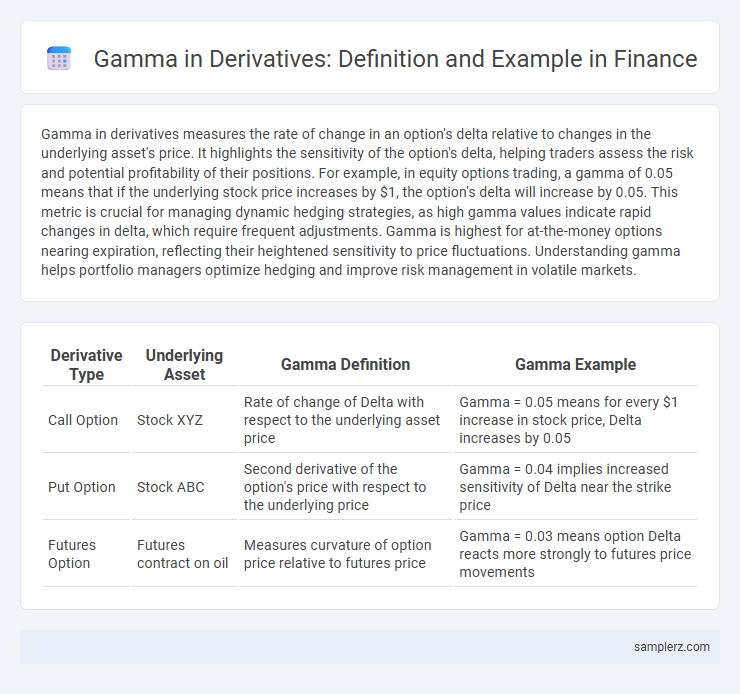

Gamma in derivatives measures the rate of change in an option's delta relative to changes in the underlying asset's price. It highlights the sensitivity of the option's delta, helping traders assess the risk and potential profitability of their positions. For example, in equity options trading, a gamma of 0.05 means that if the underlying stock price increases by $1, the option's delta will increase by 0.05. This metric is crucial for managing dynamic hedging strategies, as high gamma values indicate rapid changes in delta, which require frequent adjustments. Gamma is highest for at-the-money options nearing expiration, reflecting their heightened sensitivity to price fluctuations. Understanding gamma helps portfolio managers optimize hedging and improve risk management in volatile markets.

Table of Comparison

| Derivative Type | Underlying Asset | Gamma Definition | Gamma Example |

|---|---|---|---|

| Call Option | Stock XYZ | Rate of change of Delta with respect to the underlying asset price | Gamma = 0.05 means for every $1 increase in stock price, Delta increases by 0.05 |

| Put Option | Stock ABC | Second derivative of the option's price with respect to the underlying price | Gamma = 0.04 implies increased sensitivity of Delta near the strike price |

| Futures Option | Futures contract on oil | Measures curvature of option price relative to futures price | Gamma = 0.03 means option Delta reacts more strongly to futures price movements |

Understanding Gamma in Derivatives: A Primer

Gamma measures the rate of change of an option's delta with respect to the underlying asset price, reflecting the curvature of the option's value profile. High gamma values indicate significant sensitivity of delta, making gamma essential for managing the risk of large price movements in options trading. Traders use gamma to adjust hedging strategies, ensuring portfolios remain balanced under different market conditions.

Real-World Gamma Example in Options Trading

Gamma measures the rate of change of an option's delta relative to the underlying asset's price, crucial for managing portfolio risk. In options trading, a call option near its strike price exhibits high gamma, causing delta to fluctuate rapidly with small price movements in the underlying stock, requiring active hedging. Traders monitoring gamma adjust their hedge ratios frequently to maintain a delta-neutral position and mitigate exposure to market volatility.

How Gamma Influences Option Prices

Gamma measures the rate of change in an option's delta relative to movements in the underlying asset's price, directly affecting option price sensitivity. Higher gamma values indicate greater fluctuations in delta, causing option prices to react more sharply to small changes in the underlying asset's price. Traders monitor gamma closely to manage risk and adjust hedging strategies effectively in volatile markets.

Practical Gamma Calculation in Equity Derivatives

Gamma in equity derivatives measures the rate of change of delta with respect to the underlying asset price, providing insights into the convexity of an option's price. A practical gamma calculation involves using finite difference methods on equity option prices, often through a three-point estimation: Gamma [Delta(up) - Delta(down)] / (2 x underlying price change), where Delta(up) and Delta(down) are the deltas computed at incrementally adjusted underlying prices. This calculation is essential for managing the dynamic sensitivity of a portfolio to underlying price movements and effectively hedging risks in options trading.

Gamma Scalping: Example and Explanation

Gamma scalping is a dynamic hedging strategy used in options trading to maintain a delta-neutral portfolio by continuously adjusting the underlying asset position as the option's delta changes. For instance, if a trader holds a long call option on a stock with a high gamma, they buy or sell shares of the underlying stock to hedge against price movements, profiting from the volatility while minimizing directional risk. This precise adjustment leverages gamma's sensitivity to price changes, allowing the trader to capture gains from frequent small moves in the underlying asset price.

Gamma’s Impact During Market Volatility: Case Study

Gamma measures the rate of change in an option's delta relative to underlying asset price movements, critically impacting portfolio risk during market volatility. For example, during the 2020 market crash, options with high gamma exhibited rapid delta shifts, forcing traders to frequently hedge positions to manage exposure. This phenomenon underscores gamma's role in amplifying price sensitivity and influencing dynamic risk management strategies amidst fluctuating markets.

Comparing Delta and Gamma in Derivative Strategies

Delta measures the sensitivity of an option's price to changes in the underlying asset's price, while Gamma quantifies the rate of change of Delta itself, highlighting the curvature of the option's value. Traders employ Gamma to manage the risk of Delta hedging, as it helps anticipate how Delta will evolve with price fluctuations, especially in volatile markets. In derivative strategies, high Gamma indicates greater sensitivity and potential for rapid Delta changes, necessitating frequent adjustments to maintain a delta-neutral position.

Gamma Risk Management: An Illustrative Example

Gamma risk management in derivatives involves monitoring the rate of change in an option's delta relative to the underlying asset price, crucial for maintaining a neutral portfolio. For instance, a trader holding a long call option on a stock with high gamma will adjust their hedge ratio frequently to minimize exposure to rapid price movements, thus controlling potential losses during volatile markets. Utilizing gamma scalping strategies allows continuous rebalancing, ensuring the portfolio remains delta-neutral, enhancing risk-adjusted returns.

Gamma Exposure in Multi-Asset Derivatives

Gamma exposure in multi-asset derivatives quantifies the sensitivity of a portfolio's delta to underlying asset price changes, impacting risk management and hedging strategies. For example, a multi-asset option comprising equity and commodity components exhibits complex gamma profiles due to cross-asset correlations and volatility dynamics. Accurately modeling gamma exposure enables traders to optimize hedges and mitigate nonlinear risks arising from simultaneous movements in multiple underlying assets.

Using Gamma for Hedging Portfolios: Practical Scenarios

Gamma, a key second-order Greek in options trading, measures the rate of change of delta relative to the underlying asset's price. In hedging portfolios, gamma is used to adjust delta-hedges dynamically, ensuring the portfolio remains delta-neutral as market prices fluctuate. For example, a portfolio manager holding long call options with high positive gamma frequently rebalances underlying asset positions to mitigate risks from rapid price movements and maintain stable hedge effectiveness.

example of gamma in derivative Infographic

samplerz.com

samplerz.com