Shariah-compliant investing adheres to Islamic laws that prohibit interest (riba), uncertainty (gharar), and unethical business activities. One common example is investing in equity stocks of companies that operate in permissible sectors such as technology, healthcare, and halal food production. These investments exclude businesses involved in alcohol, gambling, pork products, and conventional financial services like banks offering interest-based loans. Another example is the use of Islamic finance instruments like Sukuk, which are Shariah-compliant bonds structured to generate returns without interest payments. Sukuk represent ownership in tangible assets or projects, offering investors a share in profits rather than a fixed interest income. This approach aligns investments with ethical standards and risk-sharing principles mandated by Shariah law.

Table of Comparison

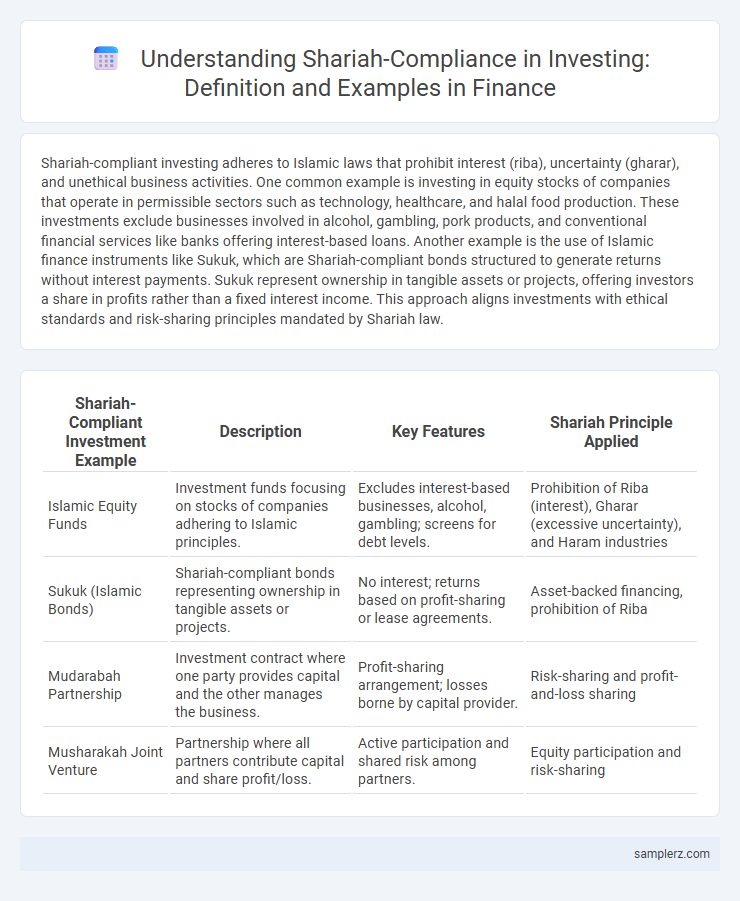

| Shariah-Compliant Investment Example | Description | Key Features | Shariah Principle Applied |

|---|---|---|---|

| Islamic Equity Funds | Investment funds focusing on stocks of companies adhering to Islamic principles. | Excludes interest-based businesses, alcohol, gambling; screens for debt levels. | Prohibition of Riba (interest), Gharar (excessive uncertainty), and Haram industries |

| Sukuk (Islamic Bonds) | Shariah-compliant bonds representing ownership in tangible assets or projects. | No interest; returns based on profit-sharing or lease agreements. | Asset-backed financing, prohibition of Riba |

| Mudarabah Partnership | Investment contract where one party provides capital and the other manages the business. | Profit-sharing arrangement; losses borne by capital provider. | Risk-sharing and profit-and-loss sharing |

| Musharakah Joint Venture | Partnership where all partners contribute capital and share profit/loss. | Active participation and shared risk among partners. | Equity participation and risk-sharing |

Key Principles of Shariah-Compliant Investing

Shariah-compliant investing adheres to key principles including the prohibition of interest (riba), avoidance of industries such as alcohol, gambling, and pork, and ensuring all investment activities are ethically sound and socially responsible. Financial transactions must be structured on profit-and-loss sharing models rather than fixed income, emphasizing asset-backed investments and transparency in contracts. Screening processes use qualitative and quantitative methods to filter out non-compliant companies, aligning portfolios with Islamic ethical standards.

