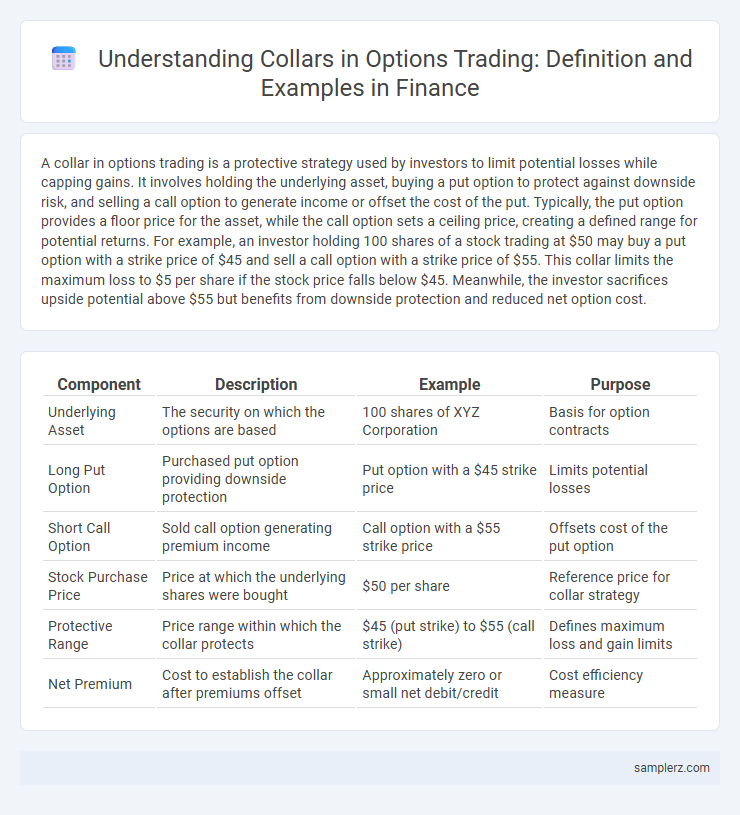

A collar in options trading is a protective strategy used by investors to limit potential losses while capping gains. It involves holding the underlying asset, buying a put option to protect against downside risk, and selling a call option to generate income or offset the cost of the put. Typically, the put option provides a floor price for the asset, while the call option sets a ceiling price, creating a defined range for potential returns. For example, an investor holding 100 shares of a stock trading at $50 may buy a put option with a strike price of $45 and sell a call option with a strike price of $55. This collar limits the maximum loss to $5 per share if the stock price falls below $45. Meanwhile, the investor sacrifices upside potential above $55 but benefits from downside protection and reduced net option cost.

Table of Comparison

| Component | Description | Example | Purpose |

|---|---|---|---|

| Underlying Asset | The security on which the options are based | 100 shares of XYZ Corporation | Basis for option contracts |

| Long Put Option | Purchased put option providing downside protection | Put option with a $45 strike price | Limits potential losses |

| Short Call Option | Sold call option generating premium income | Call option with a $55 strike price | Offsets cost of the put option |

| Stock Purchase Price | Price at which the underlying shares were bought | $50 per share | Reference price for collar strategy |

| Protective Range | Price range within which the collar protects | $45 (put strike) to $55 (call strike) | Defines maximum loss and gain limits |

| Net Premium | Cost to establish the collar after premiums offset | Approximately zero or small net debit/credit | Cost efficiency measure |

Understanding the Basics of a Collar Strategy in Options

A collar strategy in options involves holding an underlying asset while simultaneously buying a protective put option and selling a call option to limit potential losses and gains. For example, an investor owning 100 shares of XYZ stock at $50 may buy a put option with a strike price of $45 and sell a call option with a strike price of $55, effectively creating a price floor and ceiling. This strategy helps manage downside risk without selling the asset and can be cost-effective by using the premium received from the call option to offset the put option's cost.

