Alpha in hedge funds refers to the excess returns generated above the benchmark index, representing the fund manager's skill in selecting investments. A hedge fund that achieves a positive alpha consistently demonstrates its ability to outperform the market after adjusting for risk. This metric is crucial for investors aiming to identify managers who can deliver superior risk-adjusted returns. An example of alpha in a hedge fund context is a fund specializing in long-short equity strategies. Suppose the S&P 500 index returns 8% in a year, but the fund delivers a 12% return with similar risk levels. The 4% difference is the alpha, showcasing the manager's success in picking undervalued stocks and shorting overvalued ones to outperform the market.

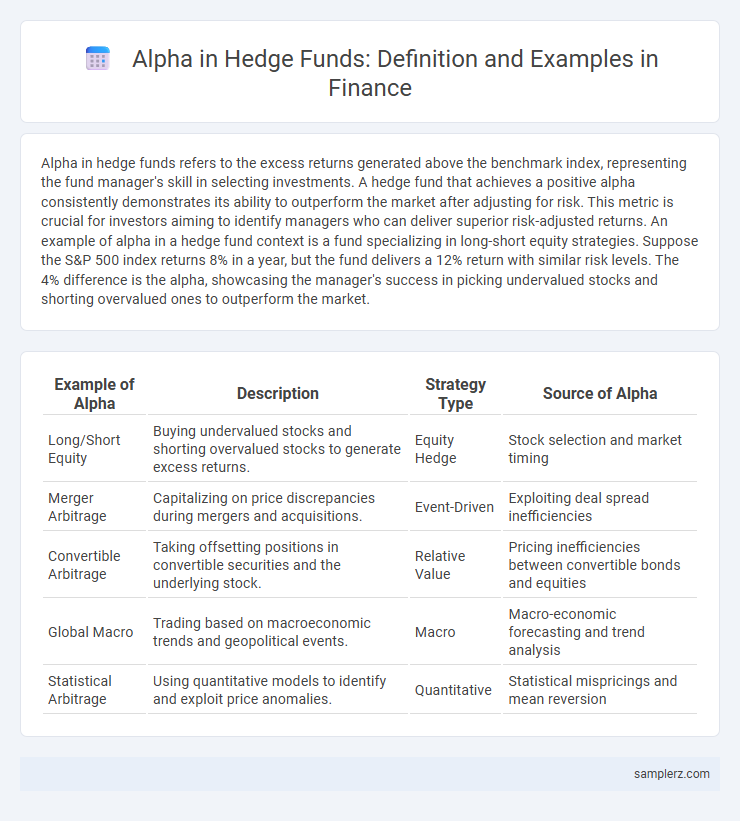

Table of Comparison

| Example of Alpha | Description | Strategy Type | Source of Alpha |

|---|---|---|---|

| Long/Short Equity | Buying undervalued stocks and shorting overvalued stocks to generate excess returns. | Equity Hedge | Stock selection and market timing |

| Merger Arbitrage | Capitalizing on price discrepancies during mergers and acquisitions. | Event-Driven | Exploiting deal spread inefficiencies |

| Convertible Arbitrage | Taking offsetting positions in convertible securities and the underlying stock. | Relative Value | Pricing inefficiencies between convertible bonds and equities |

| Global Macro | Trading based on macroeconomic trends and geopolitical events. | Macro | Macro-economic forecasting and trend analysis |

| Statistical Arbitrage | Using quantitative models to identify and exploit price anomalies. | Quantitative | Statistical mispricings and mean reversion |

Understanding Alpha: Definition and Importance in Hedge Funds

Alpha in hedge funds measures the excess returns generated beyond market benchmarks, reflecting the fund manager's skill in selecting investments. For example, a hedge fund achieving a 12% annual return while its benchmark index returns 8% results in an alpha of 4%. This positive alpha illustrates the fund's ability to outperform the market and create value for investors through active management strategies.

Real-World Examples of Alpha Generation in Hedge Fund Strategies

Hedge funds often generate alpha through strategies such as long/short equity, where they exploit market inefficiencies by taking opposing positions in stocks to achieve excess returns. Quantitative hedge funds use sophisticated algorithms and data analysis to identify subtle patterns and arbitrage opportunities, consistently outperforming market benchmarks. For example, Renaissance Technologies' Medallion Fund reportedly achieves annualized alpha exceeding 30% through high-frequency trading and complex statistical models.

