A samurai bond is a yen-denominated bond issued in Japan by non-Japanese companies. These bonds allow foreign entities to raise capital in the Japanese market while benefiting from low interest rates and access to Japanese investors. The issuer repays the bond in yen, which exposes them to currency risk if their revenues are in a different currency. In the bond market, samurai bonds play a crucial role in diversifying funding sources for global corporations. Entities such as multinational corporations and sovereign governments prefer issuing samurai bonds to tap into Japan's deep and liquid financial markets. Data shows that samurai bonds can offer competitive yields compared to other international debt instruments, making them attractive for both issuers and investors.

Table of Comparison

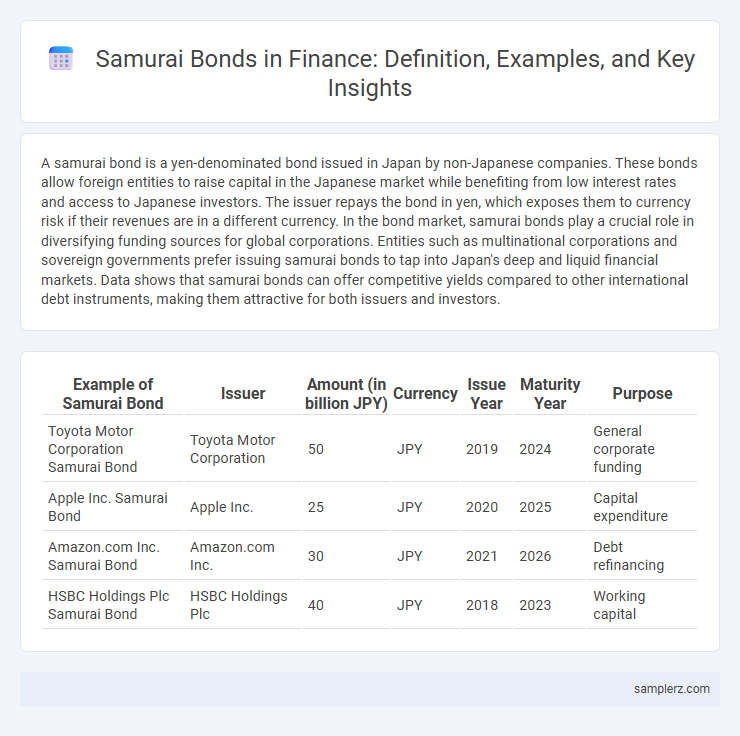

| Example of Samurai Bond | Issuer | Amount (in billion JPY) | Currency | Issue Year | Maturity Year | Purpose |

|---|---|---|---|---|---|---|

| Toyota Motor Corporation Samurai Bond | Toyota Motor Corporation | 50 | JPY | 2019 | 2024 | General corporate funding |

| Apple Inc. Samurai Bond | Apple Inc. | 25 | JPY | 2020 | 2025 | Capital expenditure |

| Amazon.com Inc. Samurai Bond | Amazon.com Inc. | 30 | JPY | 2021 | 2026 | Debt refinancing |

| HSBC Holdings Plc Samurai Bond | HSBC Holdings Plc | 40 | JPY | 2018 | 2023 | Working capital |

Understanding Samurai Bonds: Definition and Characteristics

Samurai bonds are yen-denominated bonds issued in Japan by non-Japanese entities, providing a way for foreign companies to access Japanese capital markets while raising funds in local currency. These bonds offer distinct features such as compliance with Japanese regulations, appeal to local investors, and typically involve credit ratings from recognized agencies to assure transparency and risk evaluation. Understanding Samurai bonds helps investors diversify portfolios with international exposure while leveraging the stability of the Japanese financial market.

Historical Background of Samurai Bonds in Japan

Samurai bonds originated in the 1970s as Japan's first foray into offering yen-denominated bonds to foreign investors, helping diversify capital sources beyond domestic markets. These bonds gained prominence during Japan's rapid economic growth, allowing international entities to tap into Japan's deep liquidity and stable financial system. The historical background of Samurai bonds reflects Japan's strategic efforts to integrate its financial markets with the global economy while bolstering its financial sector's international presence.

