The Greenshoe option, also known as an over-allotment option, is a mechanism used during an Initial Public Offering (IPO) to stabilize the stock price. It allows underwriters to sell additional shares, typically up to 15% more than the original number offered, if demand exceeds expectations. For example, in the Facebook IPO of 2012, the Greenshoe option allowed underwriters to sell 15% more shares, helping to manage price volatility during the initial trading period. This option provides flexibility to underwriters and can protect investors from sharp price drops after the IPO. It is activated when the share price rises above the offering price, prompting underwriters to buy back shares to cover their short position. The use of a Greenshoe option is a common practice in major IPOs, ensuring market stability and investor confidence.

Table of Comparison

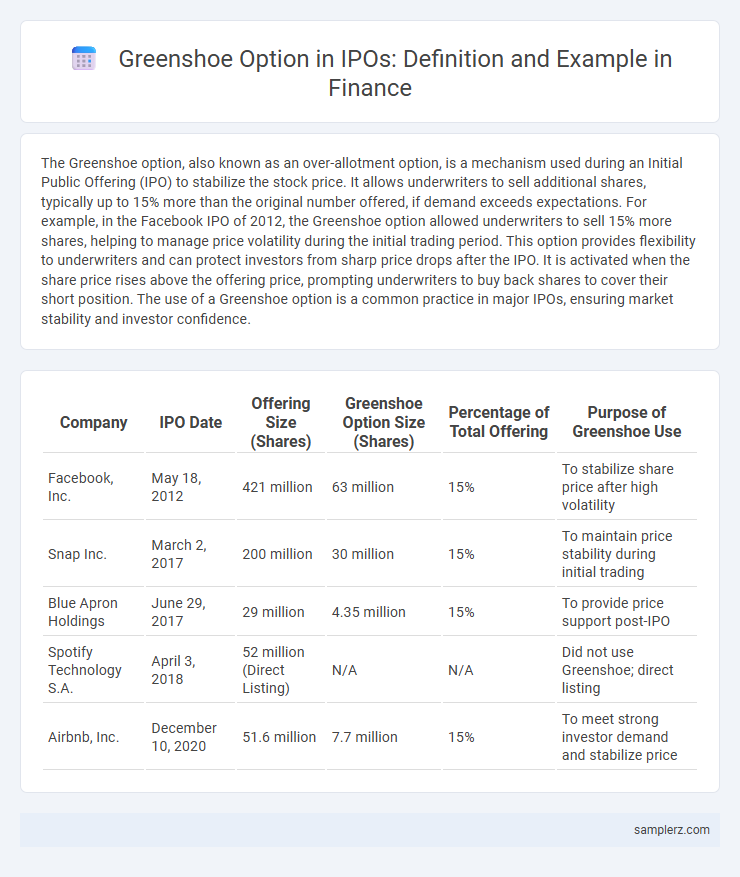

| Company | IPO Date | Offering Size (Shares) | Greenshoe Option Size (Shares) | Percentage of Total Offering | Purpose of Greenshoe Use |

|---|---|---|---|---|---|

| Facebook, Inc. | May 18, 2012 | 421 million | 63 million | 15% | To stabilize share price after high volatility |

| Snap Inc. | March 2, 2017 | 200 million | 30 million | 15% | To maintain price stability during initial trading |

| Blue Apron Holdings | June 29, 2017 | 29 million | 4.35 million | 15% | To provide price support post-IPO |

| Spotify Technology S.A. | April 3, 2018 | 52 million (Direct Listing) | N/A | N/A | Did not use Greenshoe; direct listing |

| Airbnb, Inc. | December 10, 2020 | 51.6 million | 7.7 million | 15% | To meet strong investor demand and stabilize price |

Understanding the Greenshoe Option in IPOs

The Greenshoe option, also known as an over-allotment option, allows underwriters to sell additional shares, typically up to 15% more than the original amount offered in an IPO, to stabilize the stock price post-launch. This mechanism helps manage volatility by permitting the purchase of extra shares from the issuer if demand exceeds expectations. Understanding the Greenshoe option's role in price stabilization is crucial for investors assessing IPO risk and aftermarket performance.

