A cross-currency swap is a financial derivative involving the exchange of principal and interest payments in two different currencies between parties. For example, a U.S. company may enter into a swap with a European firm where the U.S. company pays interest in U.S. dollars while receiving interest payments in euros. This arrangement helps both parties manage currency risk and optimize financing costs in their respective currencies. In this example, the U.S. company will initially exchange a fixed amount of U.S. dollars for euros at the current spot rate with the European firm. Throughout the swap's life, each party makes periodic interest payments in the currency they received initially. At maturity, the principal amounts are re-exchanged at the original agreed-upon rate, minimizing exchange rate volatility risk in long-term financing.

Table of Comparison

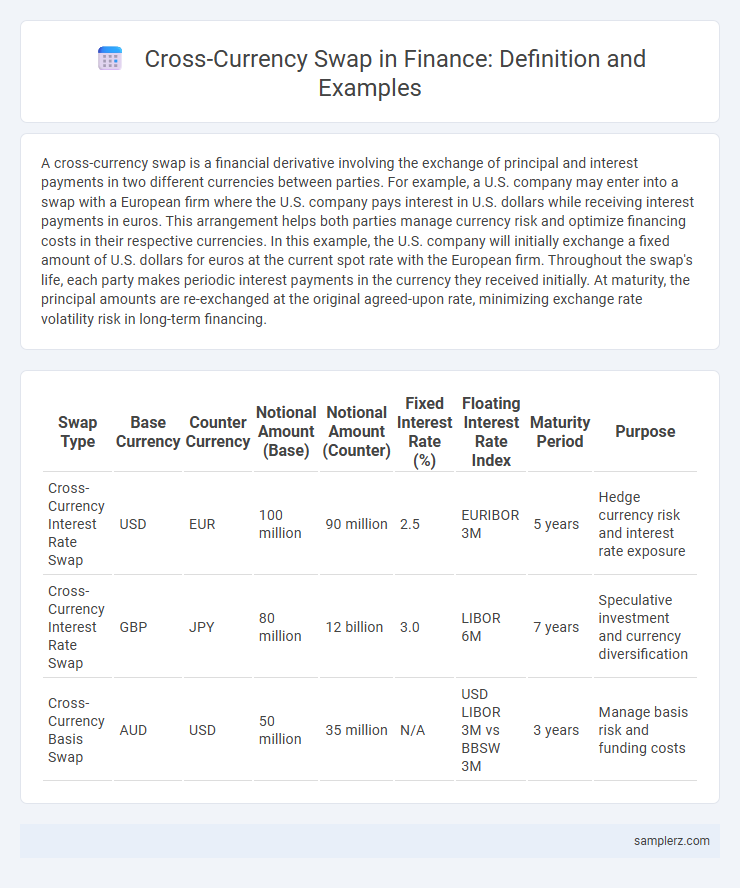

| Swap Type | Base Currency | Counter Currency | Notional Amount (Base) | Notional Amount (Counter) | Fixed Interest Rate (%) | Floating Interest Rate Index | Maturity Period | Purpose |

|---|---|---|---|---|---|---|---|---|

| Cross-Currency Interest Rate Swap | USD | EUR | 100 million | 90 million | 2.5 | EURIBOR 3M | 5 years | Hedge currency risk and interest rate exposure |

| Cross-Currency Interest Rate Swap | GBP | JPY | 80 million | 12 billion | 3.0 | LIBOR 6M | 7 years | Speculative investment and currency diversification |

| Cross-Currency Basis Swap | AUD | USD | 50 million | 35 million | N/A | USD LIBOR 3M vs BBSW 3M | 3 years | Manage basis risk and funding costs |

Introduction to Cross-Currency Swaps

Cross-currency swaps involve the exchange of principal and interest payments in different currencies, allowing companies to manage currency risk and access foreign capital markets more efficiently. For example, a U.S. company with euro-denominated debt can enter into a swap with a European firm holding dollar liabilities, exchanging cash flows to hedge exposure and reduce funding costs. These transactions are essential tools in international finance, facilitating liquidity and risk management across multiple currency zones.