Understanding Halal and Haram Investments

Halal investments adhere to Islamic principles by avoiding industries such as alcohol, gambling, and interest-based financial services, ensuring compliance with Shariah law. Common examples include equity in companies involved in halal food production, healthcare, and technology sectors that do not engage in prohibited activities. Shariah-compliant investment funds use rigorous screening processes to exclude haram activities, promoting ethical finance and risk-sharing models.

Screening Criteria for Shariah-Compliant Stocks

Shariah-compliant investing involves screening stocks based on financial ratios such as debt-to-equity below 33% and interest income not exceeding 5% of total revenue. Companies must operate in halal industries, excluding sectors like alcohol, gambling, and conventional finance. This screening ensures investment portfolios adhere to Islamic ethical principles while maintaining financial integrity.

Sukuk: The Islamic Alternative to Bonds

Sukuk represents a Shariah-compliant investment vehicle offering returns without violating Islamic prohibitions on interest (riba) through asset-backed securities that provide ownership in tangible assets. These instruments ensure profit and loss sharing among investors and issuers, aligning financial gains with ethical business practices. Global Sukuk markets have expanded significantly, with sovereign and corporate issuances driving diversification in Islamic finance portfolios.

Islamic Mutual Funds: Structure and Benefits

Islamic Mutual Funds operate under Shariah-compliance by investing in equities, sukuk, and other Islamic financial instruments that prohibit interest (riba) and excessive uncertainty (gharar). Their structure includes a Shariah supervisory board ensuring adherence to Islamic principles, screening investments against prohibited sectors such as alcohol, gambling, and conventional banking. Benefits include ethical investing aligned with Islamic law, portfolio diversification, and potential for competitive returns without compromising religious values.

Role of Islamic Banks in Shariah-Compliant Portfolios

Islamic banks play a crucial role in developing Shariah-compliant portfolios by offering financial products that strictly avoid interest (riba) and investment in prohibited industries such as alcohol, gambling, and pork. These banks structure investments using profit-and-loss sharing models, such as Mudarabah and Musharakah, ensuring alignment with Islamic ethical principles. Their oversight by Shariah advisory boards guarantees continuous compliance and ethical investment processes within the financial sector.

Real Estate Investment in Shariah Finance

Shariah-compliant real estate investment adheres to Islamic finance principles by avoiding interest (riba) and ensuring asset-backed transactions. Investors participate in properties through structures like Musharakah (partnership) or Ijarah (leasing), promoting profit-and-loss sharing without exploiting debt. These investments focus on ethical sectors, excluding properties related to prohibited activities such as gambling or alcohol.

Prohibited Activities in Shariah Investing

Shariah-compliant investing strictly excludes companies involved in prohibited activities such as alcohol production, gambling, pork-related products, and conventional financial services with interest (riba). Investment portfolios are screened to avoid businesses engaging in weapons manufacturing, adult entertainment, and tobacco industries, ensuring adherence to Islamic ethical standards. This rigorous filtering aligns investment practices with Shariah principles, minimizing exposure to impermissible economic activities.

Shariah Supervisory Boards and Their Significance

Shariah Supervisory Boards (SSBs) play a crucial role in ensuring investment activities comply with Islamic principles by overseeing financial products and practices in Islamic finance institutions. These boards consist of qualified scholars who review and certify that investments avoid prohibited activities such as interest (riba), excessive uncertainty (gharar), and unethical industries like alcohol or gambling. The presence of an SSB enhances investor confidence by ensuring transparency, adherence to Shariah law, and ethical financial conduct in Islamic investment portfolios.

Global Growth of Shariah-Compliant Investment Products

The global growth of Shariah-compliant investment products has surged, with assets under management exceeding $2.5 trillion as of 2023, driven by increasing demand from Muslim-majority countries and ethical investors worldwide. Key sectors attracting Shariah investments include technology, healthcare, and real estate, adhering to Islamic finance principles that prohibit interest (riba) and excessive uncertainty (gharar). This expansion is supported by regulatory frameworks in markets like Malaysia and the Gulf Cooperation Council, promoting transparency and investor confidence in Shariah-compliant funds and sukuk issuance.

example of shariah-compliance in investing Infographic

samplerz.com

samplerz.com