An iron condor is an option strategy involving four different contracts with the same expiration date to generate income while limiting risk. It consists of selling an out-of-the-money call and put, while simultaneously buying a further out-of-the-money call and put as protective wings. This creates a range where the trader expects the underlying asset to stay, allowing profit from time decay and limited price movement. For example, an investor holds a stock priced at $100 and implements an iron condor by selling a $105 call and a $95 put, while buying a $110 call and a $90 put for protection. The maximum profit occurs if the stock price remains between $95 and $105 at expiration, capturing the net premium received from sold options. Losses are capped beyond $110 or below $90, providing a defined risk-reward profile suitable for neutral market outlooks.

Table of Comparison

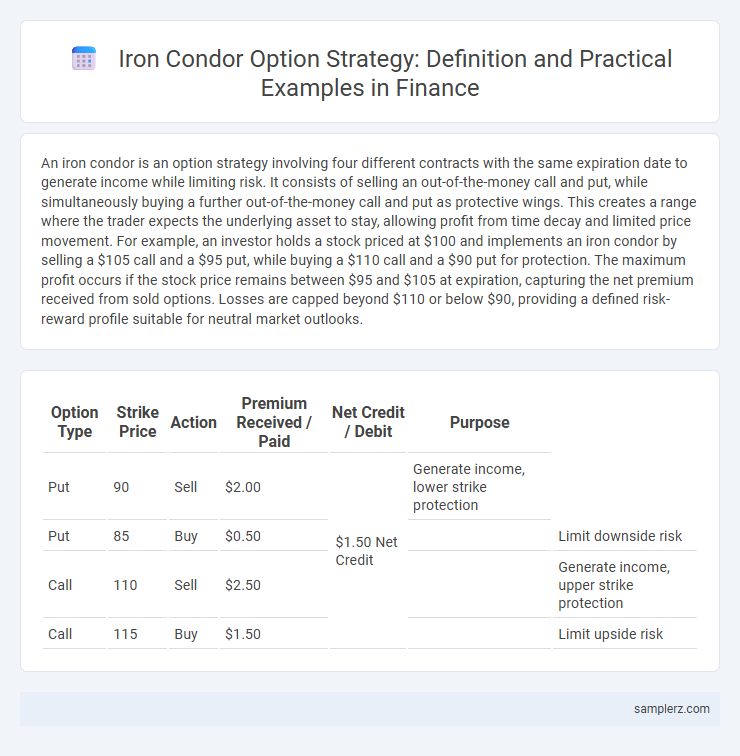

| Option Type | Strike Price | Action | Premium Received / Paid | Net Credit / Debit | Purpose |

|---|---|---|---|---|---|

| Put | 90 | Sell | $2.00 | $1.50 Net Credit | Generate income, lower strike protection |

| Put | 85 | Buy | $0.50 | Limit downside risk | |

| Call | 110 | Sell | $2.50 | Generate income, upper strike protection | |

| Call | 115 | Buy | $1.50 | Limit upside risk |

Understanding the Iron Condor Strategy

The Iron Condor strategy in options trading involves simultaneously selling an out-of-the-money put and call while buying further out-of-the-money put and call options to limit risk, creating a range where the trader profits if the underlying asset remains stable. This neutral strategy aims to capitalize on low volatility by collecting premiums from the sold options, while the purchased options serve as hedges against significant price movements. Understanding the breakeven points and potential maximum profit and loss is crucial for effectively managing risk and maximizing returns with the Iron Condor.

Components of an Iron Condor Trade

An iron condor trade in options consists of four components: selling an out-of-the-money call and put option while simultaneously buying a further out-of-the-money call and put option, creating two vertical spreads. This strategy generates a net credit and profits from low volatility when the underlying asset stays within the range defined by the short strikes. Risk is limited to the difference between the strike prices of the call or put spreads minus the net premium received.

Step-by-Step Example: Setting Up an Iron Condor

An iron condor option strategy involves simultaneously selling an out-of-the-money call and put while buying further out-of-the-money call and put options to limit risk. For example, if a stock trades at $100, you sell a $105 call and a $95 put, then buy a $110 call and a $90 put, creating a range where maximum profit occurs if the stock stays between the short strikes. This setup benefits from low volatility, allowing the trader to earn premium income while capping potential losses on either side.

Selecting Strike Prices for the Iron Condor

Selecting strike prices for an iron condor involves choosing four options contracts: two calls and two puts with different strike prices, typically equidistant from the current stock price to create a range of limited risk and reward. The short call and short put strike prices are set closer to the underlying asset's current price, where the trader expects the stock to remain, while the long call and long put strike prices lie further out-of-the-money to cap potential losses. This balanced positioning maximizes premium capture while minimizing risk exposure within a neutral market outlook.

Premium Collection and Potential Profit Calculation

An iron condor option strategy involves selling an out-of-the-money put and call while buying further out-of-the-money put and call options, creating a range where maximum premium is collected. The net credit received from selling the options represents the premium collection, which serves as the potential maximum profit if the underlying asset remains within the predicted price range until expiration. Potential profit calculation equals the total premiums collected minus the cost of the protective options, defining the strategy's risk-reward balance.

Risk and Reward Profile in Iron Condor

An iron condor option strategy involves selling an out-of-the-money call and put while buying further out-of-the-money call and put options, creating a range with limited risk and limited reward. The maximum profit is realized when the underlying asset's price remains within the short strikes, resulting in premium collected from the sold options. Risk is capped by the purchased options, with the maximum loss occurring if the underlying price moves beyond the long strikes, defining a well-structured risk and reward profile ideal for neutral market outlooks.

Iron Condor Example Using S&P 500 Options

An Iron Condor example using S&P 500 options involves selling a lower strike put and buying an even lower strike put while simultaneously selling a higher strike call and buying an even higher strike call, creating a range between two breakeven points. For instance, traders might sell the 4000 put and buy the 3950 put, while selling the 4100 call and buying the 4150 call, profiting if the SPX price remains between 4000 and 4100 until expiration. This strategy limits risk and rewards range-bound price movement by collecting premiums from both sides of the market.

Managing and Adjusting an Iron Condor Position

Managing an iron condor position involves monitoring the price movement of the underlying asset to ensure it remains within the profitable range between the short strike prices. Adjustments such as rolling one or both spreads closer to expiration or widening the wings can help reduce risk and lock in gains while maintaining defined risk characteristics. Active management also includes closing the position early if the underlying asset approaches or breaches short strikes, minimizing potential losses.

Common Mistakes in Iron Condor Trading

Iron condor trading often suffers from common mistakes such as improper strike selection, which leads to insufficient premium collection or excessive risk exposure, and neglecting to monitor implied volatility changes that affect option prices. Traders frequently ignore adjusting or closing positions early, resulting in preventable losses, especially during sudden market volatility spikes. Misjudging the optimal expiration dates reduces the strategy's effectiveness, causing failures in balancing time decay benefits against potential adverse price movements.

When to Use Iron Condor in Your Portfolio

An iron condor option strategy is ideal for investors expecting low volatility in the underlying asset, as it profits from the asset price remaining within a specific range until expiration. This strategy generates income by selling both a lower and an upper out-of-the-money put and call, balancing risk and reward in neutral market conditions. Employing an iron condor is beneficial when portfolio diversification seeks consistent premium collection with limited directional risk exposure.

example of iron condor in option strategy Infographic

samplerz.com

samplerz.com