance fees after annual profits declined. Courts typically enforce clawback provisions based on specific contractual language and detailed fund accounting records, reinforcing fiduciary duties of fund managers. Notable cases such as Highland Capital Management emphasize the importance of clear clawback clauses to protect investor interests under complex profit-sharing arrangements.

How Clawbacks Address Misstated Fund Performance

Clawbacks in hedge funds serve to recover previously distributed profits when fund performance is later found to be misstated due to errors or misconduct. These provisions protect investors by ensuring that fund managers return excess incentive fees calculated on inflated gains, aligning compensation with true performance. This mechanism enhances transparency and accountability in fund management by correcting discrepancies between reported and actual returns.

example of clawback in hedge fund Infographic

samplerz.com

samplerz.com