Contango in commodity markets occurs when the futures price of a commodity is higher than the expected spot price at contract maturity. This situation often arises due to storage costs, insurance, and financing expenses associated with holding the physical commodity over time. For example, crude oil futures might trade at a premium compared to current spot prices during periods of excess supply or inventory buildup. Investors and traders observe contango as an indicator of market expectations for future price increases or as compensation for costs of carry. In a contango market, rolling over futures contracts can result in negative roll yield, impacting the returns of commodity ETFs and funds. Understanding contango dynamics is crucial for portfolio managers dealing with energy, metals, or agricultural commodities to manage risks and optimize investment strategies.

Table of Comparison

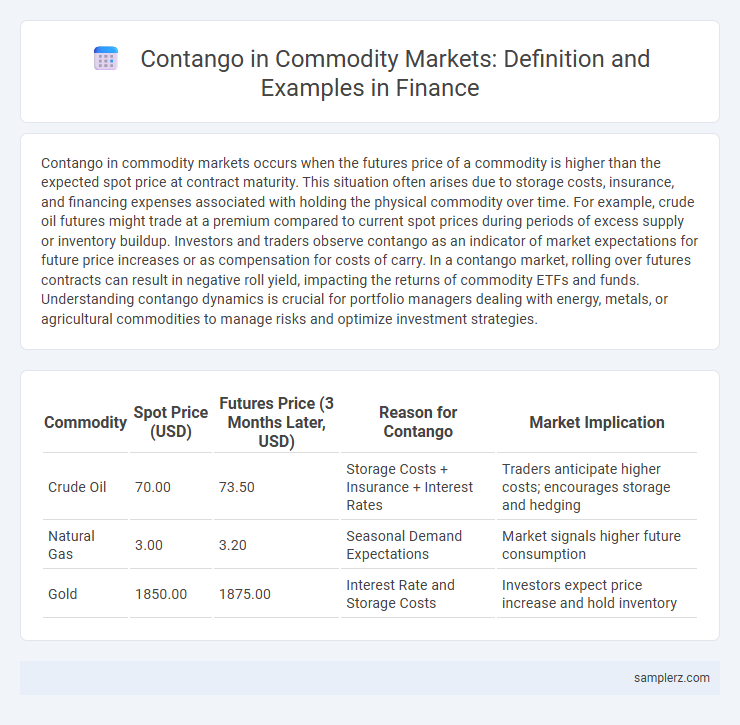

| Commodity | Spot Price (USD) | Futures Price (3 Months Later, USD) | Reason for Contango | Market Implication |

|---|---|---|---|---|

| Crude Oil | 70.00 | 73.50 | Storage Costs + Insurance + Interest Rates | Traders anticipate higher costs; encourages storage and hedging |

| Natural Gas | 3.00 | 3.20 | Seasonal Demand Expectations | Market signals higher future consumption |

| Gold | 1850.00 | 1875.00 | Interest Rate and Storage Costs | Investors expect price increase and hold inventory |

What is Contango in Commodity Markets?

Contango in commodity markets occurs when the futures price of a commodity is higher than the expected spot price at contract maturity, often due to storage costs, insurance, and financing expenses. This situation typically arises in markets with abundant supply or low immediate demand, causing futures contracts to trade above spot prices. Traders use contango to hedge or speculate, but it can lead to negative roll yields when rolling over contracts in long positions.

Key Features of Contango Explained

Contango occurs when the future price of a commodity, such as crude oil, exceeds the current spot price, reflecting storage costs, insurance, and financing expenses. This market condition is common in commodities with significant carrying costs, leading to upward sloping futures curves. Key features include the premium on futures contracts over spot prices and the potential for negative roll yields for investors holding long positions.

Real-World Example of Contango in Oil Futures

In the oil futures market, contango occurs when the futures price of crude oil exceeds the spot price due to storage costs and expectations of higher prices in the future. For instance, during times of oversupply or low demand, such as the 2020 oil market collapse, WTI crude oil futures for delivery several months ahead traded significantly above spot prices, reflecting contango. This price structure incentivizes traders to store oil and sell futures contracts at a premium, capturing profits from the spread.

Gold Futures: A Historical Contango Scenario

Gold futures markets experienced notable contango during periods of low spot demand and ample supply, such as in early 2016 when the futures price for gold contracts expiring in six months exceeded the spot price by approximately 3%. This contango reflected storage costs, insurance, and low immediate consumption interest despite expectations of stable or rising gold prices. Investors capitalized on this by entering into calendar spreads, profiting from the convergence of futures prices toward spot price at contract maturity.

Impact of Contango on Commodity Investors

Contango in commodity markets occurs when futures prices are higher than the spot prices, leading to increased costs for investors holding long positions in futures contracts due to the need to roll over contracts at higher prices. This price structure can erode returns for commodity investors by causing negative roll yields, especially in markets like crude oil where storage costs and interest rates amplify contango effects. Understanding contango is essential for managing investment strategies and mitigating risks associated with futures-based commodity portfolios.

Comparing Contango and Backwardation in Commodities

Contango occurs when future commodity prices are higher than spot prices, often driven by storage costs and expectations of rising supply. In contrast, backwardation features future prices below spot prices, typically signaling immediate demand or supply shortages. Understanding the dynamics between contango and backwardation helps investors optimize trading strategies and manage risk in commodity markets.

Risks and Opportunities in a Contango Market

In a contango market, where futures prices exceed spot prices, investors face risks such as roll yield losses due to consistently selling lower-priced spot contracts and buying higher-priced futures. However, opportunities arise for traders who exploit storage advantages or those able to capitalize on predictable price convergence by entering long positions early. Effective risk management and market timing are crucial strategies to mitigate exposure and leverage profit potential in this upward-sloping futures curve environment.

How Storage Costs Influence Contango

Storage costs significantly impact contango in commodity markets by increasing the future price relative to the spot price. For example, in crude oil markets, higher expenses for warehousing, insurance, and financing contribute to an upward slope of futures prices, reflecting these carrying costs. This relationship ensures the futures curve remains in contango as long as storage and associated expenses outweigh the benefits of immediate sale.

The Role of ETFs in a Contango Environment

In a contango environment, commodity ETFs that track futures contracts often face roll yield losses as they sell expiring contracts at lower spot prices and buy longer-dated contracts at higher prices. This persistent cost can erode returns, making it crucial for investors to understand the impact of the futures curve on ETF performance. Effective management strategies, such as utilizing optimized roll schedules or investing in ETFs with active futures management, can help mitigate the negative effects of contango on total returns.

Managing Portfolio Risk During Contango Phases

Contango occurs when the futures price of a commodity exceeds its spot price, presenting challenges in managing portfolio risk due to the cost of rolling contracts. Investors can mitigate losses by employing strategies such as using fixed income assets for diversification, incorporating inverse commodity ETFs, or adjusting exposure to futures with staggered maturities. Effective portfolio risk management during contango phases involves closely monitoring basis risk and leveraging derivatives to hedge against adverse price movements.

example of contango in commodity Infographic

samplerz.com

samplerz.com