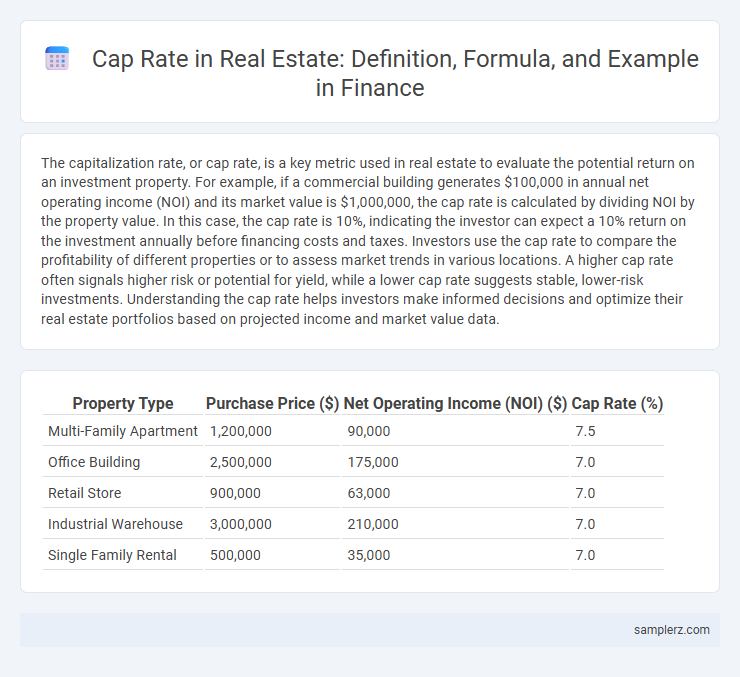

The capitalization rate, or cap rate, is a key metric used in real estate to evaluate the potential return on an investment property. For example, if a commercial building generates $100,000 in annual net operating income (NOI) and its market value is $1,000,000, the cap rate is calculated by dividing NOI by the property value. In this case, the cap rate is 10%, indicating the investor can expect a 10% return on the investment annually before financing costs and taxes. Investors use the cap rate to compare the profitability of different properties or to assess market trends in various locations. A higher cap rate often signals higher risk or potential for yield, while a lower cap rate suggests stable, lower-risk investments. Understanding the cap rate helps investors make informed decisions and optimize their real estate portfolios based on projected income and market value data.

Table of Comparison

| Property Type | Purchase Price ($) | Net Operating Income (NOI) ($) | Cap Rate (%) |

|---|---|---|---|

| Multi-Family Apartment | 1,200,000 | 90,000 | 7.5 |

| Office Building | 2,500,000 | 175,000 | 7.0 |

| Retail Store | 900,000 | 63,000 | 7.0 |

| Industrial Warehouse | 3,000,000 | 210,000 | 7.0 |

| Single Family Rental | 500,000 | 35,000 | 7.0 |

What is Cap Rate in Real Estate?

Cap rate, or capitalization rate, in real estate is the ratio of a property's net operating income (NOI) to its current market value, expressed as a percentage. It is used by investors to evaluate the potential return on investment and compare the profitability of various properties. For example, a property generating $50,000 NOI with a market value of $500,000 has a 10% cap rate, indicating the expected annual return before financing and taxes.

How to Calculate Cap Rate: Step-by-Step

To calculate the capitalization rate (cap rate) in real estate, divide the property's net operating income (NOI) by its current market value or purchase price. For example, if a property generates $50,000 in annual NOI and is valued at $500,000, the cap rate is 10% ($50,000 / $500,000). This metric helps investors estimate the potential return and compare investment opportunities effectively.

Real-Life Example of Cap Rate Calculation

A property purchased for $500,000 generates an annual net operating income (NOI) of $35,000, resulting in a cap rate of 7% (35,000 / 500,000). This metric helps investors quickly assess the potential return on investment compared to other real estate opportunities. Understanding this ratio supports informed decision-making in property acquisitions and portfolio management.

Key Factors That Impact Cap Rate

Cap rate in real estate is primarily influenced by property location, market demand, and the risk profile associated with the investment. Economic conditions, including interest rates and inflation, also play a significant role in determining the capitalization rate. Property-specific characteristics such as age, condition, and income potential further affect the cap rate calculation, guiding investor decisions.

Comparing Cap Rates Across Property Types

Cap rates vary significantly across real estate property types, with multifamily residential properties typically exhibiting lower cap rates around 4-6%, reflecting their stable cash flow and lower risk. In contrast, retail and office properties often have higher cap rates ranging from 7-9%, indicating greater risk due to market demand fluctuations and tenant turnover. Industrial properties generally sit between these ranges, with cap rates near 5-7%, balancing steady demand and moderate risk profiles.

Cap Rate Benchmarking: What’s a Good Cap Rate?

A good cap rate in real estate typically ranges from 4% to 10%, depending on the property type and location, with multifamily assets often yielding 5% to 7%, while commercial buildings may present higher rates around 8% to 10%. Cap rate benchmarking involves comparing a target property's rate against local market averages and historical trends to assess risk and return potential accurately. Investors use cap rate data alongside metrics like net operating income (NOI) and purchase price to make informed decisions and evaluate investment performance in competitive markets.

Cap Rate Example: Multifamily Property Analysis

A multifamily property priced at $1,000,000 with an annual net operating income (NOI) of $80,000 yields a cap rate of 8%. This cap rate calculation helps investors assess the potential return by dividing the NOI by the property's current market value. Understanding cap rates in multifamily properties enables more accurate risk and profitability comparisons across diverse real estate investments.

Cap Rate Example: Commercial Office Investment

A commercial office investment property priced at $2 million with an annual net operating income (NOI) of $150,000 results in a cap rate of 7.5%. This cap rate reflects the property's potential return and helps investors compare profitability across similar commercial real estate assets. Calculating cap rate involves dividing the NOI by the current market value or purchase price of the office property.

Cap Rate Example: Retail Property Investment

A retail property with an annual net operating income (NOI) of $150,000 and a market value of $2,000,000 results in a cap rate of 7.5%, calculated by dividing NOI by property value. This cap rate provides investors a snapshot of potential returns, balancing income generation against property price. Retail properties typically exhibit cap rates between 6% and 8%, reflecting moderate risk and steady cash flow in the real estate market.

Cap Rate Limitations and Investor Considerations

Cap rate, or capitalization rate, provides a quick estimate of a property's potential return by dividing net operating income by its current market value, but it often overlooks factors like financing costs, tax implications, and future market fluctuations. Investors must consider additional metrics such as cash-on-cash return and internal rate of return (IRR) to fully assess an investment's performance and risks. Limitations of relying solely on cap rate include its inability to account for property condition, location dynamics, and potential for income growth, which can significantly affect long-term profitability.

example of cap rate in real estate Infographic

samplerz.com

samplerz.com