In finance, a waterfall in distribution refers to the structured priority order in which returns or cash flows are allocated among investors or stakeholders. This method ensures that senior investors receive their agreed-upon returns before junior investors obtain any distribution. For example, in private equity, the waterfall structure typically begins with returning the initial capital contributions, followed by preferred returns to limited partners, and finally, the remaining profits are split according to pre-established carried interest agreements. Waterfall models often use tiers or hurdles to define these distribution stages clearly, impacting both the timing and quantity of payments. The data points involved include the total distributable cash flow, investor capital requirements, preferred return rates, and the percentage splits at each tier. This distribution scheme is pivotal for aligning incentives and managing risk, especially in complex financial arrangements such as real estate syndications and hedge fund payouts.

Table of Comparison

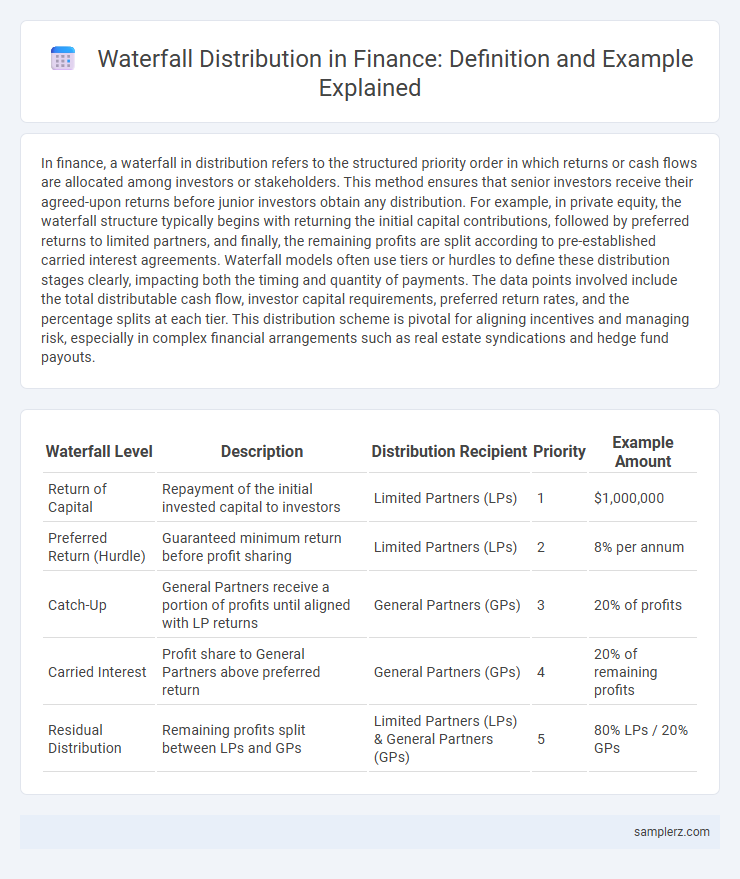

| Waterfall Level | Description | Distribution Recipient | Priority | Example Amount |

|---|---|---|---|---|

| Return of Capital | Repayment of the initial invested capital to investors | Limited Partners (LPs) | 1 | $1,000,000 |

| Preferred Return (Hurdle) | Guaranteed minimum return before profit sharing | Limited Partners (LPs) | 2 | 8% per annum |

| Catch-Up | General Partners receive a portion of profits until aligned with LP returns | General Partners (GPs) | 3 | 20% of profits |

| Carried Interest | Profit share to General Partners above preferred return | General Partners (GPs) | 4 | 20% of remaining profits |

| Residual Distribution | Remaining profits split between LPs and GPs | Limited Partners (LPs) & General Partners (GPs) | 5 | 80% LPs / 20% GPs |

Understanding Waterfall Distribution in Finance

Waterfall distribution in finance refers to the structured allocation of returns in investment partnerships, where cash flows are prioritized among stakeholders based on predefined tiers. This mechanism ensures that senior investors receive their preferred returns before subordinated investors participate in profits. Understanding waterfall distribution allows investors to evaluate the sequence and magnitude of payouts, aligning risk and reward expectations effectively.

