Gamma is a key metric in options trading that measures the rate of change of delta relative to the price of the underlying asset. For example, if a call option on a stock with a strike price of $50 has a gamma of 0.05, a $1 increase in the stock price will increase the option's delta by 0.05. This sensitivity helps traders understand how their position's risk changes as the underlying price moves. Gamma is highest for at-the-money options nearing expiration, making it crucial for managing hedging strategies. Traders use gamma to adjust delta hedges and minimize portfolio risk when the underlying asset price fluctuates significantly. Monitoring gamma allows for better prediction of option price volatility and helps in optimizing trade timing and risk exposure.

Table of Comparison

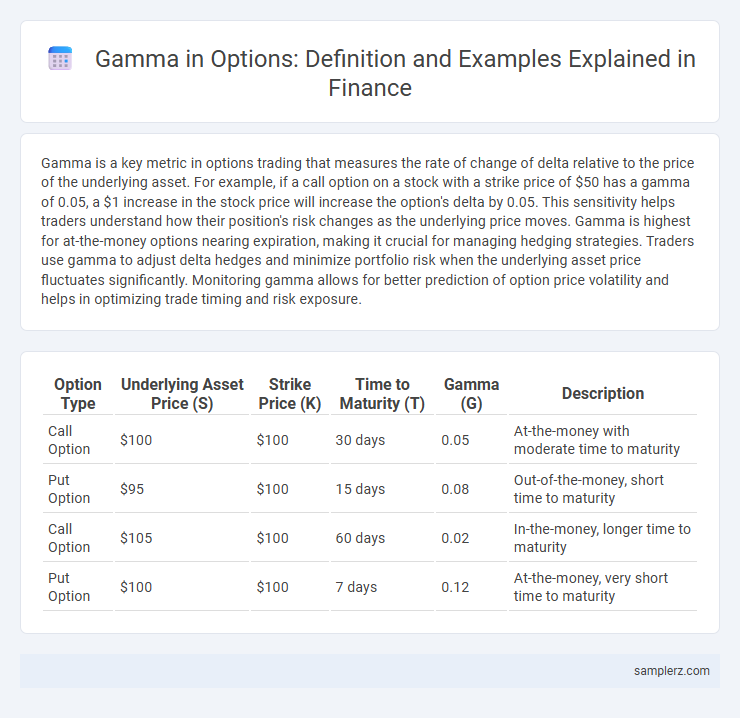

| Option Type | Underlying Asset Price (S) | Strike Price (K) | Time to Maturity (T) | Gamma (G) | Description |

|---|---|---|---|---|---|

| Call Option | $100 | $100 | 30 days | 0.05 | At-the-money with moderate time to maturity |

| Put Option | $95 | $100 | 15 days | 0.08 | Out-of-the-money, short time to maturity |

| Call Option | $105 | $100 | 60 days | 0.02 | In-the-money, longer time to maturity |

| Put Option | $100 | $100 | 7 days | 0.12 | At-the-money, very short time to maturity |

Understanding Gamma in Options Trading

Gamma measures the rate of change in an option's delta relative to the underlying asset's price movement, providing crucial insight into the stability of an option's hedge. For instance, if an option has a gamma of 0.05, a $1 increase in the stock price raises the delta by 0.05, intensifying the option's sensitivity to price changes. Traders use gamma to manage position risk dynamically, especially in volatile markets, ensuring precise adjustments to delta hedges.

Gamma’s Role in Options Price Movement

Gamma quantifies the rate of change in an option's delta relative to the underlying asset's price movement, highlighting how sensitively an option's price will react to market fluctuations. High gamma values indicate that delta will experience significant shifts, increasing the option's price volatility, especially for options near the money as expiration approaches. Traders monitor gamma to manage risk and optimize hedging strategies, ensuring their positions adjust dynamically to changing market conditions.

Gamma Example: ATM vs. OTM Options

Gamma measures the rate of change in an option's delta relative to the underlying asset's price, with at-the-money (ATM) options exhibiting higher gamma compared to out-of-the-money (OTM) options. For instance, an ATM call option on a stock priced at $100 might have a gamma of 0.05, indicating delta will change by 0.05 for each $1 move in the underlying asset. In contrast, an OTM call option with a strike price of $110 might have a gamma of 0.02, reflecting lower sensitivity and slower delta adjustment as the stock price moves.

Gamma Impact on Delta Hedging

Gamma measures the rate of change of an option's delta relative to the underlying asset's price movement, significantly impacting delta hedging strategies. High gamma indicates that delta can change rapidly, requiring frequent adjustments to maintain a neutral position and manage risk effectively. Understanding gamma's influence helps traders minimize hedging errors and optimize option portfolio performance under varying market conditions.

Real-World Example: Gamma in a Volatile Market

Gamma measures the rate of change of an option's delta relative to the underlying asset price, playing a crucial role during volatile market conditions. For instance, during the 2020 COVID-19 market crash, options with high gamma experienced rapid shifts in delta, forcing traders to adjust hedging positions frequently to manage risk effectively. This real-world example highlights gamma's importance in maintaining dynamic hedging strategies amid sudden price swings.

Interpreting Gamma Sensitivity in Portfolios

Gamma measures the rate of change of an option's delta relative to the underlying asset price, providing crucial insights into portfolio risk management. A high gamma indicates that an option's delta will change rapidly with small movements in the underlying asset, increasing sensitivity and potential volatility. Portfolio managers use gamma to adjust hedging strategies dynamically, minimizing unexpected losses in volatile markets.

Gamma Scalping: Practical Illustration

Gamma scalping is a dynamic option trading strategy that involves continuously adjusting the hedge as the underlying asset price fluctuates to capture profits from gamma, the second derivative of option price relative to the underlying. For example, a trader holding a long gamma position in call options will buy or sell the underlying asset to maintain a delta-neutral stance, capitalizing on rapid price movements to generate small but consistent gains. This method requires real-time monitoring and frequent rebalancing to exploit volatility while minimizing directional risk.

Gamma Behavior Near Expiry: A Case Study

Gamma in options measures the rate of change of delta relative to the underlying asset's price, exhibiting heightened sensitivity near expiry. As expiration approaches, gamma spikes significantly, especially for at-the-money options, causing rapid fluctuations in delta with small price movements. This behavior intensifies risk and hedging challenges for traders managing option portfolios close to expiration dates.

Managing Gamma Risk: Real Examples

Managing gamma risk involves adjusting option positions to maintain a balanced portfolio sensitive to price changes. For example, a trader holding long call options on a volatile stock may delta hedge by shorting the underlying shares, continuously rebalancing as gamma causes delta to fluctuate. This dynamic hedging reduces exposure to sudden price swings, stabilizing the portfolio's delta and minimizing losses during high volatility periods.

Comparative Analysis: Gamma vs. Other Greeks

Gamma measures the rate of change of an option's delta relative to the underlying asset's price, offering insights into convexity and potential price acceleration. Compared to other Greeks like delta, which indicates directional risk, or theta, which measures time decay, gamma specifically captures the sensitivity of delta, making it crucial for dynamic hedging strategies. High gamma values suggest greater risk of rapid delta shifts, especially in at-the-money options nearing expiration, contrasting with vega that gauges volatility sensitivity.

example of gamma in option Infographic

samplerz.com

samplerz.com