In the finance sector, flipping during an IPO refers to the rapid buying and selling of shares shortly after the stock is offered to the public. Investors purchase IPO shares at the initial offering price and sell them quickly to capitalize on short-term price spikes. This practice is common among retail investors and traders aiming to benefit from the temporary increases in stock prices. Flipping can impact the overall market dynamics of an IPO by creating volatility and influencing the stock's opening day performance. Entities such as underwriters and institutional investors often monitor flipping activity to gauge demand and adjust future offerings. Data on flipping rates can provide insights into investor sentiment and market confidence in the newly listed company.

Table of Comparison

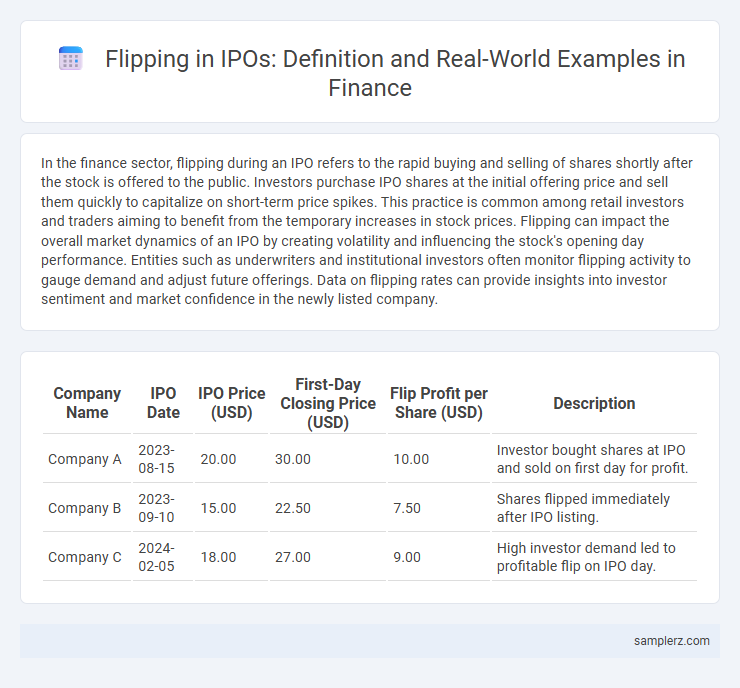

| Company Name | IPO Date | IPO Price (USD) | First-Day Closing Price (USD) | Flip Profit per Share (USD) | Description |

|---|---|---|---|---|---|

| Company A | 2023-08-15 | 20.00 | 30.00 | 10.00 | Investor bought shares at IPO and sold on first day for profit. |

| Company B | 2023-09-10 | 15.00 | 22.50 | 7.50 | Shares flipped immediately after IPO listing. |

| Company C | 2024-02-05 | 18.00 | 27.00 | 9.00 | High investor demand led to profitable flip on IPO day. |

Understanding IPO Flipping: Definition and Overview

IPO flipping refers to the rapid buying and selling of shares immediately after an initial public offering to capitalize on short-term price gains. Investors engage in flipping to exploit the initial volatility and demand surge typically seen within the first days of trading. This practice can impact market stability and investor sentiment by causing price fluctuations beyond the company's fundamental value.

Common Motivations Behind IPO Flipping

Investors often flip shares during an IPO to capture quick profits from initial price surges driven by market hype and limited supply. Institutional investors may leverage IPO flipping to rebalance portfolios or respond to short-term liquidity needs. Retail investors typically engage in flipping motivated by speculative gains and the desire to capitalize on volatile first-day trading.

Steps Involved in Flipping an IPO

Flipping an IPO involves purchasing shares at the initial offering price during an IPO and quickly selling them in the secondary market for a profit. The key steps include submitting an allocation request during the IPO subscription period, receiving the allocated shares at the IPO price, and promptly listing those shares on the exchange to sell when the price rises. Investors must monitor market demand and timing closely to maximize gains from the short-term price volatility typical of IPOs.

Real-World Examples of IPO Flipping Success

In 2020, Airbnb's IPO saw significant flipping, with institutional investors quickly selling shares after the debut, realizing profits as the stock surged over 112% on the first day. Similarly, DoorDash's public offering experienced rapid flipping, where early shareholders capitalized on a strong opening pop, boosting their returns substantially. These examples highlight the trend of IPO flipping as a strategic move to generate quick gains in volatile but promising market conditions.

Risks and Downsides of IPO Flipping

IPO flipping involves buying shares at the initial offering price and quickly selling them for a profit, but this practice carries significant risks including price volatility and potential regulatory scrutiny. Flipping can exacerbate short-term market fluctuations, leading to unstable post-IPO trading and harming long-term investor confidence. Investors face downsides such as possible lock-up period violations, canceled orders, and reputational damage if perceived as market manipulators.

Impact of Flipping on IPO Performance

Flipping in IPOs occurs when investors sell shares immediately after the initial offering, often leading to increased price volatility and undermining long-term price stability. This behavior can distort true market demand, causing underwriters to misprice the offering and potentially damaging the issuer's reputation. Empirical studies show that high flipping rates are correlated with lower aftermarket performance and reduced capital-raising efficiency for the issuing firm.

Regulatory Responses to IPO Flipping

Regulatory responses to IPO flipping include stricter lock-up periods to prevent rapid resale of shares that can destabilize stock prices. The Securities and Exchange Commission (SEC) enforces enhanced disclosure requirements to identify and deter flipping activities by underwriters and investors. These measures aim to promote market stability and protect long-term investors from the volatility caused by IPO flipping.

Differences Between Long-Term Investing and IPO Flipping

IPO flipping involves purchasing shares at an initial public offering and quickly selling them to capitalize on short-term price spikes, contrasting with long-term investing where shares are held to benefit from sustained company growth and compounding returns. Long-term investors prioritize thorough fundamental analysis, risk management, and dividend reinvestment, whereas IPO flippers rely on market momentum and timing to maximize short-term gains. The volatility and uncertainty inherent in IPO flipping demand rapid decision-making and higher risk tolerance compared to the strategic patience required for long-term wealth accumulation.

How Underwriters and Companies Handle IPO Flipping

Underwriters closely monitor IPO flipping by implementing allocation strategies that limit the number of shares sold to frequent traders, ensuring a stable aftermarket. Companies collaborate with underwriters to structure lock-up agreements preventing immediate resale of shares, which maintains investor confidence and stock price stability. Clear communication with investors about the long-term value proposition of the IPO further mitigates the risks associated with flipping.

Tips for Investors Considering IPO Flipping

Investors considering IPO flipping should conduct thorough research on the company's financial health, market conditions, and short-term price volatility to identify potential profit opportunities. Monitoring lock-up periods and insider trading activities provides insights into post-IPO price movements and liquidity risks. Diversifying IPO investments reduces exposure to sudden downturns while maintaining agility to capitalize on initial trading surges enhances overall returns.

example of flipping in IPO Infographic

samplerz.com

samplerz.com