A caplet is a single-period interest rate derivative that provides protection against rising interest rates for a specific time interval within a cap agreement. It functions as a call option on a specified interest rate index, such as LIBOR or SOFR, with a predetermined strike rate and maturity date. The payoff of a caplet depends on the difference between the actual interest rate at the reset date and the agreed strike rate, multiplied by the notional principal and accrual period. In practice, caplets are used to hedge interest rate risk or speculate on future interest rate movements, commonly in loan or bond portfolios. For example, a firm expecting to borrow funds at a floating rate indexed to LIBOR may buy caplets to limit exposure to rate increases above a certain threshold. Market participants price caplets using models like Black's formula, incorporating volatility, time to maturity, and current forward rates to determine fair values.

Table of Comparison

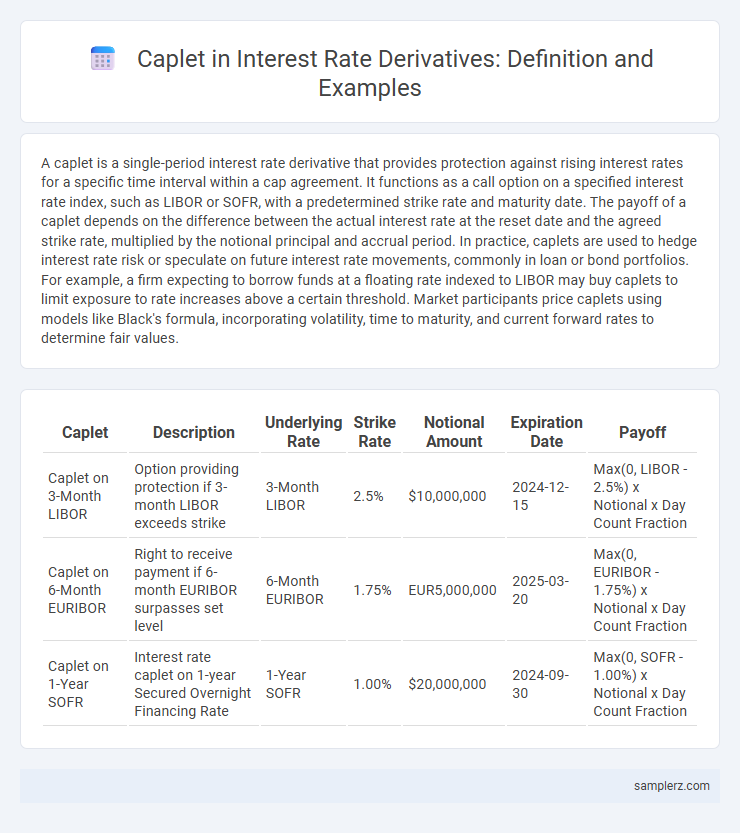

| Caplet | Description | Underlying Rate | Strike Rate | Notional Amount | Expiration Date | Payoff |

|---|---|---|---|---|---|---|

| Caplet on 3-Month LIBOR | Option providing protection if 3-month LIBOR exceeds strike | 3-Month LIBOR | 2.5% | $10,000,000 | 2024-12-15 | Max(0, LIBOR - 2.5%) x Notional x Day Count Fraction |

| Caplet on 6-Month EURIBOR | Right to receive payment if 6-month EURIBOR surpasses set level | 6-Month EURIBOR | 1.75% | EUR5,000,000 | 2025-03-20 | Max(0, EURIBOR - 1.75%) x Notional x Day Count Fraction |

| Caplet on 1-Year SOFR | Interest rate caplet on 1-year Secured Overnight Financing Rate | 1-Year SOFR | 1.00% | $20,000,000 | 2024-09-30 | Max(0, SOFR - 1.00%) x Notional x Day Count Fraction |

Introduction to Caplets in Interest Rate Derivatives

A caplet is a financial derivative that provides protection against rising interest rates by capping the maximum rate on a floating-rate loan or bond for a specific period. Each caplet corresponds to an individual interest payment period within a larger interest rate cap contract, allowing investors to hedge against interest rate volatility on short-term rates like LIBOR or SOFR. Pricing of caplets involves models such as Black's Model, which assesses the option value based on volatility, time to maturity, and current forward rates.

