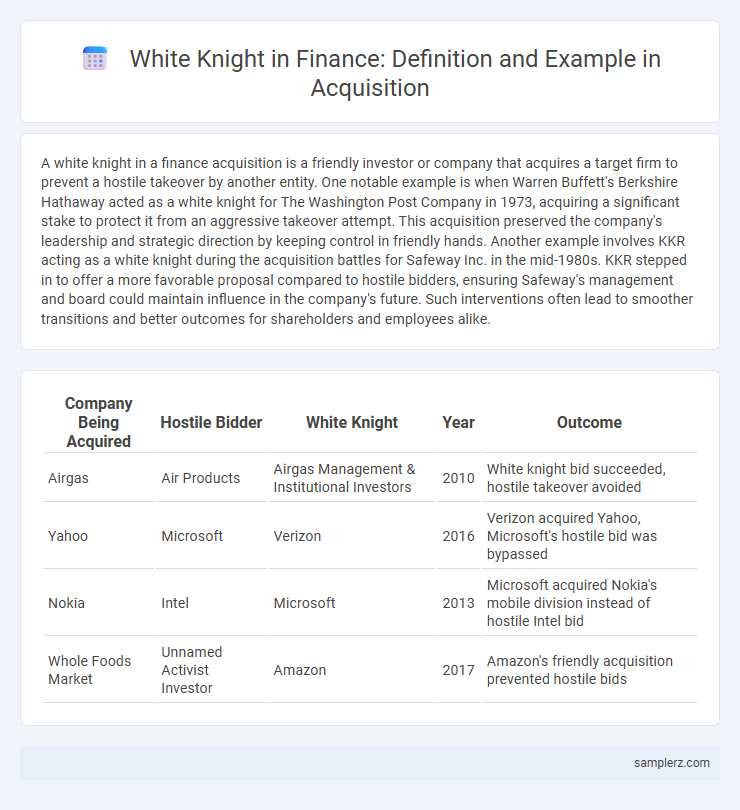

A white knight in a finance acquisition is a friendly investor or company that acquires a target firm to prevent a hostile takeover by another entity. One notable example is when Warren Buffett's Berkshire Hathaway acted as a white knight for The Washington Post Company in 1973, acquiring a significant stake to protect it from an aggressive takeover attempt. This acquisition preserved the company's leadership and strategic direction by keeping control in friendly hands. Another example involves KKR acting as a white knight during the acquisition battles for Safeway Inc. in the mid-1980s. KKR stepped in to offer a more favorable proposal compared to hostile bidders, ensuring Safeway's management and board could maintain influence in the company's future. Such interventions often lead to smoother transitions and better outcomes for shareholders and employees alike.

Table of Comparison

| Company Being Acquired | Hostile Bidder | White Knight | Year | Outcome |

|---|---|---|---|---|

| Airgas | Air Products | Airgas Management & Institutional Investors | 2010 | White knight bid succeeded, hostile takeover avoided |

| Yahoo | Microsoft | Verizon | 2016 | Verizon acquired Yahoo, Microsoft's hostile bid was bypassed |

| Nokia | Intel | Microsoft | 2013 | Microsoft acquired Nokia's mobile division instead of hostile Intel bid |

| Whole Foods Market | Unnamed Activist Investor | Amazon | 2017 | Amazon's friendly acquisition prevented hostile bids |

Introduction to White Knight in Acquisitions

A white knight in acquisitions refers to a friendly third-party company that steps in to acquire a target firm facing a hostile takeover bid. This strategic move helps the target company avoid being acquired by an unwelcome bidder, preserving its management and business operations. Notable examples include Microsoft acting as a white knight for Yahoo in 2008 to fend off aggressive takeover attempts.

Defining the White Knight Strategy

The white knight strategy in mergers and acquisitions involves a friendly third-party company that rescues a target firm from a hostile takeover by offering a more favorable acquisition proposal. This approach helps the target company maintain better control over its operations and protect shareholder value by avoiding a hostile bidder. White knights often negotiate terms that align with the target's long-term strategic goals, preserving management autonomy and corporate culture.

Historical Cases of White Knight Interventions

White knight interventions have been pivotal in notable acquisition battles, such as the 2005 defense of Yahoo! against Microsoft, where private equity firm Silver Lake Partners stepped in as the white knight, preserving Yahoo!'s independence. Another historical case includes the 1984 rescue of Nabisco by Kohlberg Kravis Roberts, which prevented a hostile take over by RJR Nabisco's competitor. These examples underscore how white knights strategically safeguard target companies from hostile bids, impacting deal outcomes and shareholder value.

Iconic Example: IBM’s Acquisition of Lotus

IBM's acquisition of Lotus in 1995 serves as a classic example of a white knight scenario, where IBM intervened to save Lotus from a hostile takeover by competitors seeking to dismantle its valuable software assets. This strategic move allowed IBM to strengthen its position in the collaborative software market while preserving Lotus's innovative product lines like Lotus Notes. The acquisition not only prevented a disruptive takeover but also enhanced IBM's portfolio and competitiveness in enterprise technology.

White Knight vs. Other Takeover Defenses

A white knight is a friendly investor or company that acquires a firm facing a hostile takeover, offering better terms and protecting existing management from aggressive bidders. Unlike poison pills, which dilute share value to deter acquirers, or golden parachutes that provide lucrative exit packages to executives, white knights facilitate a smoother transition and often preserve shareholder value. This strategy is preferred for maintaining company stability and minimizing disruptions during acquisition.

Case Study: United Airlines and White Knight Rescue

United Airlines faced a hostile takeover attempt in 2002, prompting seeking a white knight investor to preserve corporate control and protect shareholder value. The private equity firm, Silver Lake Partners, stepped in as the white knight, providing a vital $1.9 billion rescue package to stabilize United Airlines' financial position. This strategic intervention helped United Airlines avoid hostile acquisition and restructure its operations during a period of industry turbulence.

The Role of Management in White Knight Deals

In white knight acquisitions, management plays a critical role by actively seeking a financially stable and compatible buyer to counter hostile takeover attempts, ensuring business continuity and protecting shareholder value. Executive teams often collaborate closely with potential white knights to negotiate terms that preserve operational control and strategic direction. Effective management intervention can turn a threatening takeover into a mutually beneficial transaction, aligning interests between shareholders and acquiring entities.

Market Impact of White Knight Acquisitions

White knight acquisitions often stabilize volatile market conditions by preventing hostile takeovers, which can preserve shareholder value and maintain company reputation. These friendly acquisitions typically lead to positive market reactions, as investors perceive reduced risk and potential strategic growth from the white knight's involvement. Stock prices of the target company frequently experience gains post-announcement, reflecting increased confidence in the company's future under the white knight's management.

Risks and Challenges Faced by White Knights

White knights in acquisitions often confront significant risks such as overpayment for the target company, which can strain their financial resources and reduce shareholder value. They face challenges in integrating the acquired business, including cultural clashes and operational disruptions that may hinder synergy realization. Furthermore, white knights encounter market skepticism and possible retaliation from hostile bidders, impacting stock prices and stakeholder confidence.

Lessons Learned from White Knight Examples

White knight interventions in acquisitions often demonstrate the importance of strategic alignment and timing to preserve company value and shareholder interests. Lessons learned highlight that selecting a white knight with complementary resources and shared vision can prevent hostile takeovers and ensure smoother integration. Effective communication with stakeholders during such processes minimizes uncertainty and supports long-term business sustainability.

example of white knight in acquisition Infographic

samplerz.com

samplerz.com