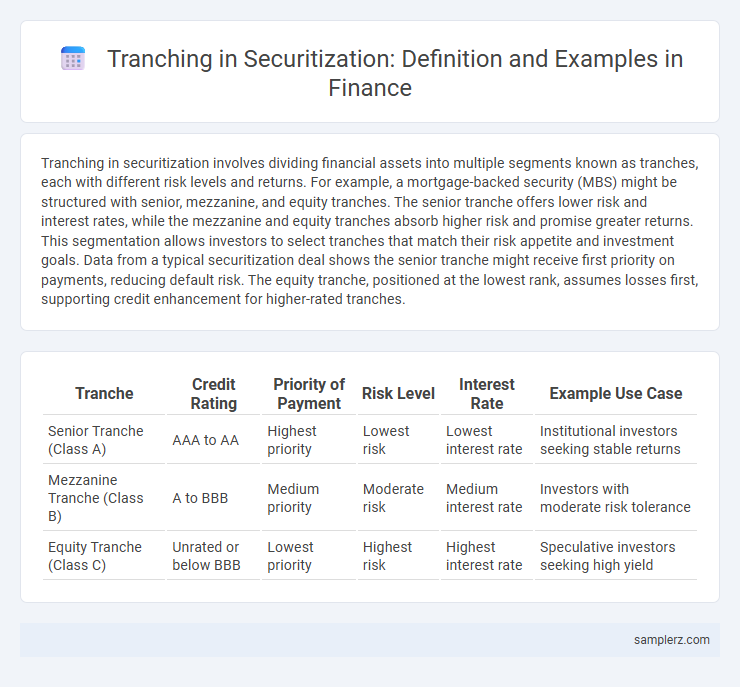

Tranching in securitization involves dividing financial assets into multiple segments known as tranches, each with different risk levels and returns. For example, a mortgage-backed security (MBS) might be structured with senior, mezzanine, and equity tranches. The senior tranche offers lower risk and interest rates, while the mezzanine and equity tranches absorb higher risk and promise greater returns. This segmentation allows investors to select tranches that match their risk appetite and investment goals. Data from a typical securitization deal shows the senior tranche might receive first priority on payments, reducing default risk. The equity tranche, positioned at the lowest rank, assumes losses first, supporting credit enhancement for higher-rated tranches.

Table of Comparison

| Tranche | Credit Rating | Priority of Payment | Risk Level | Interest Rate | Example Use Case |

|---|---|---|---|---|---|

| Senior Tranche (Class A) | AAA to AA | Highest priority | Lowest risk | Lowest interest rate | Institutional investors seeking stable returns |

| Mezzanine Tranche (Class B) | A to BBB | Medium priority | Moderate risk | Medium interest rate | Investors with moderate risk tolerance |

| Equity Tranche (Class C) | Unrated or below BBB | Lowest priority | Highest risk | Highest interest rate | Speculative investors seeking high yield |

Introduction to Tranching in Securitization

Tranching in securitization involves dividing a pool of financial assets into segments or "tranches" that vary by risk and return profiles, enabling investors to choose based on their risk tolerance. Senior tranches typically offer lower yields with higher credit ratings, while junior or mezzanine tranches provide higher yields with increased risk exposure. This structured approach enhances capital efficiency by attracting a broader spectrum of investors through tailored risk distribution.

Understanding Securitization: A Brief Overview

Tranching in securitization involves dividing pooled financial assets, such as mortgages or loans, into multiple layers with varying risk and return profiles, known as tranches. Each tranche is assigned a priority level that determines the order of cash flow distribution, where senior tranches receive payments first and subordinate tranches absorb losses initially. This structured hierarchy enhances creditworthiness for senior tranches and provides tailored investment options for different risk appetites in capital markets.

What is Tranching?

Tranching in securitization involves dividing a pool of financial assets into multiple classes or tranches, each with varying risk levels, maturities, and returns. This process allows investors to select tranches that match their risk tolerance and investment objectives, with senior tranches receiving priority on payments and junior tranches absorbing initial losses. A common example is mortgage-backed securities where tranches range from AAA-rated senior debt to equity tranches with higher risk and potential reward.

Structure of Tranches in Financial Products

In securitization, tranching divides pooled financial assets into multiple layers called tranches, each with distinct risk and return profiles. Senior tranches receive priority on cash flows and typically have lower yield but higher credit ratings, while mezzanine and equity tranches absorb higher risk with correspondingly higher potential returns. This structured hierarchy allows investors to select tranches that align with their risk tolerance and investment objectives.

Example: Mortgage-Backed Securities (MBS) Tranching

Mortgage-Backed Securities (MBS) are structured into tranches that differ by risk, maturity, and yield, allowing investors to select based on their risk tolerance and income needs. Senior tranches receive priority for principal and interest payments, making them lower risk and typically assigned higher credit ratings, while junior tranches absorb initial losses and offer higher yields to compensate for increased risk. This tranching mechanism enables efficient distribution of mortgage cash flows and risk diversification among various investor classes.

Example: Collateralized Debt Obligations (CDOs) Tranching

Collateralized Debt Obligations (CDOs) utilize tranching by dividing the pooled debt assets into multiple segments based on risk and return profiles, such as senior, mezzanine, and equity tranches. Senior tranches typically receive priority in cash flow distribution and have lower risk and interest rates, while mezzanine and equity tranches absorb more risk and offer higher yields. This structure allows investors to select tranches aligning with their risk tolerance and investment goals within securitized debt products.

Cash Flow Distribution Among Tranches

In securitization, tranching allocates cash flow based on priority of claims, where senior tranches receive principal and interest payments first, reducing their risk compared to junior tranches. Mezzanine tranches absorb losses after senior tranches are paid, while equity or residual tranches receive remaining cash flows last, bearing the highest risk and potential returns. This structured hierarchy optimizes investor risk-return profiles and enhances marketability of asset-backed securities.

Risk and Return Profiles of Different Tranches

In securitization, tranching divides a pool of assets into segments with varying risk and return profiles to attract diverse investors. Senior tranches typically have the highest credit ratings, offering lower yields and priority in payment, minimizing risk exposure. Subordinated or mezzanine tranches carry higher default risk but provide greater returns, reflecting their position in the payment waterfall and potential for loss absorption.

Real-World Tranching Case Studies

In the 2007-2008 financial crisis, the securitization of mortgage-backed securities (MBS) demonstrated complex tranching structures where senior tranches offered higher credit ratings and lower yields, while mezzanine and equity tranches bore greater risk with higher potential returns. The case of Lehman Brothers' MBS showed how subprime mortgage defaults caused significant losses in lower tranches, triggering cascading effects on investor confidence and market liquidity. Real-world tranching illustrates the importance of accurately assessing tranche risk profiles to optimize portfolio diversification and capital allocation strategies.

Benefits and Challenges of Tranching in Securitization

Tranching in securitization allows investors to choose risk levels by dividing pooled assets into different classes, each with varying credit ratings and interest rates, enhancing marketability and capital efficiency. The primary benefits include improved risk distribution, tailored investment opportunities, and increased liquidity for originators. Challenges involve potential complexity in valuation, the risk of misaligned incentives among tranches, and regulatory scrutiny that can impact transparency and investor confidence.

example of tranching in securitization Infographic

samplerz.com

samplerz.com