How Cross-Currency Swaps Work

Cross-currency swaps involve exchanging principal and interest payments in different currencies between two parties to hedge currency risk or access foreign capital. For example, a U.S. company may swap its dollar-denominated debt payments with a European firm's euro obligations, effectively converting liabilities and interest payments. These swaps typically include exchanging fixed or floating interest rates and principal amounts at contract initiation and maturity, allowing both parties to manage currency exposure and optimize financing costs.

Key Components of a Cross-Currency Swap

A cross-currency swap involves exchanging principal and interest payments in two different currencies, typically comprising the initial exchange of principal amounts at the spot rate, periodic interest payments based on agreed-upon rates in each currency, and the re-exchange of principal at maturity at the original or a pre-determined rate. Key components include the notional principal amounts, interest rate structures (fixed or floating), the exchange rates used for principal and interest payments, and the swap tenor. Accurate management of foreign exchange risk and interest rate risk is critical in structuring cross-currency swaps to meet the hedging or speculative objectives of participating entities.

Real-World Examples of Cross-Currency Swaps

A prominent real-world example of a cross-currency swap involved the 2012 agreement between IBM and the European Investment Bank, where IBM exchanged U.S. dollars for euros to fund a European project while hedging currency risk. Another significant instance is the 2008 currency swap between the Federal Reserve and the European Central Bank, which stabilized liquidity by allowing central banks to exchange U.S. dollars and euros during the global financial crisis. These swaps enable multinational corporations and financial institutions to manage currency exposure and refinance debt in different currencies effectively.

Cross-Currency Swaps in Corporate Financing

Cross-currency swaps in corporate financing enable companies to manage exposure to foreign exchange risk by exchanging principal and interest payments in different currencies. For example, a U.S. corporation needing euros might enter into a swap with a European firm requiring dollars, locking in exchange rates and reducing uncertainty in cash flows. These instruments are essential for optimizing debt structures, improving liquidity, and achieving cost-effective financing in global markets.

Hedging Foreign Exchange Risk with Cross-Currency Swaps

Cross-currency swaps enable multinational corporations to hedge foreign exchange risk by exchanging principal and interest payments in different currencies, effectively locking in exchange rates. For instance, a U.S. company with Euro-denominated debt can swap cash flows with a European counterpart, converting USD payments into EUR obligations while mitigating exposure to currency fluctuations. This strategy enhances financial stability by aligning currency liabilities with revenue streams in the same currency, reducing volatility in cash flow forecasts.

Cross-Currency Swaps vs. Interest Rate Swaps

Cross-currency swaps involve exchanging principal and interest payments in different currencies, allowing companies to hedge foreign exchange risk while securing favorable borrowing costs in multiple currencies. Interest rate swaps, by contrast, only exchange interest payments in the same currency, typically swapping fixed rates for floating rates to manage interest rate exposure. Corporations engaging in international finance often prefer cross-currency swaps over interest rate swaps to simultaneously mitigate currency risk and interest rate risk in global operations.

Case Study: USD/EUR Cross-Currency Swap

A USD/EUR cross-currency swap involves exchanging principal and interest payments in U.S. dollars for equivalent amounts in euros, mitigating forex risk for multinational corporations. For instance, a U.S. company with euro-denominated debt might enter a swap with a European counterpart to secure fixed interest rates and hedge currency exposure. This financial instrument enhances liquidity management and interest cost predictability across different currency environments.

Benefits and Risks of Cross-Currency Swaps

Cross-currency swaps offer benefits such as hedging foreign exchange risk and securing lower borrowing costs by exchanging principal and interest payments in different currencies. These contracts help multinational corporations manage cash flow volatility and optimize capital structure amid fluctuating exchange rates. Risks include counterparty credit risk, market risk from currency fluctuations, and potential liquidity challenges in less liquid currency markets.

Regulatory Considerations for Cross-Currency Swaps

Regulatory considerations for cross-currency swaps include compliance with international frameworks such as EMIR in the EU and Dodd-Frank in the US, which mandate central clearing and reporting to trade repositories. Market participants must also adhere to margin requirements and conduct rigorous counterparty credit risk assessments to mitigate systemic risk. Ensuring transparency and regulatory alignment helps maintain market stability in cross-border derivative transactions.

example of cross-currency in swap Infographic

samplerz.com

samplerz.com