Historical Overview of Greenshoe Usage

The Greenshoe option, first introduced during the U.S. IPO boom of the 1960s, allowed underwriters to stabilize share prices by selling up to 15% more shares than originally planned. Significant early examples include the initial public offering of Ford Motor Company in 1956, where the Greenshoe mechanism helped manage excess demand and price volatility. Over decades, the Greenshoe has become a standard practice in IPOs globally, optimizing share allocation and aiding price stabilization in volatile markets.

Case Study: Google’s IPO Greenshoe Example

Google's IPO in 2004 included a Greenshoe option allowing underwriters to sell an additional 15% of shares to stabilize the stock price amid high volatility. This mechanism helped absorb excess demand, preventing extreme price fluctuations during the initial trading days. The Greenshoe exercised by Morgan Stanley increased share allocation, demonstrating an effective strategy for managing IPO supply and demand dynamics.

How the Greenshoe Stabilizes IPO Prices

The Greenshoe option allows underwriters to sell up to 15% more shares than initially planned, providing a mechanism to stabilize IPO prices by enabling market intervention when share prices fluctuate. By exercising the Greenshoe option, underwriters can purchase additional shares at the offering price, curbing excessive volatility and supporting price stability during early trading. This flexibility mitigates downward pressure on the stock, ensuring a smoother market adjustment and investor confidence post-IPO.

Real-World Greenshoe Execution: Facebook IPO

The Facebook IPO in 2012 featured a real-world Greenshoe option that allowed underwriters to purchase up to 30% more shares than the original number offered, stabilizing the stock price amid heavy demand. This mechanism helped mitigate market volatility by providing additional liquidity, reducing downward price pressure during initial trading. The successful execution of the Greenshoe option in Facebook's IPO highlighted its significance in managing supply and demand imbalances during high-profile public offerings.

Role of Underwriters in Greenshoe Transactions

Underwriters play a critical role in Greenshoe transactions by stabilizing the share price during an IPO through their option to purchase additional shares, typically up to 15% more than the original offering. This mechanism allows underwriters to manage overallotments and mitigate price volatility by covering short positions if demand exceeds supply. Their intervention helps ensure market confidence and smoothens the transition of shares from the issuer to public investors.

Benefits of Greenshoe Option for Investors

The Greenshoe option in an IPO allows investors to purchase additional shares, typically up to 15% more than the original offering, stabilizing the stock price post-launch. This mechanism reduces volatility and increases liquidity by enabling underwriters to cover short positions if demand exceeds supply. As a result, investors gain enhanced confidence and potential for improved returns due to managed price fluctuations and greater market depth.

Comparing Greenshoe Outcomes: Alibaba vs. Uber IPOs

Alibaba's IPO utilized a greenshoe option to stabilize shares, increasing the offering size by 15% and raising an additional $4 billion, which helped maintain price stability during initial trading. In contrast, Uber's IPO also exercised the greenshoe option but faced greater volatility, as the increased offering size only marginally reduced share price fluctuations amid investor uncertainty. The comparative outcomes highlight Alibaba's successful greenshoe implementation in boosting capital and stabilizing equity, whereas Uber experienced limited benefits due to market conditions and investor sentiment.

Regulatory Framework Surrounding Greenshoe Option

The Greenshoe option in IPOs allows underwriters to buy up to 15% more shares than initially planned, stabilizing the stock price post-listing under strict regulatory frameworks such as SEC Rule 415 in the United States. Compliance with these regulations ensures transparency and protects investors by limiting potential market manipulation during the IPO process. The framework mandates timely disclosure and adherence to lock-up periods, maintaining market integrity and investor confidence.

Key Takeaways from Famous Greenshoe Implementations

Famous Greenshoe implementations, such as the Alibaba IPO, demonstrate how exercising the greenshoe option stabilizes share prices during volatile market conditions, ensuring investor confidence. Key takeaways include enhanced liquidity, price stabilization within 30 days post-IPO, and increased underwriting flexibility for issuers managing supply and demand imbalances. These examples highlight the strategic use of greenshoe options to mitigate post-IPO price volatility and optimize capital raising outcomes.

example of Greenshoe in IPO Infographic

samplerz.com

samplerz.com