Key Components of a Financial Waterfall

A financial waterfall in distribution systematically allocates cash flow among stakeholders based on predefined priority tiers, including return of capital, preferred returns, and profit splits. Key components consist of the catch-up tier, where sponsors catch up on their share of profits after investors receive their preferred returns, followed by the promote tier that allocates excess profits based on agreed-upon percentages. This structured hierarchy ensures transparent and equitable distribution of earnings, aligning incentives between investors and managers while mitigating conflicts in fund management.

Priority of Payments: Waterfall Structure Explained

The priority of payments in a waterfall structure dictates the sequential order in which cash flows are allocated to different stakeholders, ensuring senior creditors receive payments before junior investors. This hierarchy typically begins with operating expenses and debt service, followed by reserves, subordinated debt, and finally equity distributions. Understanding the waterfall mechanism is crucial for managing risk and aligning incentives in structured finance and investment funds.

Real Estate Investment Waterfall Example

In a Real Estate Investment Waterfall example, cash flow distributions prioritize returning the preferred return to limited partners before general partners receive their share. Once the preferred return hurdle is met, profits are split according to predetermined tiers, often with increasing percentages allocated to general partners as returns exceed specific benchmarks. This structured allocation aligns incentives and ensures that capital is distributed fairly based on investment performance.

Private Equity Waterfall Distribution Scenario

In a Private Equity waterfall distribution scenario, cash flows are allocated sequentially starting with the return of the limited partners' invested capital, followed by the preferred return or hurdle rate. Once these thresholds are met, the remaining profits are split according to the agreed carried interest, often around 20% to the general partners. This structured priority ensures alignment of interests between limited partners and general partners by incentivizing performance-based compensation.

Debt vs Equity Waterfall Distribution

In finance, a debt vs equity waterfall distribution illustrates the priority of cash flow allocation between creditors and shareholders. Debt holders receive payments first, covering interest and principal, before any residual cash flows are distributed to equity investors. This hierarchical structure ensures creditors' claims are satisfied prior to equity distributions, reflecting the risk-return tradeoff inherent in capital structure.

Step-by-Step Waterfall Calculation Example

A step-by-step waterfall calculation in finance involves sequentially allocating cash flows or profits according to predefined priorities among stakeholders, such as investors or partners. Starting with the return of capital contributions, followed by preferred returns, and then the distribution of remaining profits based on ownership percentages, this method ensures transparent and fair distribution aligned with contractual agreements. Precise waterfall modeling is essential in private equity, real estate syndications, and structured finance to accurately reflect each party's entitlements and optimize investment returns.

Common Pitfalls in Waterfall Distributions

Waterfall distributions often encounter pitfalls such as misalignment of investor expectations and unclear hurdle rate definitions that lead to disputes. Overlooking the timing and sequencing of cash flows can result in inaccurate profit allocations between general partners and limited partners. Failure to update waterfall models regularly with changing market conditions and deal specifics can cause significant financial discrepancies and erode trust among stakeholders.

Impact of Waterfall Provisions on Investor Returns

Waterfall provisions in finance dictate the order and priority of cash flow distributions to investors, significantly impacting their returns by defining when and how much each class of investor receives. These provisions ensure senior investors obtain their preferred returns before subordinate investors receive any distributions, often leading to higher risk-adjusted returns for senior stakeholders. Structuring waterfall models effectively can optimize capital recovery and enhance overall investment performance by aligning risk and reward across different investor tiers.

Best Practices for Structuring Waterfall Distributions

Waterfall distributions in finance are best structured by clearly defining priority tiers, such as return of capital, preferred return, catch-up, and carried interest, to ensure transparent allocation of profits. Establishing precise hurdle rates and split percentages for each tier minimizes disputes and aligns incentives between investors and fund managers. Regularly updating waterfall structures to reflect changes in fund performance or investor agreements enhances flexibility and maintains equitable distribution throughout the investment lifecycle.

example of waterfall in distribution Infographic

samplerz.com

samplerz.com