Negative convexity in mortgages occurs when prepayment options affect the bond's price-yield relationship, causing price appreciation to slow as yields decline. This typically happens in mortgage-backed securities (MBS) where borrowers refinance or prepay loans when interest rates drop. The increased prepayments shorten the duration, limiting price gains and creating negative convexity. In a practical example, a homeowner with a fixed-rate mortgage may refinance if rates fall, resulting in early loan repayment. This action reduces expected cash flows for investors holding MBS, impacting yields and price behavior. Negative convexity risks require portfolio managers to adjust hedging strategies to mitigate potential losses in declining rate environments.

Table of Comparison

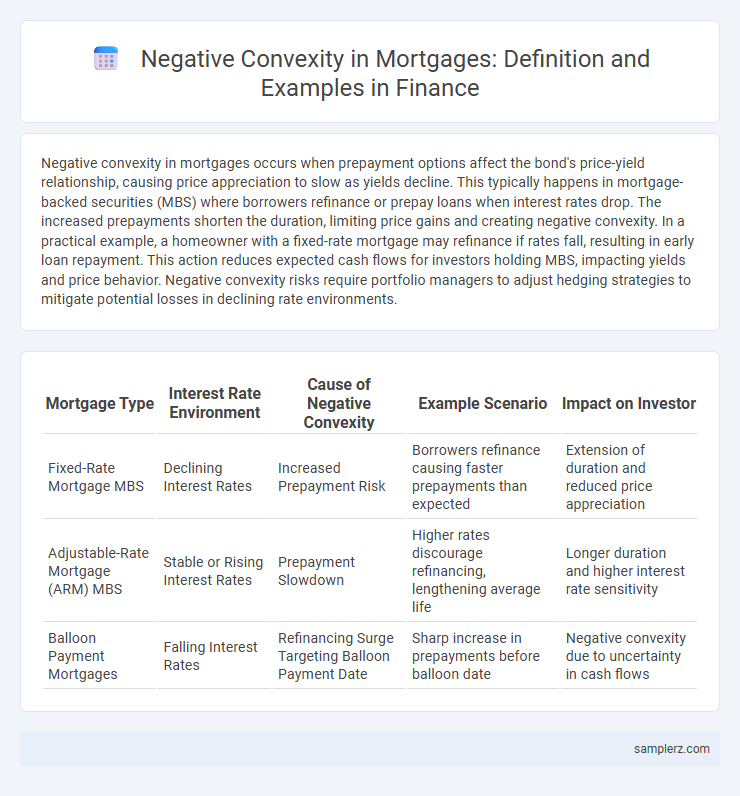

| Mortgage Type | Interest Rate Environment | Cause of Negative Convexity | Example Scenario | Impact on Investor |

|---|---|---|---|---|

| Fixed-Rate Mortgage MBS | Declining Interest Rates | Increased Prepayment Risk | Borrowers refinance causing faster prepayments than expected | Extension of duration and reduced price appreciation |

| Adjustable-Rate Mortgage (ARM) MBS | Stable or Rising Interest Rates | Prepayment Slowdown | Higher rates discourage refinancing, lengthening average life | Longer duration and higher interest rate sensitivity |

| Balloon Payment Mortgages | Falling Interest Rates | Refinancing Surge Targeting Balloon Payment Date | Sharp increase in prepayments before balloon date | Negative convexity due to uncertainty in cash flows |

Introduction to Negative Convexity in Mortgages

Negative convexity in mortgages occurs when rising interest rates lead to slower prepayment rates, causing mortgage-backed securities (MBS) prices to decline more than expected. This phenomenon is typical in mortgage pools where borrowers have the option to refinance or prepay, especially in rising rate environments. Investors face increased interest rate risk as the expected cash flows become more uncertain due to changing prepayment speeds.

Understanding Convexity in Fixed-Income Securities

Negative convexity in mortgage-backed securities occurs when prepayment risks cause the duration to shorten as interest rates decline, limiting price appreciation. This phenomenon arises because borrowers tend to refinance or repay their loans early during falling rates, reducing the expected cash flows to investors. Understanding this dynamic is crucial for fixed-income portfolio management, as it impacts hedging strategies and risk assessment.