Understanding the Caplet: Definition and Structure

A caplet is a single-period interest rate derivative that provides a payoff when a reference interest rate, such as LIBOR or SOFR, exceeds a predetermined strike rate at the caplet's maturity. It functions as a call option on the interest rate, allowing investors to hedge against rising interest rates over a specific interval within a broader interest rate cap. The caplet's payoff is calculated based on the difference between the reference rate and the strike rate, multiplied by the notional principal and the accrual period, making it a crucial tool for managing interest rate risk in fixed-income portfolios.

Real-World Application: Caplet Example Explained

A caplet is a financial derivative that provides payoff based on the difference between a floating interest rate and a predetermined strike rate for a specific period, commonly used within interest rate cap contracts. For example, a company concerned about rising LIBOR rates can purchase a caplet to hedge interest rate exposure on a loan with quarterly settlements; if LIBOR exceeds the caplet strike rate during the settlement date, the caplet pays the difference multiplied by the notional amount. This real-world application effectively limits borrowing costs, offering protection against interest rate spikes without locking the borrower into fixed rates.

Caplet Payoff Calculation: Step-by-Step Example

A caplet payoff calculation involves determining the payment based on the difference between the realized interest rate and the cap rate, multiplied by the notional principal and the accrual period. For example, if the cap rate is 5%, the realized LIBOR rate is 6%, the notional principal is $1 million, and the accrual period is 0.25 years, the payoff equals (6% - 5%) x $1,000,000 x 0.25 = $2,500. This calculation ensures protection against rising interest rates by capping the maximum effective borrowing cost.

Caplet vs. Interest Rate Caps: Key Differences

A caplet is a single-period interest rate option protecting against rising rates over one specific interval, whereas an interest rate cap bundles multiple caplets covering a series of periods. Each caplet on a cap corresponds to the payoff received if the reference interest rate exceeds the predetermined strike during its period. The main difference lies in the cap's aggregated multi-period coverage versus a caplet's isolated, single-period protection, affecting their pricing, risk management, and hedging strategies.

Benefits of Using Caplets in Financial Management

Caplets provide targeted protection against rising interest rates by capping the maximum rate on floating-rate debt, thereby enhancing cash flow predictability and reducing interest expense volatility. Their flexibility allows financial managers to customize risk exposure across specific periods without committing to a full interest rate swap, optimizing hedging strategies. Using caplets improves balance sheet stability and supports strategic financial planning by limiting potential increases in borrowing costs.

Hedging Interest Rate Risk: Role of Caplets

Caplets serve as crucial instruments in hedging interest rate risk by providing protection against rising interest rates in floating-rate debt portfolios. Each caplet corresponds to a specific interest rate reset period, allowing precise management of exposure to short-term interest rate fluctuations. By locking in maximum borrowing costs through caplets, financial institutions effectively mitigate the adverse impact of volatile interest rates on cash flows.

Market Participants: Who Uses Caplets and Why

Caplets are primarily used by institutional investors, banks, and hedge funds to manage exposure to fluctuating interest rates in the derivatives market. These market participants employ caplets to hedge against rising short-term borrowing costs or to speculate on future interest rate movements. The flexibility of caplets in customizing strike rates and maturities makes them valuable tools for interest rate risk management and portfolio optimization.

Pricing a Caplet: Example Using Black Model

Pricing a caplet using the Black model involves calculating the present value of the capped interest rate payoff, which depends on the forward rate, strike rate, volatility, and time to maturity. The formula uses the cumulative distribution function of the standard normal distribution to estimate the option's price, applying inputs like forward LIBOR rates, risk-free discount factors, and implied volatility from the interest rate market. This approach provides an efficient valuation method for interest rate caplets, crucial for hedging and risk management in fixed income portfolios.

Conclusion: The Relevance of Caplets in Modern Finance

Caplets serve as fundamental components in structuring interest rate derivatives, allowing investors to hedge against rising interest rates with precision. Their modular nature facilitates tailored risk management strategies, enhancing portfolio flexibility in volatile markets. Understanding caplet valuation and application remains crucial for effectively navigating contemporary fixed income and interest rate environments.

example of caplet in interest rate derivative Infographic

samplerz.com

samplerz.com