A twist in the yield curve occurs when short-term and long-term interest rates move in opposite directions, altering the slope without changing the overall level. For instance, if short-term yields rise due to Federal Reserve tightening while long-term yields decline because of economic growth concerns, this creates a yield curve twist. This phenomenon signals shifts in investor expectations about inflation, economic growth, and central bank policy. Such twists provide critical insights for fixed-income investors and policymakers. Data from the U.S. Treasury on Treasury note yields often illustrate these movements, with the 2-year and 10-year yields serving as key indicators. Analyzing yield curve twists helps in forecasting recessions or periods of economic recovery by reflecting market sentiment through varying bond maturities.

Table of Comparison

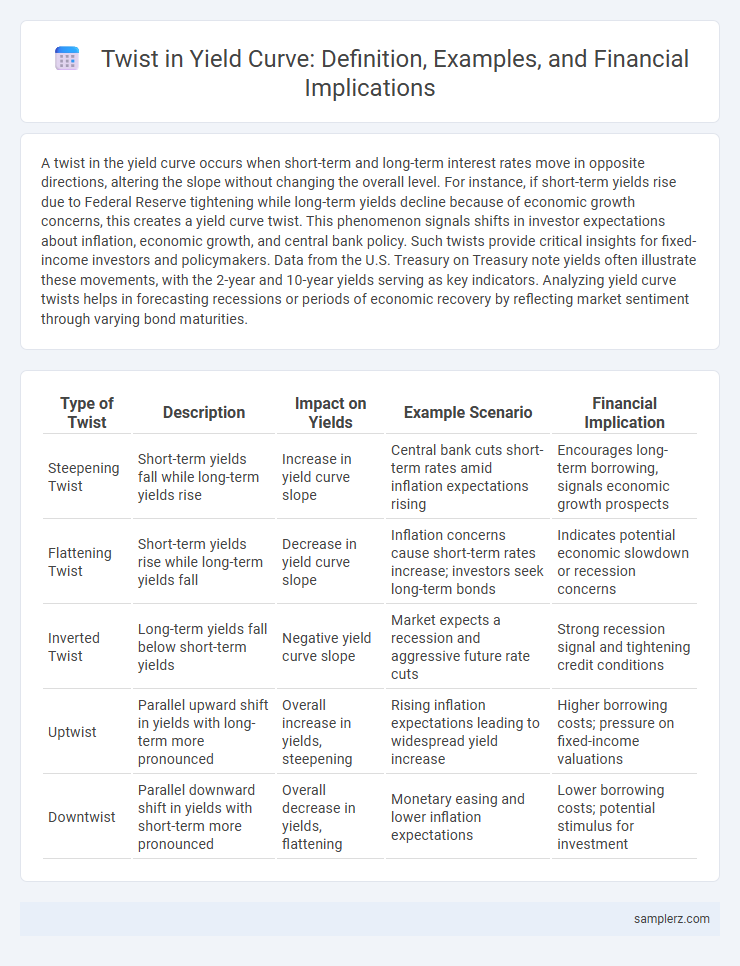

| Type of Twist | Description | Impact on Yields | Example Scenario | Financial Implication |

|---|---|---|---|---|

| Steepening Twist | Short-term yields fall while long-term yields rise | Increase in yield curve slope | Central bank cuts short-term rates amid inflation expectations rising | Encourages long-term borrowing, signals economic growth prospects |

| Flattening Twist | Short-term yields rise while long-term yields fall | Decrease in yield curve slope | Inflation concerns cause short-term rates increase; investors seek long-term bonds | Indicates potential economic slowdown or recession concerns |

| Inverted Twist | Long-term yields fall below short-term yields | Negative yield curve slope | Market expects a recession and aggressive future rate cuts | Strong recession signal and tightening credit conditions |

| Uptwist | Parallel upward shift in yields with long-term more pronounced | Overall increase in yields, steepening | Rising inflation expectations leading to widespread yield increase | Higher borrowing costs; pressure on fixed-income valuations |

| Downtwist | Parallel downward shift in yields with short-term more pronounced | Overall decrease in yields, flattening | Monetary easing and lower inflation expectations | Lower borrowing costs; potential stimulus for investment |

Understanding Yield Curve Twists: A Primer

Yield curve twists occur when different maturities on the debt spectrum experience varying yield changes, causing the curve to pivot rather than shift uniformly. This phenomenon reflects shifting investor expectations about interest rates, inflation, and economic growth, often signaling increased market volatility or uncertainty. Analyzing yield curve twists helps finance professionals anticipate central bank policies and assess bond portfolio risk more accurately.