Key Components of a Collar Option Example

A collar option involves holding a long stock position while simultaneously purchasing a protective put option and selling a call option to limit downside risk and cap upside potential. Key components include the strike price of the put option, which sets the maximum loss threshold, and the strike price of the call option, which defines the profit ceiling. The premium paid for the put is offset by the premium received from the call, making collars a cost-effective hedging strategy in equity portfolios.

Step-by-Step Guide: Constructing a Collar Trade

Constructing a collar trade involves simultaneously buying a put option and selling a call option on the same underlying asset to limit downside risk while capping potential gains. For instance, an investor holding 100 shares of XYZ stock at $50 can buy a $45 put option as downside protection and sell a $55 call option to offset the put's cost, effectively creating a protective range between $45 and $55. This step-by-step approach mitigates losses if the stock falls below $45 and limits profit if the stock rises above $55 during the option's expiration period.

Real-Life Example: Implementing a Collar with Stock XYZ

Investors holding 1,000 shares of Stock XYZ priced at $50 per share can implement a collar by simultaneously buying put options at a $45 strike price and selling call options at a $55 strike price. This strategy limits potential losses below $45 while capping gains above $55, effectively creating a protective range for the investment. Using collars in this manner helps manage risk in volatile markets without incurring the full cost of protective puts.

Calculating Potential Gains and Losses in a Collar

Calculating potential gains and losses in a collar option strategy involves analyzing the premium paid for the put option and the premium received from the call option to determine net cost or credit. The maximum gain is limited to the difference between the strike prices minus the net premium paid, while the maximum loss is capped by the put strike price minus the initial stock price plus the net premium. This risk-defined structure allows investors to hedge downside risk while sacrificing some upside potential in exchange for cost efficiency.

Protective Benefits of Using a Collar in Volatile Markets

A collar option strategy involves holding a long stock position while simultaneously buying a put option and selling a call option to limit downside risk and cap potential gains. This protective approach reduces portfolio volatility by establishing a predefined price range, effectively shielding investors from sharp market downturns during periods of uncertainty. Investors in volatile markets benefit from collars as they secure downside protection without the significant cost of outright put buying, maintaining exposure to potential appreciation within controlled risk parameters.

Comparison: Collar vs. Other Option Hedging Strategies

A collar strategy involves holding the underlying asset while simultaneously buying a protective put and selling a call option, effectively limiting both downside risk and upside potential. Compared to protective puts alone, collars reduce the net cost of hedging by generating premium income from the sold call, whereas covered calls expose investors to unlimited downside risk without protective puts. Unlike straddles or strangles that profit from volatility, collars provide more controlled risk management, making them suitable for conservative investors prioritizing capital preservation.

Risks Involved When Setting Up a Collar Position

Establishing a collar option position involves risks such as limited profit potential due to the capped upside from the call option sold. The cost of purchasing the protective put option can erode returns or reduce capital flexibility. Market gaps and liquidity constraints may also lead to execution risks, impacting the effectiveness of the hedge.

Tax Implications of Executing a Collar Option

Executing a collar option, which involves holding a long stock position while simultaneously buying a protective put and selling a covered call, can have significant tax implications depending on the holding period and option strikes. The sale of the call option typically generates immediate short-term capital gains, while the purchased put may defer gains by setting a floor on the asset's value, potentially impacting the timing of taxable events. Investors must carefully consider IRS rules on constructive sales and straddle regulations, as these can affect the recognition of gains and losses resulting from collar strategies.

Best Practices for Managing an Options Collar Strategy

Implementing an options collar strategy involves simultaneously buying a protective put and selling a covered call to limit downside risk while capping upside potential. Best practices include selecting strike prices that balance risk tolerance with desired return, regularly monitoring implied volatility to optimize premium income, and adjusting the collar as market conditions shift to maintain effective hedging. Continuous evaluation of portfolio objectives and transaction costs ensures the collar remains aligned with investment goals and minimizes adverse impacts on overall returns.

example of collar in option Infographic

samplerz.com

samplerz.com