Contango is a market condition in futures trading where the futures price of a commodity is higher than its expected spot price at contract maturity. This phenomenon commonly occurs in commodity markets, such as oil, where storage costs, insurance, and interest rates contribute to the higher futures prices. For instance, if crude oil is trading at $50 per barrel in the spot market, the futures contract for delivery in six months might be priced at $55 per barrel, reflecting contango. In the finance sector, contango affects trading strategies and risk management for investors and companies involved in commodity markets. Futures contracts in contango typically imply carrying costs and expectations of rising prices, influencing hedging and speculative decisions. Data on contango helps market participants analyze supply and demand dynamics, guiding investment choices and portfolio optimization.

Table of Comparison

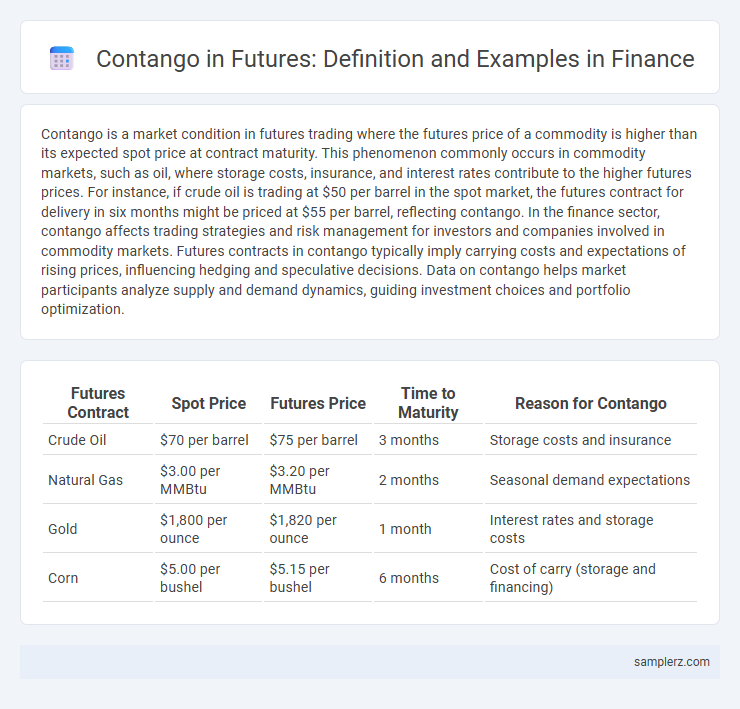

| Futures Contract | Spot Price | Futures Price | Time to Maturity | Reason for Contango |

|---|---|---|---|---|

| Crude Oil | $70 per barrel | $75 per barrel | 3 months | Storage costs and insurance |

| Natural Gas | $3.00 per MMBtu | $3.20 per MMBtu | 2 months | Seasonal demand expectations |

| Gold | $1,800 per ounce | $1,820 per ounce | 1 month | Interest rates and storage costs |

| Corn | $5.00 per bushel | $5.15 per bushel | 6 months | Cost of carry (storage and financing) |

Understanding Contango in Futures Markets

Contango in futures markets occurs when the futures price of a commodity is higher than the expected future spot price, reflecting storage costs, interest rates, and convenience yield. This condition is common in markets for commodities like crude oil, where holding inventory involves significant expenses. Traders in contango environments may face roll yield losses when continuously rolling over near-expiry contracts to maintain exposure.

Key Characteristics of Contango

Contango in futures markets occurs when the futures price of a commodity is higher than the expected spot price at contract maturity, often driven by carrying costs such as storage, insurance, and interest rates. This condition is typical for commodities with high storage costs, causing the futures curve to slope upward. Investors face roll yield losses in contango because they must sell expiring contracts at lower prices to buy higher-priced longer-dated contracts.

Classic Example of Contango: Oil Futures

In oil futures markets, contango occurs when the futures price exceeds the current spot price due to storage costs and convenience yield. For example, if crude oil trades at $70 per barrel spot but the futures contract for delivery in six months is priced at $75, the $5 premium reflects contango. This classic contango scenario signals market expectations of stable or increasing future supply and demand dynamics.

Gold Futures: A Contango Scenario

Gold futures often exhibit contango when the spot price is lower than futures prices due to storage costs, insurance, and interest rates, making futures contracts more expensive than current gold prices. For example, if gold's spot price is $1,800 per ounce, a futures contract expiring in six months might trade at $1,820 per ounce, reflecting expected carrying costs. Traders in contango markets may incur losses when rolling over contracts if spot prices fail to rise to the futures price level.

Agricultural Commodities and Contango

In agricultural commodities markets, contango occurs when futures prices for crops like corn and wheat exceed current spot prices, reflecting storage costs and seasonal supply expectations. This price structure incentivizes producers and traders to hold inventory, anticipating higher future prices due to planting cycles and weather uncertainties. Contango signals a market condition where carrying costs and risk premiums lead futures contracts to trade above the spot price, impacting hedging and speculative strategies.

Impact of Storage Costs on Contango

Storage costs play a crucial role in creating contango in futures markets, particularly in commodities like oil and natural gas. When storage expenses are high, futures prices tend to rise above spot prices to cover these costs, reflecting the cost of carrying the physical commodity until delivery. This price structure incentivizes producers and investors to store goods, leading to a persistent upward-sloping futures curve.

Contango vs. Backwardation: Comparative Analysis

Contango in futures markets occurs when the futures price of a commodity is higher than the expected spot price at contract maturity, often due to storage costs or interest rates. In contrast, backwardation happens when futures prices are lower than the anticipated spot price, typically reflecting supply shortages or high immediate demand. This comparative analysis highlights how traders and investors use contango and backwardation to inform strategies related to hedging and arbitrage in commodity markets.

Real-World Case Study: Crude Oil Contango 2020

In 2020, the crude oil futures market exhibited a classic case of contango, with prices for delivery months significantly higher than the spot price due to oversupply and storage constraints amid the COVID-19 pandemic. The West Texas Intermediate (WTI) futures contracts for several months ahead traded at a premium, reflecting market expectations of future price recovery despite near-term demand collapse. This contango situation led investors to exploit roll yield strategies, buying cheaper spot contracts and selling overpriced future contracts to generate returns.

How Contango Affects Futures Traders

Contango occurs when futures prices are higher than the expected spot price at contract maturity, causing traders to pay a premium to roll over contracts. This situation impacts futures traders by increasing the cost of maintaining long positions over time, potentially eroding profits. Traders managing portfolios in energy or commodity markets must carefully assess contango's effect on their hedging strategies and risk management.

Managing Risks Associated with Contango

Managing risks associated with contango involves closely monitoring futures contracts where the price of a commodity futures contract is higher than the expected spot price at contract maturity, leading to potential losses for long positions rolled forward. Hedgers and investors can implement strategies such as using calendar spreads to offset the negative roll yield or adjusting the timing of their contract rolls to minimize exposure to steep contango conditions. Employing risk management tools like stop-loss orders and incorporating spot market hedges also helps mitigate financial impact caused by contango in futures markets.

example of contango in futures Infographic

samplerz.com

samplerz.com