A stub in a spin-off refers to the remaining portion of the parent company after a subsidiary or division has been separated into an independent entity. This stub typically retains the original company's name, assets, and liabilities not transferred to the new spin-off company. Investors often analyze the stub to assess its value since it continues operating independently post-spin-off. Data on spin-off stubs highlight variations in stock performance and market capitalization following the separation event. For instance, the stub's stock price may react based on investor perception of the remaining business's prospects. Tracking financial metrics such as earnings per share and revenue for the stub entity provides insights into its standalone viability after a spin-off transaction.

Table of Comparison

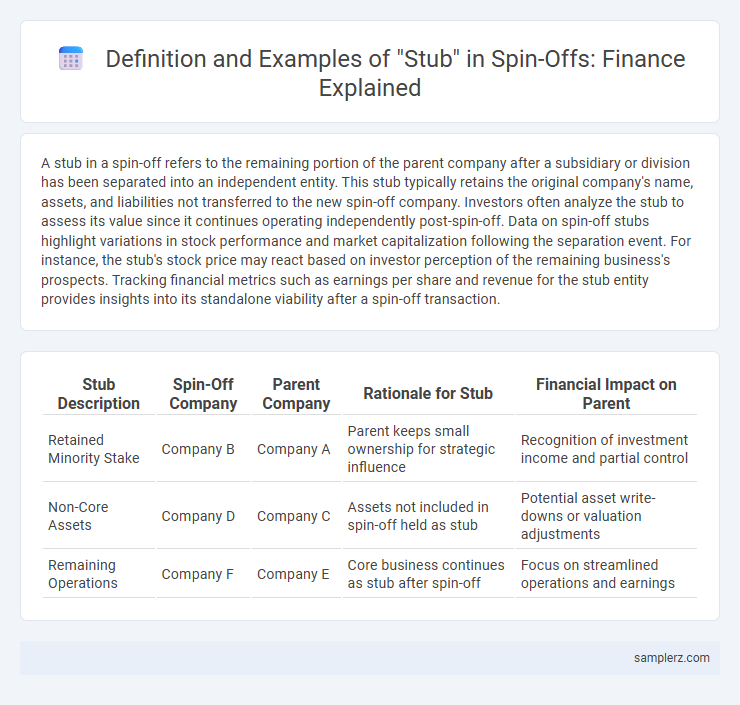

| Stub Description | Spin-Off Company | Parent Company | Rationale for Stub | Financial Impact on Parent |

|---|---|---|---|---|

| Retained Minority Stake | Company B | Company A | Parent keeps small ownership for strategic influence | Recognition of investment income and partial control |

| Non-Core Assets | Company D | Company C | Assets not included in spin-off held as stub | Potential asset write-downs or valuation adjustments |

| Remaining Operations | Company F | Company E | Core business continues as stub after spin-off | Focus on streamlined operations and earnings |

Understanding Stubs in Spin-Off Transactions

In spin-off transactions, a stub represents the remaining shares of the parent company after the spin-off of a subsidiary, reflecting its residual equity value. Investors analyze stubs to assess how much value remains in the parent company independent of the spun-off entity, often influencing post-spin-off investment decisions. Understanding the market performance and valuation metrics of stubs is crucial for evaluating the financial impact of spin-offs on shareholder wealth.

Key Characteristics of a Stub in Finance

A stub in finance refers to the remaining equity interest in a parent company after a spin-off has occurred, representing the residual value once spun-off assets are separated. Key characteristics of a stub include its often volatile market valuation, reflecting investors' assessment of the parent company's retained business and potential future growth. The stub typically carries unique risk profiles and may have adjusted financial metrics due to the reallocation of assets and liabilities post spin-off.

Real-World Examples of Stubs After Spin-Offs

Post-spin-off, a prominent example of a stub is Hewlett-Packard Enterprise (HPE) following its separation from HP Inc. in 2015, where the original entity retained a smaller, distinct business focused on enterprise solutions. Another case includes Kraft Heinz's spin-off of its natural cheese segment, leaving behind a stub focused on other packaged foods. These stubs represent the residual companies maintaining core operations, distinct from the spun-off units, highlighting strategic corporate restructuring in finance.

Case Study: Stub Creation in Corporate Spin-Offs

In the case study of stub creation during corporate spin-offs, a company divests a portion of its business, leaving behind a "stub" representing the remaining entity that retains the original corporate structure and branding. For example, when Hewlett-Packard split into HP Inc. and Hewlett Packard Enterprise, the stub corresponded to Hewlett Packard Enterprise, which continued operating core enterprise services while HP Inc. focused on personal computing and printing solutions. This strategic stub formation enables shareholders to retain value in the continuing business, providing clear investment options post-spin-off.

How Stubs Affect Shareholder Value Post Spin-Off

Stub shares represent the remaining equity in the parent company after a spin-off and often carry significant implications for shareholder value. These stubs can experience volatility due to market perceptions of the parent company's residual assets and liabilities, influencing investor confidence and stock price. Understanding the stub's valuation is crucial for shareholders as it directly impacts their overall portfolio performance post spin-off.

Valuation Methods for Stubs During Spin-Offs

Valuation methods for stubs during spin-offs often involve discounted cash flow (DCF) analysis and comparable company multiples to assess the residual interest in the parent company's continuing operations. Analysts use these techniques to isolate the value of the stub by estimating future cash flows or benchmarking against industry peers post-separation. Market-based valuation is crucial as it reflects investor sentiment and potential growth prospects of the stub entity.

Prominent Companies With Notable Stub Examples

Prominent companies like AT&T and Time Warner showcase notable stub examples after their spin-offs, where the spun-off entity retains core business segments while the parent company maintains a streamlined focus. In AT&T's case, the stub entity continued its operations in telecommunications infrastructure, preserving shareholder value and enabling targeted growth strategies. Time Warner's stub after the spin-off of WarnerMedia demonstrated effective capital allocation and operational focus on legacy media assets.

Risks and Opportunities in Trading Stubs

Trading stubs in spin-offs present unique risks including high volatility and liquidity challenges, which can lead to pricing inefficiencies and increased bid-ask spreads. Investors have opportunities to capitalize on mispricing and potential undervaluation as the stub represents the remaining parent company's assets not distributed in the spin-off. Careful analysis of the stub's financial health, market perception, and strategic outlook is essential to manage risks and exploit trading opportunities effectively.

Legal and Regulatory Considerations for Stubs

In spin-offs, legal and regulatory considerations for stubs involve ensuring compliance with securities laws and disclosure requirements mandated by the SEC, including the filing of Form 10 or Form 10-K for public reporting. Corporate governance must be established independently for the stub entity to maintain transparency and accountability, often reviewed under the Sarbanes-Oxley Act provisions. Regulatory frameworks such as the Dodd-Frank Act also influence risk management and compliance obligations for the stub's ongoing operations post-spin-off.

Strategic Implications of Stubs in Spin-Off Strategies

Stub stocks created from spin-offs often represent a company's core assets with focused management, enhancing shareholder value through targeted operational strategies. These entities enable parent companies to streamline portfolios by divesting non-core segments while maintaining strategic influence via retained equity stakes. Investors benefit from clearer valuation metrics and growth potential as stubs operate autonomously, driving market efficiency and unlocking hidden value in complex corporate restructurings.

example of stub in spin-off Infographic

samplerz.com

samplerz.com