A gamma squeeze occurs in option trading when the price of an underlying asset rises sharply due to aggressive buying of call options, forcing market makers to purchase the stock to hedge their positions. This hedging activity leads to further upward pressure on the asset's price, creating a feedback loop. For example, during the 2021 GameStop rally, a surge in call option volume caused market makers to buy large quantities of GameStop shares, driving the price higher rapidly. Gamma squeeze is closely tied to the concept of gamma, which measures the rate of change in an option's delta relative to the underlying asset's price. When traders buy out-of-the-money call options in large numbers, gamma exposure increases, compelling market makers to adjust their hedging constantly. Data from platforms like the Chicago Board Options Exchange often shows spikes in gamma exposure preceding such squeezes, signaling potential price volatility in stocks like AMC or Tesla.

Table of Comparison

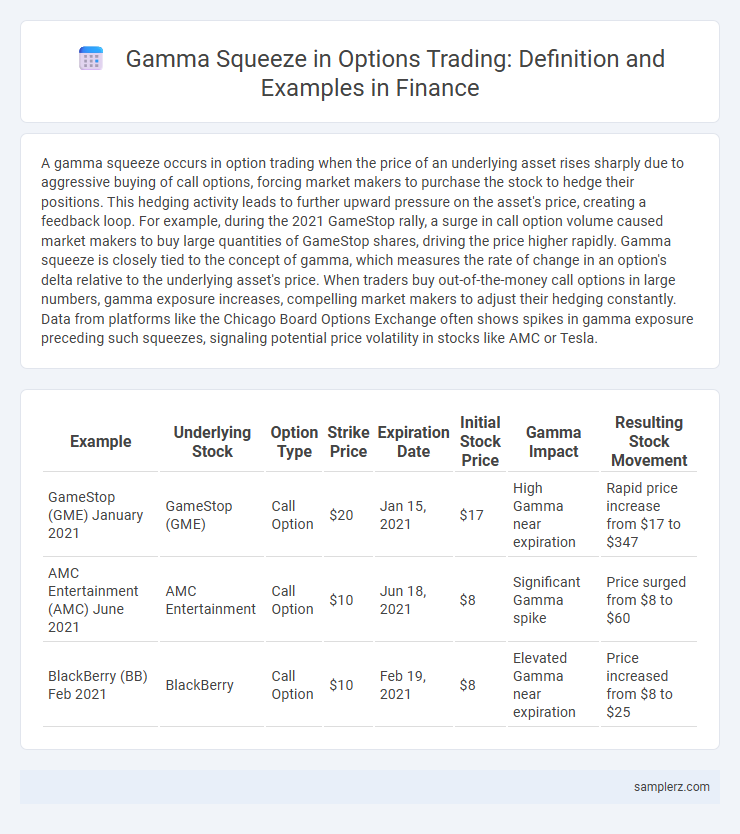

| Example | Underlying Stock | Option Type | Strike Price | Expiration Date | Initial Stock Price | Gamma Impact | Resulting Stock Movement |

|---|---|---|---|---|---|---|---|

| GameStop (GME) January 2021 | GameStop (GME) | Call Option | $20 | Jan 15, 2021 | $17 | High Gamma near expiration | Rapid price increase from $17 to $347 |

| AMC Entertainment (AMC) June 2021 | AMC Entertainment | Call Option | $10 | Jun 18, 2021 | $8 | Significant Gamma spike | Price surged from $8 to $60 |

| BlackBerry (BB) Feb 2021 | BlackBerry | Call Option | $10 | Feb 19, 2021 | $8 | Elevated Gamma near expiration | Price increased from $8 to $25 |

Understanding Gamma Squeeze in Options Trading

A gamma squeeze occurs when rapid buying of short-dated call options forces market makers to hedge by purchasing the underlying stock, driving prices higher. This creates a feedback loop as rising stock prices increase the delta of options, requiring more stock purchases and intensifying the squeeze. Understanding gamma dynamics helps traders anticipate sharp price movements and manage risk in option trading strategies.