Stock Selection: Case Studies of Alpha Outperformance

Stock selection alpha in hedge funds is demonstrated by the consistent outperformance of portfolios such as those managed by Renaissance Technologies and Viking Global Investors, which leverage advanced quantitative models to identify undervalued stocks. These funds achieve alpha by exploiting market inefficiencies through deep fundamental analysis and proprietary algorithms, resulting in returns that surpass benchmark indices. Empirical studies show that targeted stock picking, particularly in small-cap and mid-cap sectors, significantly contributes to hedge fund alpha by capturing mispriced assets and growth opportunities.

Market Neutral Strategies: Alpha in Action

Market neutral strategies aim to generate alpha by exploiting price inefficiencies while minimizing market risk exposure, often through paired long and short positions in correlated securities. For example, a hedge fund might go long on undervalued technology stocks and short overvalued counterparts in the same sector, capturing alpha from relative performance differences regardless of overall market movements. Consistent alpha generation in these market neutral strategies depends on rigorous quantitative models and real-time data analysis to identify mispricings and maintain balanced risk profiles.

Event-Driven Hedge Funds: Capturing Alpha from Corporate Events

Event-driven hedge funds generate alpha by exploiting price inefficiencies created by corporate events such as mergers, acquisitions, bankruptcies, and restructurings. These funds analyze deal announcements and regulatory approvals to position trades ahead of market reactions, capturing abnormal returns. Sophisticated models and fundamental research enable event-driven strategies to capitalize on information asymmetries and timing discrepancies inherent in corporate actions.

Quantitative Hedge Funds: Data-Driven Alpha Creation

Quantitative hedge funds leverage advanced algorithms and large datasets to identify market inefficiencies and generate alpha through systematic trading strategies. By utilizing machine learning models and statistical arbitrage, these funds exploit subtle patterns and correlations unnoticeable to traditional analysis, enhancing portfolio returns. The integration of alternative data sources, such as satellite imagery and social media sentiment, further refines predictive accuracy, driving consistent alpha generation in complex market environments.

Arbitrage Opportunities as a Source of Alpha

Arbitrage opportunities in hedge funds arise from price inefficiencies between correlated assets, enabling traders to generate alpha by exploiting temporary mispricings without market exposure. Statistical arbitrage strategies use quantitative models to identify mean-reverting price spreads, capturing consistent returns above the benchmark. These methods require advanced data analysis and rapid execution to capitalize on short-lived discrepancies, delivering risk-adjusted alpha in volatile markets.

Risk Management Techniques That Protect and Enhance Alpha

Alpha in hedge funds represents the excess return generated beyond the market benchmark, primarily achieved through sophisticated risk management techniques such as diversification, dynamic hedging, and stop-loss orders. Employing volatility targeting and tail risk hedging helps mitigate downside risks while preserving upside potential, thereby protecting capital and enhancing alpha. Utilizing quantitative models and stress testing further refines position sizing and risk exposure, ensuring consistent alpha generation in varying market conditions.

Measuring Alpha: Tools and Metrics for Hedge Funds

Measuring alpha in hedge funds involves key tools such as the Jensen's Alpha, which calculates risk-adjusted returns compared to a benchmark, and the Sharpe Ratio, highlighting excess return per unit of volatility. The Information Ratio complements these metrics by evaluating the consistency of alpha generation relative to tracking error. Advanced analytics platforms like Bloomberg Terminal and FactSet integrate these metrics to provide comprehensive performance evaluation and risk management for hedge fund managers.

Lessons from Legendary Hedge Funds Delivering Consistent Alpha

Legendary hedge funds like Renaissance Technologies and Bridgewater Associates demonstrate consistent alpha by leveraging sophisticated quantitative models and diversified strategies to outperform market benchmarks. Their success highlights the importance of robust risk management, adaptive algorithms, and deep market insights in generating excess returns. Emulating these practices can help hedge funds achieve sustainable alpha and long-term investor value.

example of alpha in hedge Infographic

samplerz.com

samplerz.com