A waterfall in payment refers to the predetermined sequence in which funds are distributed among various stakeholders during a financial transaction or liquidation event. It ensures that senior debt holders receive payment first, followed by subordinated debt, and finally equity investors, reflecting the priority of claims. This hierarchy helps manage risk and clarity in complex financings or bankruptcy proceedings. In financing structures such as collateralized loan obligations (CLOs) or real estate deals, the waterfall mechanism allocates cash flow systematically. Interest and principal payments flow down the waterfall, ensuring obligations are met according to the contractual terms. Data on payment timing, amounts, and parties involved is critical for maintaining transparency and accurately forecasting investor returns in these agreements.

Table of Comparison

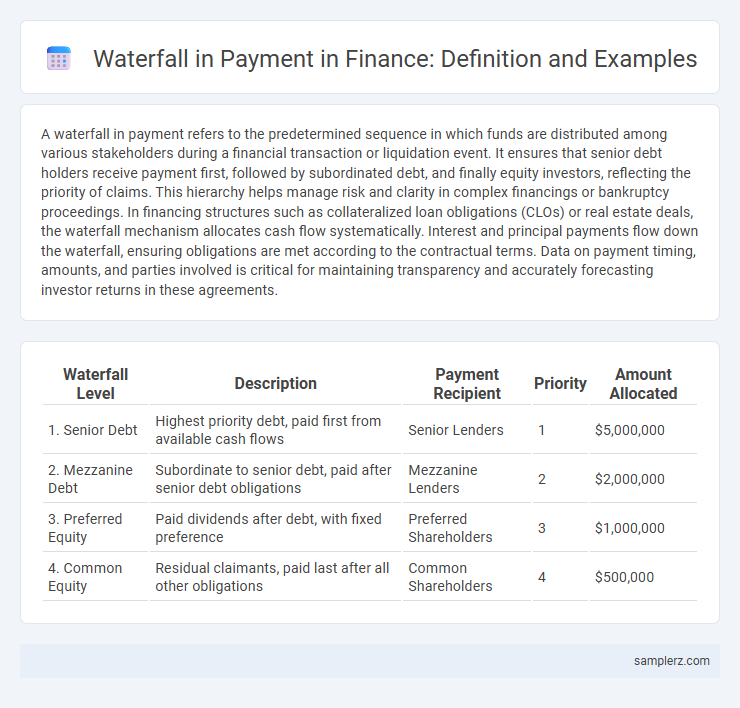

| Waterfall Level | Description | Payment Recipient | Priority | Amount Allocated |

|---|---|---|---|---|

| 1. Senior Debt | Highest priority debt, paid first from available cash flows | Senior Lenders | 1 | $5,000,000 |

| 2. Mezzanine Debt | Subordinate to senior debt, paid after senior debt obligations | Mezzanine Lenders | 2 | $2,000,000 |

| 3. Preferred Equity | Paid dividends after debt, with fixed preference | Preferred Shareholders | 3 | $1,000,000 |

| 4. Common Equity | Residual claimants, paid last after all other obligations | Common Shareholders | 4 | $500,000 |

Understanding the Waterfall Payment Structure

The waterfall payment structure prioritizes the sequential allocation of funds, where senior debt holders receive payments first, followed by mezzanine debt, and finally equity investors. This hierarchy ensures that obligations are met according to predefined contractual agreements, minimizing risk for higher-priority stakeholders. Understanding this distribution model is crucial for investors and financial managers to assess cash flow risks and returns accurately.

Key Components of a Payment Waterfall

A payment waterfall in finance outlines the sequential distribution of cash flows or payments based on predefined priorities and agreements. Key components include the senior debt tranche, which is paid first, followed by subordinated debt, and finally equity holders, with each layer receiving payments only after obligations to higher priority tiers are met. This structured hierarchy ensures orderly risk allocation, clear cash flow management, and compliance with contractual obligations in complex financing arrangements.

Step-by-Step Payment Waterfall Example

A step-by-step payment waterfall example in finance begins with allocating cash inflows to senior debt holders, ensuring their principal and interest are paid in full. Once senior obligations are satisfied, remaining funds flow to mezzanine lenders, followed by the equity holders receiving residual payments last. This structured hierarchy prioritizes debt repayment and minimizes risk exposure for senior stakeholders while rewarding equity holders only after all debts are covered.

Seniority of Claims in Waterfall Payments

In waterfall payments, the seniority of claims dictates the order in which cash flows are distributed, with senior debt receiving priority before subordinated debt or equity stakeholders. Senior claims are paid in full before any funds flow to mezzanine debts or equity holders, minimizing risk for investors holding higher-ranked obligations. This hierarchical payment structure ensures that creditors with senior claims have the first right to available cash, preserving capital protection and reducing default risk.

Real-World Application: Waterfall in Leveraged Loans

In leveraged loans, the waterfall structure dictates the priority of payments, ensuring senior debt holders receive principal and interest before subordinated creditors. This hierarchical payment system minimizes risk for senior lenders by allocating available cash flows sequentially according to predefined tiers. Applying a waterfall model streamlines the distribution of loan repayments and enforces financial discipline across multiple layers of debt instruments.

Waterfall Payment Example in Project Finance

In project finance, a waterfall payment structure prioritizes cash flow distribution by sequentially allocating funds to cover operating expenses, debt service, and then equity returns. For example, surplus revenue first services senior debt obligations before junior debt and finally pays dividends to equity investors. This tiered payment arrangement ensures risk mitigation by satisfying critical financial commitments ahead of profit-sharing.

Mezzanine vs. Equity in Waterfall Distribution

In a finance waterfall distribution, mezzanine debt holders receive payments immediately after senior debt obligations are satisfied, reflecting their intermediate risk position between senior debt and equity. Equity investors are last in line, receiving distributions only after mezzanine and senior debt claims are fully paid, which corresponds to their higher risk and potentially greater return. The priority order in a waterfall ensures that mezzanine financing typically commands higher interest rates than senior debt but offers lower returns compared to equity due to its secured position.

Waterfall Payment Schedule in Bankruptcy Scenarios

A waterfall payment schedule in bankruptcy scenarios prioritizes claims by distributing available funds sequentially, ensuring secured creditors receive payment before unsecured creditors and equity holders. This structured approach maximizes recovery value by adhering to the legal hierarchy of claims, reducing disputes among stakeholders. Detailed cash flow allocation in the waterfall model enhances transparency and efficiency during bankruptcy asset liquidation.

Common Mistakes in Waterfall Payment Calculations

Common mistakes in waterfall payment calculations often include incorrect prioritization of cash flows, resulting in misallocation among senior and subordinated debt holders. Failing to account for accrued interest or late fees accurately can distort the waterfall structure and payment sequencing. Omitting contingency reserves or overestimating available cash flow leads to unrealistic projections, undermining financial planning and stakeholder expectations.

Best Practices for Implementing a Payment Waterfall

Implementing a payment waterfall requires clearly defining the priority order of cash flows, such as operating expenses, senior debt repayments, and equity distributions to ensure transparency and accuracy. Establishing automated tracking systems and regular reconciliation processes helps maintain compliance and reduces errors during fund allocation. Documenting all waterfall rules and payment triggers in legal agreements ensures all stakeholders understand their rights and obligations throughout the payment process.

example of waterfall in payment Infographic

samplerz.com

samplerz.com