Key Drivers Behind Yield Curve Twists

Yield curve twists are driven primarily by shifts in monetary policy expectations, changes in inflation outlook, and demand fluctuations across maturities. Central bank actions, such as adjusting short-term interest rates, significantly influence short-end yields, while alterations in long-term inflation projections impact the long end. Market liquidity and investor risk appetite also play critical roles in reshaping the yield curve's slope and curvature during these twists.

Real-World Example: Bullish Yield Curve Twist

A bullish yield curve twist occurs when short-term interest rates rise while long-term rates decline, signaling increased investor optimism about economic growth and lower inflation expectations. A real-world example appeared in 2019 when the Federal Reserve raised short-term rates amidst trade tensions, yet long-term Treasury yields fell as investors sought safe-haven assets, anticipating slower growth. This shift in the yield curve reflects market confidence in sustained economic expansion despite near-term cost pressures.

Bearish Yield Curve Twist: An Illustrative Case

A Bearish Yield Curve Twist occurs when short-term interest rates decline while long-term rates rise, reflecting increasing economic uncertainty and inflation expectations. This shift often signals investor concern about future credit risk and potential tightening monetary policy. Financial institutions and bond traders analyze these movements to adjust portfolios, hedge risks, and predict recessionary pressures.

Historical Instances of Yield Curve Twists

Historical instances of yield curve twists often signal shifts in economic outlooks, as seen during the 1994 Federal Reserve tightening when short-term rates rose sharply while long-term yields remained stable, causing an inverted curve. Another notable example occurred in 2019, when global uncertainty and trade tensions led to a flattening and occasional inversion of the U.S. Treasury yield curve, predicting a potential recession. These twists reflect market expectations for future interest rates, inflation, and economic growth, providing crucial insights for investors and policymakers.

Impact of Yield Curve Twists on Bond Strategies

Yield curve twists, where short-term and long-term interest rates move in opposite directions, significantly affect bond strategies by altering duration and convexity profiles. Investors may shift to barbell or laddered portfolios to manage interest rate risk and capitalize on changing yield differentials. These adjustments help optimize returns and mitigate volatility during periods of market uncertainty.

Yield Curve Twist vs. Parallel Shift: Key Differences

A yield curve twist occurs when short-term and long-term interest rates move in opposite directions, causing a change in the slope and curvature of the yield curve, unlike a parallel shift where all maturities move uniformly. Yield curve twists often signal changing market expectations about economic growth or monetary policy, while parallel shifts typically reflect broad changes in interest rate levels. Understanding these dynamics is crucial for fixed income portfolio management and interest rate risk assessment.

Central Bank Policies and Yield Curve Twists

Central bank policies, such as unexpected changes in interest rates or quantitative easing programs, often cause yield curve twists by altering investor expectations for short- and long-term economic growth. For instance, when the Federal Reserve signals a pause in rate hikes while maintaining a hawkish stance on inflation, short-term yields may decline as markets anticipate stable borrowing costs, whereas long-term yields rise due to inflation concerns. This divergence creates a twist in the yield curve, reflecting the nuanced impact of monetary policy on bond prices and investor sentiment across different maturities.

Market Reactions to Yield Curve Twists

A twist in the yield curve, such as a steepening or flattening between short- and long-term Treasury yields, often signals shifting market expectations for inflation and economic growth. Investors typically react by adjusting portfolio allocations, favoring either shorter-duration bonds during flattening scenarios or longer-duration assets when the curve steepens sharply. These market movements influence borrowing costs, equity valuations, and risk sentiment, often prompting central banks to reassess monetary policy approaches.

Implications for Investors During Yield Curve Twists

Yield curve twists, characterized by changes in the slope between short-term and long-term yields, signal shifts in market expectations for interest rates and economic growth. Investors facing a steepening curve may benefit from long-duration bonds as growth prospects improve, while those encountering a flattening or inverted curve might prioritize shorter maturities to reduce risk exposure. Tactical portfolio adjustments during yield curve twists can enhance yield while managing duration risk effectively.

example of twist in yield curve Infographic

samplerz.com

samplerz.com