In finance, a haircut refers to the percentage reduction applied to the market value of an asset used as collateral for a loan. For example, if a bond worth $1,000 is subjected to a 10% haircut, its value as collateral is considered to be $900. This adjustment accounts for potential fluctuations in asset value, reducing the lender's risk exposure. A common example of a haircut in collateral occurs in repo transactions, where securities are sold with an agreement to repurchase. If government bonds valued at $1 million have a 5% haircut, the lender will provide $950,000 in cash, reflecting the decreased collateral value. Haircuts vary by asset type, market conditions, and borrower creditworthiness.

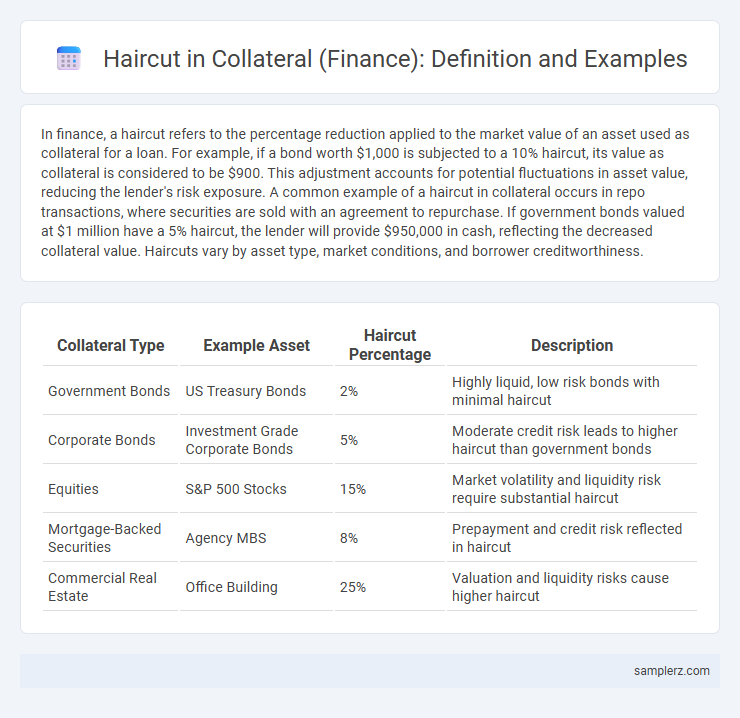

Table of Comparison

| Collateral Type | Example Asset | Haircut Percentage | Description |

|---|---|---|---|

| Government Bonds | US Treasury Bonds | 2% | Highly liquid, low risk bonds with minimal haircut |

| Corporate Bonds | Investment Grade Corporate Bonds | 5% | Moderate credit risk leads to higher haircut than government bonds |

| Equities | S&P 500 Stocks | 15% | Market volatility and liquidity risk require substantial haircut |

| Mortgage-Backed Securities | Agency MBS | 8% | Prepayment and credit risk reflected in haircut |

| Commercial Real Estate | Office Building | 25% | Valuation and liquidity risks cause higher haircut |

Introduction to Haircuts in Collateral

Haircuts in collateral refer to the percentage reduction applied to the market value of an asset to determine its lending value. For example, if a bond valued at $100,000 is assigned a 10% haircut, its collateral value becomes $90,000 for securing a loan. This mechanism protects lenders against market volatility and potential asset depreciation.

Why Haircuts Are Applied to Collateral

Haircuts are applied to collateral to mitigate the risk of borrower default and market volatility by reducing the asset's market value used for securing a loan. This practice ensures lenders maintain sufficient protection against potential losses during rapid price fluctuations or liquidation delays. By requiring a collateral value below the asset's current market price, haircuts provide a buffer that enhances financial stability and credit risk management.

Common Types of Collateral Subject to Haircuts

Common types of collateral subject to haircuts include government bonds, corporate bonds, and equities, each adjusted based on market volatility and credit risk. Government bonds typically receive lower haircuts due to higher liquidity and credit quality, while corporate bonds and equities face higher haircuts reflecting greater risk exposure. These haircuts ensure lenders are protected against potential declines in collateral value during margin calls or liquidation.

Example: Haircut Calculation for Government Bonds

A haircut in collateral management adjusts the market value of government bonds to mitigate credit risk, typically expressed as a percentage. For example, if a bond's market value is $1 million and the haircut is 5%, the adjusted collateral value becomes $950,000, reflecting a $50,000 risk buffer. This calculation ensures lenders maintain adequate protection against potential price volatility or default risk in the bond market.

Example: Applying Haircuts to Corporate Bonds

When applying haircuts to corporate bonds as collateral, a typical haircut rate ranges from 5% to 20%, depending on the issuer's credit quality and bond liquidity. For instance, a corporate bond with a market value of $1 million and a 10% haircut would be valued at $900,000 for collateral purposes, reducing the lender's risk exposure. This adjustment ensures that fluctuations in bond prices do not compromise the loan's secured value, stabilizing the lender's collateral requirements.

Example: Real Estate Assets and Haircut Scenarios

In finance, a haircut applied to real estate collateral represents a percentage reduction from the asset's market value to account for risk and liquidity concerns. For example, if a property valued at $1 million is assigned a 20% haircut, the lender considers its collateral value as $800,000 for loan eligibility. Different scenarios such as market volatility or location risk can lead to haircuts ranging from 10% to 40% on real estate assets.

Example of Haircut in Stock Collateralization

A common example of a haircut in stock collateralization occurs when a lender values pledged shares at 80% of their market price, applying a 20% haircut to mitigate risk from price volatility. For instance, if an investor uses $100,000 worth of stock as collateral, the lender may only advance $80,000 as the loan amount. This risk-adjusted valuation helps protect lenders from potential declines in stock value during the loan term.

Example: Haircut Practices in Repo Transactions

In repo transactions, a haircut represents the percentage reduction applied to the market value of collateral to mitigate risk. For instance, if a bond with a market value of $1 million is used as collateral with a 5% haircut, the lender values the collateral at $950,000 to protect against price volatility or credit risk. Typical haircut percentages vary depending on the asset quality and liquidity, ranging from 1% for government securities to over 10% for lower-rated corporate bonds.

Factors Influencing Haircut Percentages

Haircut percentages in collateral valuation fluctuate based on factors such as asset liquidity, market volatility, and credit quality. Highly liquid assets like government bonds generally attract lower haircuts due to their stable market prices, whereas volatile equities or lower-rated debt instruments require higher haircuts to mitigate risk. Regulatory requirements and counterparty risk assessments also play critical roles in determining appropriate haircut levels in financial transactions.

Implications of Haircuts for Borrowers and Lenders

Haircuts in collateral management impact borrowers by reducing the usable value of pledged assets, forcing them to provide more collateral or accept smaller loan amounts. For lenders, haircuts mitigate credit risk by establishing a buffer against asset price volatility, enhancing recovery potential in case of default. This balance shapes lending terms and capital allocation strategies within financial institutions.

example of haircut in collateral Infographic

samplerz.com

samplerz.com