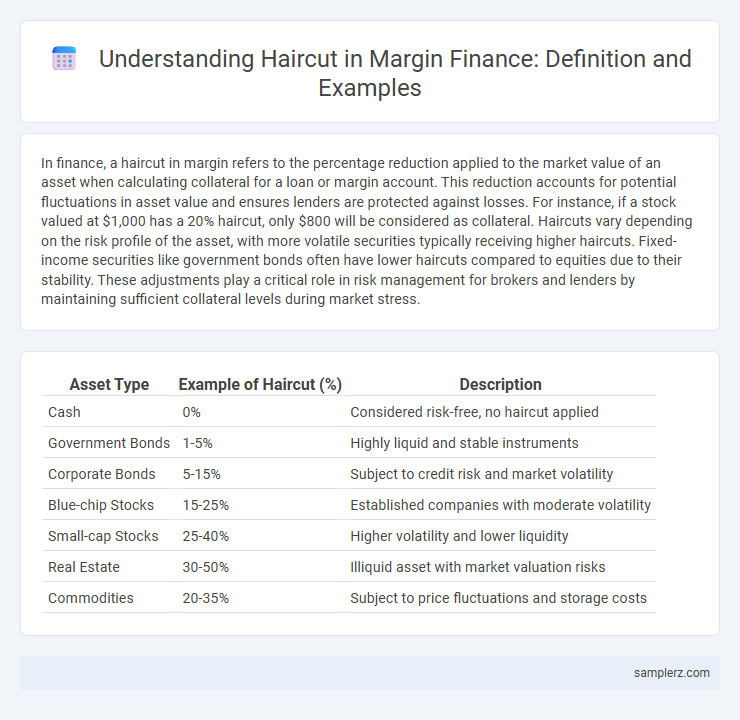

In finance, a haircut in margin refers to the percentage reduction applied to the market value of an asset when calculating collateral for a loan or margin account. This reduction accounts for potential fluctuations in asset value and ensures lenders are protected against losses. For instance, if a stock valued at $1,000 has a 20% haircut, only $800 will be considered as collateral. Haircuts vary depending on the risk profile of the asset, with more volatile securities typically receiving higher haircuts. Fixed-income securities like government bonds often have lower haircuts compared to equities due to their stability. These adjustments play a critical role in risk management for brokers and lenders by maintaining sufficient collateral levels during market stress.

Table of Comparison

| Asset Type | Example of Haircut (%) | Description |

|---|---|---|

| Cash | 0% | Considered risk-free, no haircut applied |

| Government Bonds | 1-5% | Highly liquid and stable instruments |

| Corporate Bonds | 5-15% | Subject to credit risk and market volatility |

| Blue-chip Stocks | 15-25% | Established companies with moderate volatility |

| Small-cap Stocks | 25-40% | Higher volatility and lower liquidity |

| Real Estate | 30-50% | Illiquid asset with market valuation risks |

| Commodities | 20-35% | Subject to price fluctuations and storage costs |

Understanding Haircuts in Margin Trading

In margin trading, a haircut refers to the percentage reduction applied to the market value of an asset when calculating collateral value. For example, if a stock valued at $100 has a 20% haircut, its collateral value will be $80, limiting the borrowing power. This risk management tool protects lenders from potential declines in asset prices and ensures sufficient margin maintenance.

Purpose of Haircuts in Finance

Haircuts in finance serve as risk management tools by reducing the value of assets used as collateral to protect lenders from market volatility and potential borrower default. By applying a haircut, institutions ensure that the collateral exceeds the loan amount, thus maintaining sufficient coverage in case asset prices decline. This mechanism safeguards credit exposure and maintains financial stability within margin trading and secured lending practices.

Common Examples of Haircut Application

Common examples of haircut application in margin trading include reducing the market value of securities held as collateral to mitigate credit risk. For instance, a 20% haircut on a stock valued at $10,000 means the broker will consider only $8,000 as collateral when calculating the margin requirement. This practice protects lenders against market volatility by ensuring borrowers maintain a sufficient equity cushion.

Haircut Rates for Different Collateral Types

Haircut rates in margin trading vary significantly by collateral type, reflecting the underlying risk and liquidity of the assets pledged. For example, government bonds typically have low haircut rates around 2-5%, whereas equities may require haircuts ranging from 15-25%, and high-yield corporate bonds or illiquid assets can face haircuts exceeding 30%. These differentiated haircut rates protect lenders from market volatility and potential declines in collateral value, ensuring sufficient buffer in margin lending agreements.

How Haircuts Protect Lenders

Haircuts in margin trading reduce the loan-to-value ratio by discounting the collateral's market value, minimizing lenders' risk exposure to market volatility. For instance, if a stock valued at $100 has a 20% haircut, lenders recognize it as worth only $80, safeguarding against sudden price drops. This buffer ensures that lenders can recover their funds even if the collateral's value declines, maintaining financial stability in margin lending.

Haircut Calculation: Step-by-Step Example

Haircut calculation in margin trading involves determining the percentage reduction applied to the market value of an asset to account for risk exposure. For example, if a stock valued at $100 has a 20% haircut, its adjusted value for margin purposes would be $80, reducing the borrowing capacity. This step-by-step method ensures lenders manage potential losses by lowering asset valuation based on volatility and liquidity factors.

Real-World Scenarios of Margin Haircuts

In real-world finance, a margin haircut represents the percentage reduction applied to the market value of collateral to protect lenders from potential losses. For example, if government bonds worth $100,000 are used as collateral with a 10% haircut, the borrowing capacity is limited to $90,000. This adjustment accounts for market volatility and credit risk, ensuring adequate protection in margin lending transactions.

Regulatory Requirements for Haircuts

Regulatory requirements for haircuts in margin trading mandate financial institutions to apply specific percentage reductions to the market value of collateral assets to mitigate counterparty risk. For example, under Basel III guidelines, high-quality government bonds might receive a haircut of 2%, while lower-quality corporate bonds could require haircuts of 15% or more. These standardized haircuts ensure capital adequacy and promote systemic stability by accounting for potential asset value volatility during market stress.

Impact of Haircuts on Leverage

Haircuts in margin trading reduce the collateral value of assets, thereby limiting the borrowing capacity and lowering overall leverage. For example, a 20% haircut on a $100,000 bond means only $80,000 is counted as collateral, forcing traders to either provide more funds or reduce positions. This risk management tool curbs excessive leverage, protecting lenders and stabilizing financial markets during volatility.

Strategies to Manage Margin Haircut Risk

Margin haircut risk can be effectively managed by implementing diversified collateral portfolios that reduce exposure to any single asset's price volatility. Utilizing real-time market data and sophisticated risk models enables accurate haircut adjustments aligned with current market conditions. Employing dynamic margining strategies, including stress testing and scenario analysis, ensures sufficient liquidity buffers to absorb potential haircut fluctuations.

example of haircut in margin Infographic

samplerz.com

samplerz.com