Prepayment risk in mortgage occurs when borrowers pay off their loans earlier than expected, often due to refinancing or selling the property. This early repayment reduces the lender's anticipated interest income, affecting cash flow projections and investment returns. Mortgage-backed securities are particularly vulnerable to prepayment risk, as fluctuations in interest rates can significantly alter borrower behavior. Data shows that prepayment risk rises during periods of declining interest rates, prompting more homeowners to refinance at lower rates. Entities managing mortgage portfolios use statistical models to estimate prepayment probabilities based on historical borrower behavior and current market conditions. Accurate risk assessment helps lenders and investors adjust pricing, hedge strategies, and portfolio allocations to mitigate potential losses from prepayment.

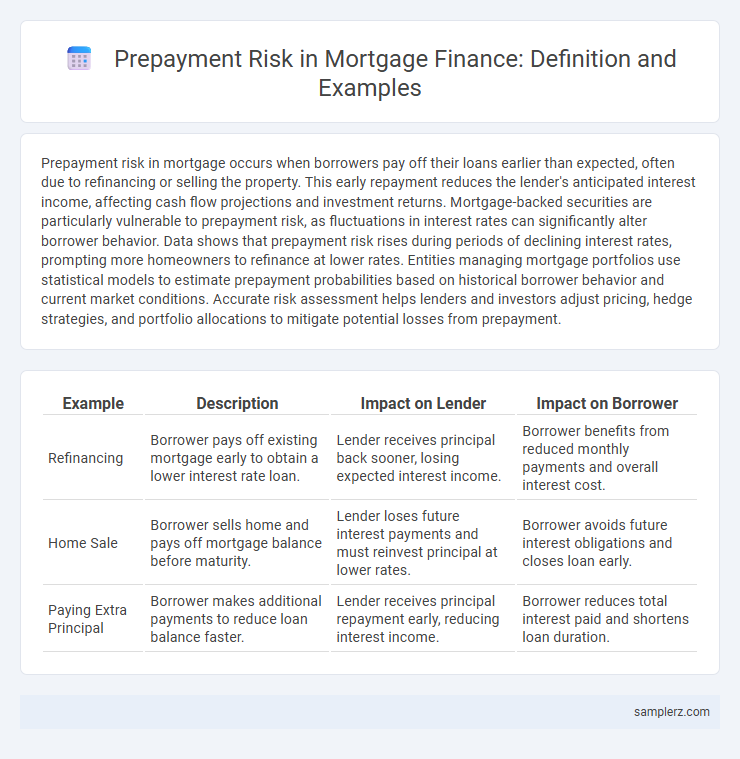

Table of Comparison

| Example | Description | Impact on Lender | Impact on Borrower |

|---|---|---|---|

| Refinancing | Borrower pays off existing mortgage early to obtain a lower interest rate loan. | Lender receives principal back sooner, losing expected interest income. | Borrower benefits from reduced monthly payments and overall interest cost. |

| Home Sale | Borrower sells home and pays off mortgage balance before maturity. | Lender loses future interest payments and must reinvest principal at lower rates. | Borrower avoids future interest obligations and closes loan early. |

| Paying Extra Principal | Borrower makes additional payments to reduce loan balance faster. | Lender receives principal repayment early, reducing interest income. | Borrower reduces total interest paid and shortens loan duration. |

Understanding Prepayment Risk in Mortgages

Prepayment risk in mortgages occurs when borrowers repay their loans earlier than scheduled, affecting the expected interest income for lenders. For instance, homeowners refinancing during declining interest rates often accelerate repayments, forcing investors to reinvest at lower yields. This risk significantly impacts mortgage-backed securities by reducing the anticipated cash flow and altering the duration of these investments.

Common Scenarios Illustrating Mortgage Prepayment Risk

Mortgage prepayment risk commonly arises when homeowners refinance their loans to capitalize on falling interest rates, resulting in early loan repayments that affect lenders' expected cash flows. Homeowners may also accelerate payments during home sales or financial windfalls, disrupting the timing of interest income for mortgage-backed securities investors. Seasonal income variations influencing borrower payment patterns further exemplify typical scenarios that contribute to mortgage prepayment risk.

How Falling Interest Rates Trigger Prepayment Risk

Falling interest rates increase the incentive for mortgage borrowers to refinance their loans, leading to higher prepayment rates. When borrowers refinance at lower rates, lenders receive their principal back sooner than expected, causing reinvestment risk and potential loss of anticipated interest income. This acceleration in loan repayments directly impacts mortgage-backed securities' cash flows and valuation.

Early Mortgage Payoff: A Classic Example

Early mortgage payoff exemplifies prepayment risk as borrowers refinance or fully repay loans ahead of schedule, disrupting expected interest income for lenders. This risk impacts mortgage-backed securities by reducing cash flow predictability and potentially lowering returns due to the premature return of principal. Lenders mitigate prepayment risk through prepayment penalties or adjustable-rate mortgages to align incentives with loan duration.

Refinancing and Its Impact on Prepayment Risk

Refinancing significantly increases prepayment risk in mortgage portfolios as borrowers replace existing loans with new ones at lower interest rates, leading to early payoff of the original mortgages. This behavior reduces the expected cash flows and yields for lenders, disrupting long-term investment projections. The heightened sensitivity to interest rate fluctuations intensifies uncertainty in mortgage-backed securities performance.

Prepayment Risk in Adjustable-Rate Mortgages

Prepayment risk in adjustable-rate mortgages (ARMs) arises when borrowers refinance or pay off their loans early due to declining interest rates, reducing expected interest income for lenders. This risk is heightened during periods of falling benchmark rates like the LIBOR or SOFR, which directly impact ARM interest adjustments. Lenders face uncertainty in cash flow and reinvestment opportunities, impacting the valuation of ARM-backed securities.

Case Study: Prepayment Surge after Rate Cuts

A notable case study of prepayment risk in mortgages occurred after significant interest rate cuts in 2020, when borrowers rushed to refinance their loans, causing a surge in early repayments. This prepayment spike disrupted lenders' cash flow projections, reducing the expected interest income on longer-term fixed-rate mortgages. Mortgage-backed securities also experienced increased volatility as prepayment speeds accelerated unexpectedly, challenging risk models and investor returns.

Lender Strategies to Mitigate Prepayment Risk

Lenders implement strategies such as prepayment penalties, yield maintenance clauses, and lockout periods to mitigate prepayment risk in mortgage financing. These tools help stabilize cash flow by discouraging early loan payoff, preserving the expected interest income. Additionally, lenders may offer adjustable-rate mortgages with step-up coupons to reduce incentives for borrowers to refinance prematurely.

Effects of Prepayment Risk on Mortgage-Backed Securities

Prepayment risk in mortgage-backed securities (MBS) occurs when borrowers repay their mortgages faster than expected, reducing the anticipated interest income for investors. This risk causes cash flow uncertainty and can lead to reinvestment at lower interest rates, diminishing the overall yield of the MBS portfolio. Consequently, prepayment risk affects the valuation, duration, and convexity of mortgage-backed securities, making risk management essential for portfolio performance.

Real-World Example: Prepayment Trends during Economic Downturns

During economic downturns, mortgage holders frequently accelerate loan repayments to reduce debt exposure, leading to increased prepayment risk for lenders. For instance, the 2008 financial crisis saw a surge in prepayments as homeowners refinanced to secure lower interest rates amid falling market rates. This trend diminished expected interest income for mortgage-backed securities investors, highlighting the vulnerability of fixed-income portfolios during economic stress.

example of prepayment risk in mortgage Infographic

samplerz.com

samplerz.com