A block trade in the equity market involves the sale or purchase of a large number of shares, typically exceeding 10,000 shares or valued over $200,000. Institutional investors such as mutual funds, pension funds, or hedge funds often execute block trades to efficiently buy or sell large positions without significantly impacting the market price. These trades are usually conducted off the public order book through private negotiations or specialized trading platforms. Block trades help maintain market stability by minimizing price fluctuations that large volume orders might cause if placed directly on the exchange. Market participants rely on block trade desks or brokers to facilitate these transactions with confidentiality and speed. The data from block trades provide insights into institutional investor activity and can influence market sentiment and share price movements.

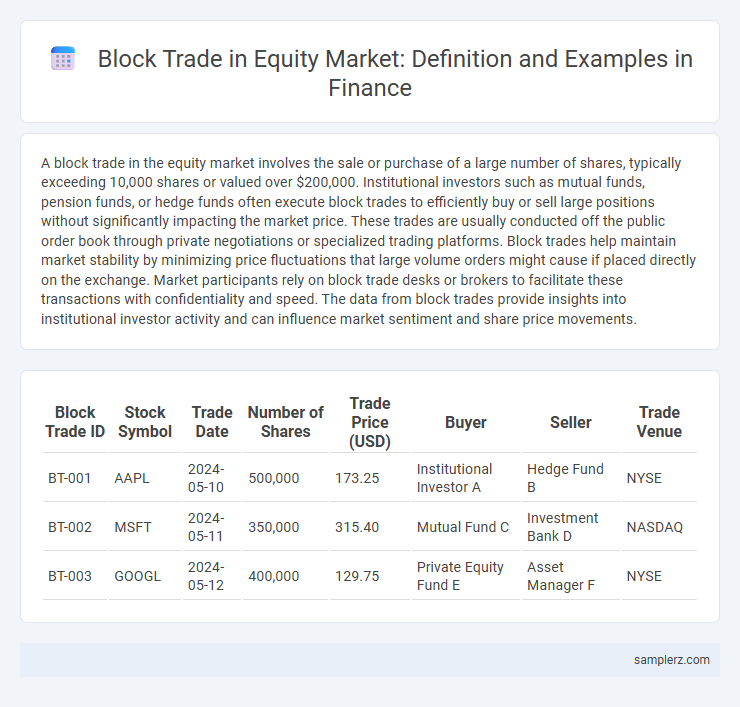

Table of Comparison

| Block Trade ID | Stock Symbol | Trade Date | Number of Shares | Trade Price (USD) | Buyer | Seller | Trade Venue |

|---|---|---|---|---|---|---|---|

| BT-001 | AAPL | 2024-05-10 | 500,000 | 173.25 | Institutional Investor A | Hedge Fund B | NYSE |

| BT-002 | MSFT | 2024-05-11 | 350,000 | 315.40 | Mutual Fund C | Investment Bank D | NASDAQ |

| BT-003 | GOOGL | 2024-05-12 | 400,000 | 129.75 | Private Equity Fund E | Asset Manager F | NYSE |

Introduction to Block Trades in Equity Markets

Block trades in equity markets involve the sale or purchase of a large number of shares, typically exceeding 10,000 shares or valued at over $200,000, executed privately to minimize market impact. Institutional investors, such as mutual funds and pension funds, frequently engage in block trades to efficiently transfer substantial equity positions without causing significant price fluctuations. These trades are often facilitated by specialized brokers or executed through alternative trading systems (ATS) to maintain confidentiality and secure optimal pricing.

Key Characteristics of Block Trades

Block trades in the equity market involve the sale or purchase of a large number of shares, typically exceeding 10,000 shares or $200,000 in value, executed privately to avoid significant price impact. These trades often occur between institutional investors, such as mutual funds, pension funds, or hedge funds, and are facilitated by investment banks or brokers acting as intermediaries. The key characteristics include negotiated pricing away from the public market to minimize volatility, limited market exposure until completion, and the potential for improved liquidity in otherwise less liquid securities.

The Mechanics of Executing a Block Trade

A block trade in the equity market involves a large number of shares sold or purchased as a single transaction, typically between institutional investors, to minimize market impact. Execution is coordinated through a broker-dealer who matches buyers and sellers off the public exchange using dark pools or private negotiation to maintain anonymity and price stability. Settlement follows standard clearing procedures but may include special terms to accommodate the trade's size and timing.

Real-World Example: Block Trade by Institutional Investor

In March 2024, an institutional investor executed a block trade involving 5 million shares of Tesla Inc. on the New York Stock Exchange, valuing approximately $1.2 billion. This transaction was facilitated through a single, private negotiation to minimize market impact and ensure price stability. Such large-scale block trades enable institutional investors to adjust significant equity positions efficiently without causing substantial price fluctuations.

Case Study: Block Trade Impact on Stock Price

In a notable block trade involving 1 million shares of Company XYZ at $50 per share, the transaction caused a significant 7% drop in the stock price within minutes, reflecting heightened market sensitivity and liquidity constraints. This large-scale sale overwhelmed typical trading volumes, triggering algorithmic sell-offs and price slippage, emphasizing the market impact of substantial equity block trades. The case study demonstrates how block trades can disrupt price discovery and increase volatility in equity markets, influencing investor sentiment and trading strategies.

Regulatory Framework Governing Block Trades

Block trades in the equity market are subject to stringent regulatory frameworks to ensure transparency and market integrity, such as Regulation NMS in the United States which mandates fair access and equitable rules for all market participants. These regulations require the reporting of large trades, often exceeding 10,000 shares or $200,000 in value, to prevent market manipulation and ensure accurate price discovery. Compliance with regulatory bodies like the SEC or FCA involves pre-trade notifications, post-trade disclosures, and adherence to specific execution protocols to mitigate systemic risk.

Role of Brokers and Intermediaries in Block Trades

Brokers and intermediaries facilitate block trades by connecting institutional investors willing to buy or sell large equity positions outside the open market, ensuring minimal price impact and confidentiality. Their expertise in pricing, negotiation, and execution helps manage liquidity risks and transaction costs, benefiting both buyers and sellers. Efficient coordination by these professionals accelerates trade settlement, maintaining market stability during substantial equity transfers.

Advantages and Risks of Block Trading

Block trades in the equity market allow large institutional investors to buy or sell substantial quantities of shares without causing significant price fluctuations, enhancing liquidity and enabling efficient portfolio rebalancing. The primary advantage is reduced market impact, which helps maintain price stability during large transactions, while the risks include limited transparency and potential difficulties in price discovery. Understanding these dynamics is crucial for market participants aiming to optimize trade execution and manage the inherent risks of block trading.

Block Trades vs. Regular Market Trades

Block trades in the equity market involve the private sale of large volumes of shares, often exceeding 10,000 shares or $200,000 in value, conducted outside the regular public markets to minimize price impact and market disruption. Unlike regular market trades that occur on public exchanges with continuous price discovery, block trades are negotiated directly between institutional investors and brokers, offering improved liquidity and confidentiality. These transactions enable institutional investors to execute large orders efficiently without significantly affecting stock prices, contrasting with smaller retail trades that are subjected to typical market fluctuations.

Noteworthy Block Trades in Recent Equity Market History

A recent noteworthy block trade occurred when Institutional Investors executed a $500 million transaction in Apple Inc. shares, reflecting significant market confidence and liquidity. Another example includes the $350 million block trade of Tesla stock, which drastically influenced short-term price volatility and trading volume. Such sizable equity block trades often signal strategic portfolio adjustments by hedge funds or mutual funds, impacting market dynamics significantly.

example of Block trade in equity market Infographic

samplerz.com

samplerz.com