How Mortgage-Backed Securities Exhibit Negative Convexity

Mortgage-backed securities (MBS) exhibit negative convexity due to the embedded prepayment option, which causes price appreciation to slow when interest rates fall and accelerate losses when rates rise. Investors face reinvestment risk as homeowners refinance mortgages during declining rates, reducing the duration and cash flows of the MBS. This prepayment risk alters interest rate sensitivity, making MBS prices less responsive to rate decreases compared to traditional bonds.

Real-World Example: Prepayment Risk Impact on Mortgage Value

Negative convexity in mortgage-backed securities arises when rising interest rates decrease prepayment speeds, reducing cash flow and increasing the security's duration risk. A real-world example is the 2008 financial crisis, where borrowers delayed refinancing due to higher rates, causing mortgage-backed securities to underperform as expected cash flows became less predictable. This prepayment risk directly impacts the mortgage's market value, leading to greater price volatility and challenging risk management for investors.

Case Study: Mortgage Refinancing and Negative Convexity

Mortgage refinancing often triggers negative convexity due to prepayment risk, where borrowers refinance when interest rates decline, shortening the expected duration of mortgage-backed securities (MBS). This behavior reduces the value of MBS as cash flows return sooner than anticipated, causing price appreciation to decelerate during rate drops and exacerbating losses when rates rise. The case study of the 2008 financial crisis highlights how widespread refinancing intensified negative convexity, significantly impacting MBS investors' risk and return profiles.

Yield Curve Movements: Effects on Mortgage Convexity

Negative convexity in mortgage-backed securities occurs when rising interest rates cause prepayment rates to slow, extending the average life of the mortgage pool and reducing price appreciation potential. Yield curve steepening intensifies this effect as longer-term rates increase relative to short-term rates, leading to greater uncertainty in cash flow timing and diminished convexity. Investors face increased duration risk due to these yield curve movements, complicating hedging strategies and portfolio risk management.

Negative Convexity During Falling Interest Rate Environments

Negative convexity in mortgage-backed securities typically occurs during falling interest rate environments when homeowners refinance or prepay their mortgages at higher rates, reducing the expected cash flows to investors. This prepayment risk limits the price appreciation of these securities as interest rates decline, causing returns to be less sensitive to falling rates compared to other fixed-income instruments. Institutional investors must account for this behavior when managing mortgage portfolios, as it creates challenges in duration and risk management strategies.

Implications for Mortgage Investors and Portfolio Managers

Negative convexity in mortgage-backed securities occurs when rising interest rates lead to extended average loan durations, reducing prepayment speeds and causing price declines greater than those of comparable bonds. This dynamic increases interest rate risk and complicates duration management for mortgage investors, demanding more sophisticated hedging strategies. Portfolio managers must account for these nonlinear price responses to optimize risk-adjusted returns and maintain portfolio resilience under varying interest rate scenarios.

Hedging Strategies Against Negative Convexity in Mortgages

Hedging strategies against negative convexity in mortgages often involve using interest rate derivatives such as interest rate swaps and swaptions to offset the prepayment risk that reduces duration and complicates duration matching. Mortgage-backed securities (MBS) portfolio managers may implement dynamic hedging by adjusting their positions in Treasury futures or options to maintain a target hedge ratio as interest rate volatility impacts mortgage prepayment speeds. Precise modeling of prepayment behavior combined with scenario analysis enables more effective selection and execution of hedging instruments, reducing the impact of negative convexity on portfolio volatility and expected returns.

Conclusion: Managing Negative Convexity Risks in Mortgage Portfolios

Managing negative convexity risks in mortgage portfolios requires dynamic hedging strategies to address prepayment variability and interest rate sensitivity. Utilizing interest rate derivatives such as swaps and options helps mitigate the impact of faster-than-expected prepayments when rates decline. Continuous monitoring and stress testing of portfolio performance under different interest rate scenarios are essential for optimizing risk-adjusted returns.

example of negative convexity in mortgage Infographic

samplerz.com

samplerz.com