A bullet loan in financing is a type of loan where the principal amount is repaid in a single lump sum at the end of the loan term. During the loan tenure, the borrower typically makes interest-only payments, minimizing periodic payment amounts. This structure is common in corporate finance and real estate lending, where cash flow management is critical. Financial institutions prefer bullet loans for short-term borrowing as they allow borrowers to defer principal repayment. The lack of gradual amortization means higher risk for lenders if the borrower's financial position deteriorates. Bullet loans are often used in bridge financing and project funding where repayment depends on future liquidity events or asset sales.

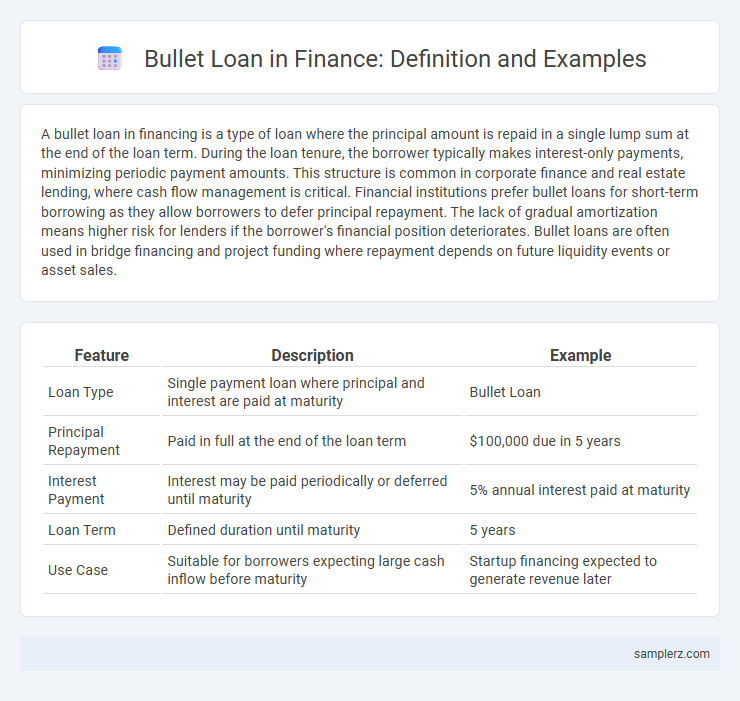

Table of Comparison

| Feature | Description | Example |

|---|---|---|

| Loan Type | Single payment loan where principal and interest are paid at maturity | Bullet Loan |

| Principal Repayment | Paid in full at the end of the loan term | $100,000 due in 5 years |

| Interest Payment | Interest may be paid periodically or deferred until maturity | 5% annual interest paid at maturity |

| Loan Term | Defined duration until maturity | 5 years |

| Use Case | Suitable for borrowers expecting large cash inflow before maturity | Startup financing expected to generate revenue later |

Understanding Bullet Loans in Finance

Bullet loans in finance require repayment of the entire principal amount at the end of the loan term, with interest typically paid periodically or compounded. These loans are common in corporate finance and real estate, where borrowers prefer lower periodic payments and a single lump-sum repayment. Understanding bullet loans is essential for cash flow management and risk assessment due to their distinctive structure and potential impact on financial planning.

Key Features of Bullet Loan Structures

A bullet loan features a single lump-sum principal repayment at maturity while interest is paid periodically throughout the loan term, enabling lower initial cash outflows. These loans often carry fixed or variable interest rates and have shorter durations compared to amortizing loans, making them suitable for projects with irregular cash flows or refinancing plans. The structure allows borrowers to manage liquidity effectively by deferring principal repayment until a predetermined date, but it also increases refinancing risk if funds are not available at maturity.

Common Uses of Bullet Loans in Corporate Financing

Bullet loans in corporate financing are commonly used for short-term liquidity needs, such as bridging gaps between project expenditures and incoming revenue streams. They enable companies to manage working capital efficiently without immediate principal repayment, often supporting activities like inventory purchases or operational expansions. Businesses also utilize bullet loans for restructuring debt, consolidating liabilities into a single payment at maturity to optimize cash flow management.

Example: Real Estate Development and Bullet Loans

A bullet loan in real estate development typically involves a single lump-sum payment of principal at the end of the loan term, allowing developers to minimize monthly cash outflows during construction phases. For example, a developer might secure a $5 million bullet loan to finance land acquisition and building costs, with interest-only payments made monthly and the entire principal repaid upon project completion or property sale. This financing structure optimizes cash flow management and aligns repayment with the realization of project revenues.

Case Study: Bullet Loans in Leveraged Buyouts

Bullet loans are frequently utilized in leveraged buyouts (LBOs) to provide borrowers with a lump-sum principal repayment at maturity, enabling better cash flow management during the acquisition phase. In a notable LBO case, the acquiring firm employed a $150 million bullet loan with a five-year term and interest-only payments until maturity to optimize leverage without immediate capital strain. This structure allowed the company to prioritize operational improvements and asset disposals before making the full principal repayment, enhancing overall deal viability and investor returns.

Bullet Loans vs. Amortizing Loans: A Comparison

Bullet loans require a lump-sum principal repayment at maturity, offering interest-only payments during the loan term and often higher flexibility for short-term financing needs. Amortizing loans involve periodic payments covering both principal and interest, gradually reducing the loan balance over time, which provides predictable cash flows and lower default risk. Investors and borrowers must weigh the benefits of bullet loans' cash flow relief against the amortizing loans' risk mitigation and consistent principal reduction.

Short-Term Corporate Funding with Bullet Loans

Bullet loans are a popular choice for short-term corporate funding due to their structure, which requires a single lump sum payment of principal and interest at maturity. These loans provide companies with immediate capital for operational needs or investments without immediate principal repayments, enhancing cash flow management. Commonly used for bridging finance or interim funding, bullet loans typically have terms ranging from 3 to 12 months, making them ideal for businesses needing quick access to capital with predictable repayment schedules.

Bullet Loan Example: Working Capital Financing

A bullet loan in working capital financing involves a borrower receiving a lump sum amount to cover short-term operational expenses, with the entire principal repayment due at the loan's maturity date. For example, a company might secure a $500,000 bullet loan to manage inventory purchases and payroll during a seasonal sales cycle, repaying the full amount in one installment after the peak period. This structure helps maintain cash flow without monthly amortization, making it ideal for businesses expecting a large inflow of revenue at a later date.

Risks and Considerations in Bullet Loan Agreements

Bullet loans require a lump-sum principal repayment at maturity, which can pose significant refinancing risk if the borrower faces liquidity constraints. Interest rate fluctuations during the loan term may increase overall borrowing costs, impacting financial stability. Careful assessment of market conditions and cash flow projections is crucial to mitigate default risk and ensure adequate contingency planning.

Notable Companies Utilizing Bullet Loan Financing

Notable companies such as Tesla and Uber have utilized bullet loan financing to manage large capital expenditures and streamline cash flow by repaying the principal in a lump sum at maturity. This financing structure allows high-growth firms to invest aggressively while deferring principal repayments, optimizing liquidity during expansion phases. Major private equity firms also commonly employ bullet loans for leveraged buyouts, leveraging the deferred payment model to align debt repayment with expected asset sell-off timelines.

example of bullet loan in financing Infographic

samplerz.com

samplerz.com