A straddle in options trading involves purchasing both a call option and a put option on the same underlying asset, with the same strike price and expiration date. This strategy allows investors to profit from significant price movements in either direction, making it ideal for highly volatile markets. Traders use the straddle to hedge against uncertainty, expecting large shifts but unsure of the direction. In the context of finance, a common example of a straddle is buying a call and put option on Tesla stock at a strike price of $700, expiring in one month. If Tesla's stock price moves far above or below $700, the trader can realize profits from one of the options while limiting losses on the other. The maximum potential loss is limited to the total premium paid for both options.

Table of Comparison

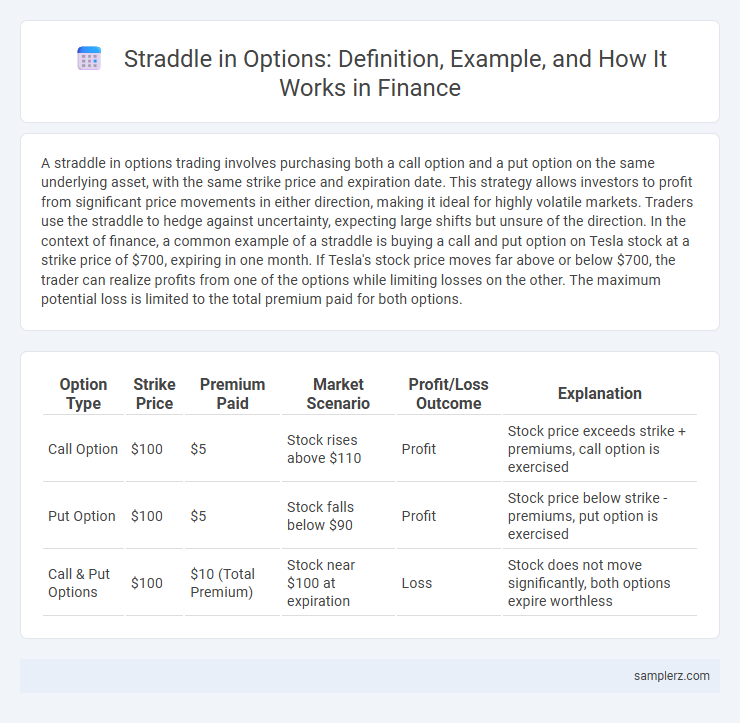

| Option Type | Strike Price | Premium Paid | Market Scenario | Profit/Loss Outcome | Explanation |

|---|---|---|---|---|---|

| Call Option | $100 | $5 | Stock rises above $110 | Profit | Stock price exceeds strike + premiums, call option is exercised |

| Put Option | $100 | $5 | Stock falls below $90 | Profit | Stock price below strike - premiums, put option is exercised |

| Call & Put Options | $100 | $10 (Total Premium) | Stock near $100 at expiration | Loss | Stock does not move significantly, both options expire worthless |

Understanding Straddles in Options Trading

A straddle in options trading involves simultaneously buying a call option and a put option with the same strike price and expiration date, allowing traders to profit from significant price movements in either direction. This strategy is particularly useful in volatile markets where the direction of the price movement is uncertain but substantial changes are expected. By leveraging the intrinsic and extrinsic value of both options, straddles provide a balanced approach to capturing upside gains while limiting downside risks.

Key Components of a Straddle Strategy

A straddle option strategy involves buying both a call option and a put option at the same strike price and expiration date, allowing investors to profit from significant price movements in either direction. Key components include the strike price, which is typically set at-the-money, and the premium paid for both options, which determines the breakeven points and potential profit. This strategy benefits from high volatility, as the total premium cost is offset only by substantial price swings exceeding the combined premiums of the call and put.

Real-Life Example of a Straddle Trade

A real-life example of a straddle trade occurred with Tesla Inc. shares before their earnings announcement, where traders purchased both call and put options at the same strike price and expiration date to profit from expected volatility. Tesla's stock price often experiences large swings surrounding earnings, making the straddle an effective strategy to capitalize on unpredictable price movements without needing to predict direction. This approach allowed investors to potentially gain from a significant price move, regardless of whether the market moved up or down after the announcement.

How a Straddle Works: Step-by-Step Breakdown

A straddle in options trading involves simultaneously buying a call and a put option at the same strike price and expiration date, aiming to profit from significant price volatility. If the underlying asset's price moves sharply above or below the strike price, the gains from one option offset the loss from the other, enabling traders to capitalize on large market swings. This strategy requires carefully monitoring time decay and implied volatility, as both influence the potential profitability of the straddle position.

Profit and Loss Analysis of Straddle Positions

A straddle option strategy involves buying both a call and a put option at the same strike price and expiration date, enabling profits from significant price movements in either direction. Profit potential is theoretically unlimited if the underlying asset moves sharply beyond the breakeven points, calculated by adding the total premium paid to the strike price for the upside, and subtracting it for the downside. Losses are limited to the total premiums paid, occurring if the underlying price remains near the strike price, resulting in both options expiring worthless.

When to Use a Straddle in Finance

A straddle is used in finance when an investor expects significant volatility in the underlying asset but is uncertain about the direction of the price movement. This options strategy involves buying both a call and a put option at the same strike price and expiration date to profit from large price swings. Straddles are particularly effective before major earnings reports, economic announcements, or geopolitical events that could cause sharp market reactions.

Risk Factors of Straddle Option Strategies

A straddle option strategy involves simultaneously buying a call and a put option at the same strike price and expiration date, exposing the investor to high volatility risk. This approach carries the risk of significant time decay, which can erode option value if the underlying asset's price remains stable. Additionally, large losses may occur if the asset price moves insufficiently to offset the combined premium paid for both options.

Comparing Straddles to Strangles in Options

A straddle involves buying a call and put option at the same strike price and expiration date, targeting significant price movement without direction bias. In contrast, strangles purchase out-of-the-money calls and puts with different strike prices, usually lower-cost but requiring larger price moves to profit. Straddles maximize profit potential in high volatility environments but carry higher premiums, while strangles offer limited upfront risk with a wider profit range during moderate price swings.

Market Scenarios Favorable for Straddle Example

A straddle strategy is most effective in highly volatile market scenarios where significant price movements are expected but the direction is uncertain, such as before major earnings announcements or economic reports. For instance, investors might buy both a call and put option at the same strike price on a stock like Tesla ahead of its quarterly earnings release to profit from potential sharp price swings. This approach allows traders to capitalize on dramatic upward or downward shifts without needing to predict the direction of the move.

Frequently Asked Questions About Straddle Examples

A straddle in options trading involves purchasing both a call and a put option at the same strike price and expiration date, allowing traders to profit from significant price movements in either direction. Commonly asked questions include how the straddle benefits from volatility, the break-even points calculated by adding and subtracting the total premium from the strike price, and the risks involved, such as losing the total premium if the underlying asset's price remains stagnant. Traders often use straddles during earnings announcements or market events expected to cause sharp price fluctuations.

example of straddle in option Infographic

samplerz.com

samplerz.com