Key Features that Distinguish Samurai Bonds

Samurai bonds are yen-denominated debt instruments issued in Japan by foreign entities, offering investors access to Japan's capital markets. Key features distinguishing Samurai bonds include their issuance under Japanese regulations, requiring approval from Japanese authorities, and the use of the Japanese yen as the currency of denomination and repayment. These bonds often provide diversification benefits and can offer lower interest rates compared to bonds issued in the issuer's home currency.

Major Corporations Issuing Samurai Bonds: Case Studies

Major corporations such as Toyota, Sony, and Mitsubishi Heavy Industries have issued Samurai bonds to tap into Japan's capital markets and diversify their funding sources. Toyota's issuance of a 10-year Samurai bond in 2020 raised approximately Y=50 billion to support its global expansion and innovation projects. Sony utilized Samurai bonds in 2018, raising Y=30 billion to finance research and development, demonstrating the strategic use of these bonds by multinational corporations.

Notable Examples of Samurai Bond Issuance in Recent Years

Notable examples of samurai bond issuance in recent years include Toyota Motor Corporation's Y=150 billion bond in 2020, which capitalized on low-interest rates to diversify funding sources. Sony Corporation issued a Y=100 billion samurai bond in 2021, reflecting strong investor confidence in Japanese yen-denominated debt. Another significant issuance involved SoftBank Group's Y=200 billion samurai bond in 2022, showcasing corporate use of the Tokyo market for strategic capital raising.

Benefits of Investing in Samurai Bonds

Samurai bonds, yen-denominated bonds issued in Japan by foreign entities, offer investors portfolio diversification and access to Japan's stable economic environment. These bonds provide competitive interest rates and are subject to Japanese regulations, enhancing transparency and reducing risk. Investing in Samurai bonds allows global investors to benefit from Japan's low inflation and strong credit ratings, ensuring steady income and capital preservation.

Risks and Challenges Associated with Samurai Bonds

Samurai bonds, issued in Japanese yen by foreign entities, carry currency risk due to fluctuations in the yen's value, impacting repayment costs for issuers. These bonds face liquidity risks in Japan's markets, especially during periods of economic volatility or regulatory changes affecting trading volumes. Issuers must also navigate complex compliance requirements under Japanese financial regulations, which can increase issuance costs and operational challenges.

Comparison: Samurai Bonds vs. Other Yen-Denominated Bonds

Samurai bonds, issued by foreign entities in Japan's yen market, typically offer more stringent regulatory compliance compared to other yen-denominated bonds like Uridashi or Shogun bonds. Unlike Uridashi bonds, which target retail investors with higher yields and risk profiles, Samurai bonds attract institutional investors seeking stable returns and transparent issuance conditions. The pricing and liquidity of Samurai bonds generally reflect Japan's robust financial infrastructure, setting them apart from other yen-denominated instruments with varying credit and market risks.

Impact of Samurai Bonds on the Japanese Financial Market

Samurai bonds, issued by foreign entities in the Japanese yen market, significantly enhanced liquidity and diversification in Japan's financial system. These bonds attracted international investors while providing domestic institutions with access to global capital, fostering a more integrated financial market. The increased cross-border investment through Samurai bonds contributed to greater market depth and resilience in Japan's bond market.

Future Trends in Samurai Bond Issuance

Samurai bonds are yen-denominated bonds issued in Japan by foreign entities, offering diversification and access to Japan's deep capital markets. Future trends indicate increased issuance driven by growing global demand for low-interest, stable-yield investments amid uncertain economic conditions. Regulatory reforms and the rise of sustainable finance are expected to further boost the popularity of Samurai bonds among multinational corporations and sovereign issuers.

example of samurai in bond Infographic

samplerz.com

samplerz.com