A butterfly spread in options trading is a neutral strategy that involves using three different strike prices to limit risk while maximizing potential profit. For example, an investor might buy one call option with a lower strike price, sell two call options at a middle strike price, and buy one call option with a higher strike price, all expiring on the same date. This setup creates a profit zone around the middle strike price, where the maximum gain occurs if the underlying asset's price equals that strike at expiration. In practical terms, if a stock is trading at $100, a trader could buy a call at $95, sell two calls at $100, and buy another call at $105. The net cost of entering this butterfly spread is relatively low, as the premium received from selling the middle calls offsets the cost of the outer calls. The risk is limited to the initial net debit paid, while the maximum profit is realized when the stock price closes exactly at the middle strike price at expiration.

Table of Comparison

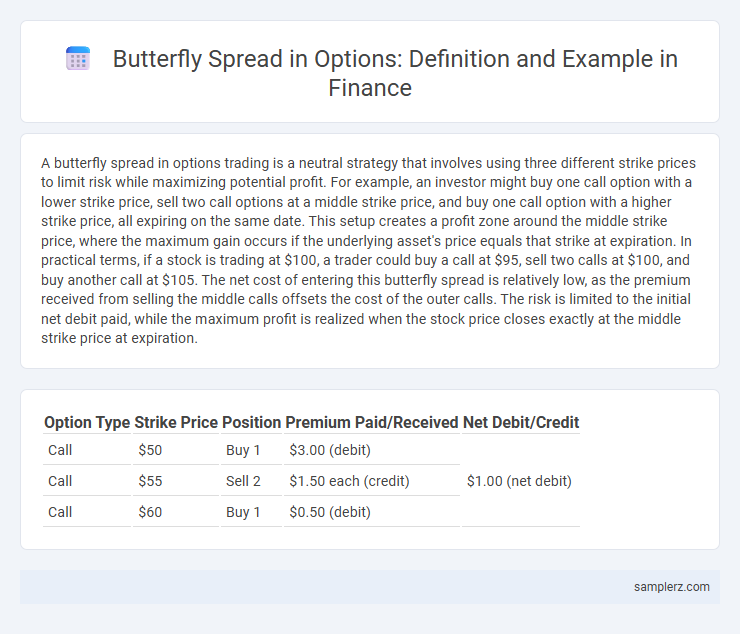

| Option Type | Strike Price | Position | Premium Paid/Received | Net Debit/Credit |

|---|---|---|---|---|

| Call | $50 | Buy 1 | $3.00 (debit) | $1.00 (net debit) |

| Call | $55 | Sell 2 | $1.50 each (credit) | |

| Call | $60 | Buy 1 | $0.50 (debit) |

Introduction to Butterfly Spread in Options

A butterfly spread in options trading involves simultaneously buying and selling multiple call or put options with three different strike prices but the same expiration date, creating a limited risk, limited profit strategy. This strategy is designed to capitalize on low volatility when the underlying asset's price is expected to remain near the middle strike price at expiration. Traders use butterfly spreads to benefit from minimal price movement while controlling costs and maximizing potential returns within a defined price range.

Key Components of a Butterfly Spread

A butterfly spread in options trading involves three strike prices, typically equidistant, combining long and short positions to limit both risk and reward. The key components include buying one lower strike call, selling two middle strike calls, and buying one higher strike call, creating a defined profit zone at the middle strike price. This strategy benefits from low volatility and time decay, with maximum profit realized when the underlying asset closes at the middle strike price at expiration.

Step-by-Step Construction of a Butterfly Spread

Constructing a butterfly spread in options involves buying one lower strike call, selling two middle strike calls, and buying one higher strike call with the same expiration date, creating a net debit position. This strategy limits both potential loss and gain, targeting minimal price movement around the middle strike price at expiration. The maximum profit occurs if the underlying asset price equals the middle strike, while maximum loss is confined to the initial premium paid.

Example: Implementing a Call Butterfly Spread

Implementing a call butterfly spread involves buying one lower strike call option, selling two middle strike call options, and buying one higher strike call option with the same expiration date to capitalize on minimal stock price movement. For example, an investor might buy one $50 call, sell two $55 calls, and buy one $60 call to profit from the underlying stock stabilizing near $55 at expiration. This strategy limits risk and potential profit by creating a net debit position, ideal for neutral market outlooks.

Example: Implementing a Put Butterfly Spread

Implementing a put butterfly spread involves simultaneously buying one in-the-money put option, selling two at-the-money put options, and buying one out-of-the-money put option with the same expiration date. This strategy limits both potential loss and gain, making it ideal for traders expecting minimal underlying asset price movement. For example, if a stock is trading at $100, an investor might buy a $95 put, sell two $100 puts, and buy a $105 put to profit from low volatility around the $100 strike price.

Profit and Loss Analysis of a Butterfly Spread Example

A butterfly spread option strategy involves buying one lower strike call, selling two middle strike calls, and buying one higher strike call, creating a limited risk, limited profit scenario. Profit is maximized when the underlying asset's price at expiration equals the middle strike price, while losses are limited to the net premium paid if the price moves significantly outside the wings' strikes. The maximum loss is capped and occurs when the underlying finishes below the lower strike or above the higher strike, highlighting the strategy's risk control and profit potential within a defined price range.

Payoff Diagram: Visualizing the Butterfly Spread Example

The payoff diagram of a butterfly spread option strategy illustrates potential profits and losses by combining three strike prices, typically with two options bought at the lowest and highest strikes and two sold at the middle strike. The maximum profit is realized if the underlying asset price closes exactly at the middle strike price at expiration, where the spread between options is maximized. This visual representation helps traders assess risk and reward, showing limited loss potential and defined profit zones within a narrow price range.

Real Market Scenario: Butterfly Spread Application

A butterfly spread in options trading involves simultaneously buying and selling calls or puts at three different strike prices to capitalize on minimal stock price movement. In a real market scenario, an investor expecting a stable stock price around $100 might buy one call at $95, sell two calls at $100, and buy one call at $105, limiting risk while targeting modest gains. This strategy effectively balances risk and reward during periods of low volatility, commonly used to profit from expected price consolidation.

Risks and Rewards in Butterfly Spread Example

A butterfly spread in options trading involves limited risk with potential for high reward by targeting minimal price movement near the middle strike price at expiration. The maximum loss is confined to the initial net premium paid, while the maximum profit occurs when the underlying asset closes exactly at the middle strike price. This strategy balances risk and reward by combining both bullish and bearish positions, minimizing exposure to large market swings.

When to Use a Butterfly Spread in Trading Strategies

A butterfly spread is ideal when a trader expects low volatility and anticipates the underlying asset to remain near a specific strike price at option expiration. This strategy limits both risk and profit potential by combining bull and bear spreads with three strike prices, maximizing gains if the asset's price matches the middle strike. Traders often use butterfly spreads during earnings announcements or when market uncertainty is low, aiming to capitalize on minimal price movement while controlling exposure.

example of butterfly spread in option Infographic

samplerz.com

samplerz.com