Key Financial Events Triggering Gamma Squeezes

Significant earnings announcements often trigger gamma squeezes by causing rapid shifts in stock prices and option open interest. Large institutional buying ahead of major product launches or market-moving news drives dealers to hedge dynamically, intensifying gamma exposure. Furthermore, unexpected regulatory decisions or central bank policy changes can lead to concentrated options activity, fueling sharp gamma-induced price accelerations.

Famous Gamma Squeeze Examples in Stock Markets

The GameStop (GME) short squeeze in early 2021 exemplifies a famous gamma squeeze, where retail investors triggered rapid call option buying, forcing market makers to buy the underlying stock to hedge their positions, amplifying the price surge. Another notable example occurred with AMC Entertainment (AMC), where similar dynamics caused extreme volatility and price spikes driven by aggressive option activity. These events highlight how gamma squeezes can create dramatic market movements and significant losses for short sellers.

GameStop (GME): A Modern Gamma Squeeze Case

The GameStop (GME) gamma squeeze in early 2021 exemplified rapid price escalation driven by intense option buying and short interest. Market makers hedging their delta exposure were forced to buy increasing quantities of GME shares, amplifying upward momentum. This phenomenon highlighted the critical interplay between options market dynamics and equity price volatility in modern trading environments.

AMC Entertainment: Gamma Squeeze Lessons Learned

AMC Entertainment's 2021 Gamma squeeze illustrated how rapid option buying escalated share price volatility, causing significant short-covering pressure. The sudden spike in options open interest forced market makers to hedge aggressively by purchasing underlying shares, intensifying AMC's stock rally. This event highlighted the critical impact of Gamma risk and the necessity for traders to monitor options liquidity and open interest to anticipate similar price surges.

Mechanisms Behind Gamma Squeeze Scenarios

A gamma squeeze in option trading occurs when market makers rapidly buy the underlying stock to hedge their delta exposure as the price approaches a strike price, causing sharp upward price movement. This dynamic is driven by high open interest in short-dated call options, which amplifies the gamma effect and forces continuous hedging adjustments. The increased buying pressure from delta hedging exacerbates volatility, often leading to rapid price spikes in the underlying asset.

Role of Market Makers During a Gamma Squeeze

Market makers manage their option positions by dynamically hedging delta exposure, which intensifies during a gamma squeeze as rapid price movements force them to buy more underlying shares to maintain a delta-neutral stance. This actions amplify upward price pressure, creating a feedback loop that accelerates the squeeze. The interplay between options volume, implied volatility, and underlying stock price volatility highlights the crucial market maker role in gamma squeeze scenarios.

Investor Strategies During Gamma Squeeze Events

During a gamma squeeze in option trading, investors often capitalize on rapid price movements by rapidly adjusting their option positions to benefit from increasing implied volatility and escalating delta values. Hedging strategies such as dynamically rebalancing portfolios with underlying shares and exploiting short-term momentum are commonly employed to maximize gains while managing risk. Sophisticated traders closely monitor open interest and gamma exposure to anticipate heightened market volatility and strategically position themselves for potential sharp price spikes.

Risks and Rewards of Trading Gamma Squeezes

Gamma squeezes in option trading can lead to rapid price surges as market makers buy underlying stocks to hedge their positions, creating heightened volatility and liquidity risks. Traders who capitalize on gamma squeezes may realize substantial short-term gains due to amplified price movements, but they face significant exposure to sudden reversals and increased margin requirements. Understanding the dynamics of gamma exposure and monitoring market sentiment are crucial to managing the balance between the potential rewards and the financial risks inherent in these aggressive trading scenarios.

Regulatory Perspective on Gamma Squeeze Episodes

Regulators closely monitor gamma squeeze episodes due to their potential to create extreme volatility and market distortions, as seen in the 2021 GameStop surge. The U.S. Securities and Exchange Commission (SEC) investigates unusual trading activities and may implement measures like enhanced reporting requirements or trading halts to protect investors. Regulatory frameworks aim to balance market integrity by mitigating risks associated with rapid option-driven price movements while promoting transparency in derivative markets.

example of Gamma squeeze in option trading Infographic

samplerz.com

samplerz.com