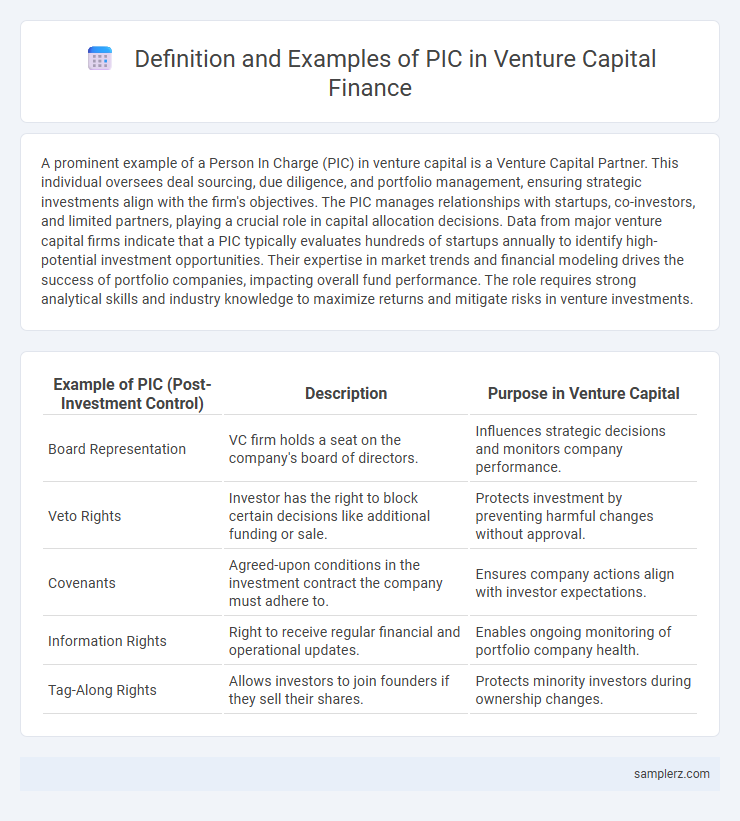

A prominent example of a Person In Charge (PIC) in venture capital is a Venture Capital Partner. This individual oversees deal sourcing, due diligence, and portfolio management, ensuring strategic investments align with the firm's objectives. The PIC manages relationships with startups, co-investors, and limited partners, playing a crucial role in capital allocation decisions. Data from major venture capital firms indicate that a PIC typically evaluates hundreds of startups annually to identify high-potential investment opportunities. Their expertise in market trends and financial modeling drives the success of portfolio companies, impacting overall fund performance. The role requires strong analytical skills and industry knowledge to maximize returns and mitigate risks in venture investments.

Table of Comparison

| Example of PIC (Post-Investment Control) | Description | Purpose in Venture Capital |

|---|---|---|

| Board Representation | VC firm holds a seat on the company's board of directors. | Influences strategic decisions and monitors company performance. |

| Veto Rights | Investor has the right to block certain decisions like additional funding or sale. | Protects investment by preventing harmful changes without approval. |

| Covenants | Agreed-upon conditions in the investment contract the company must adhere to. | Ensures company actions align with investor expectations. |

| Information Rights | Right to receive regular financial and operational updates. | Enables ongoing monitoring of portfolio company health. |

| Tag-Along Rights | Allows investors to join founders if they sell their shares. | Protects minority investors during ownership changes. |

Defining PIC in the Venture Capital Context

A PIC (Portfolio Investment Company) in venture capital refers to a startup or early-stage company that receives funding from a venture capital firm. These companies are part of the VC firm's portfolio, representing active investments aimed at achieving high growth and substantial returns. Identifying a PIC involves analyzing companies with scalable business models and strong potential for market disruption within the venture capital landscape.

Key Roles of PICs in Venture Capital Firms

Partners-in-Charge (PICs) in venture capital firms lead deal sourcing, due diligence, and portfolio management to maximize investment returns. They establish strategic relationships with startups and limited partners, ensuring alignment with the firm's investment thesis and risk appetite. PICs also mentor junior team members and influence key decision-making processes to drive fund performance.

Real-world Examples of PICs in VC Transactions

A prominent example of a PIC (Performance Incentive Compensation) in venture capital is the carried interest structure, where fund managers receive a percentage of the profits generated by successful investments, typically around 20%. Sequoia Capital's early investments in companies like Google and WhatsApp illustrate how PICs align manager incentives with portfolio success, rewarding performance with substantial profit shares. Another case is Andreessen Horowitz, where performance-based bonuses are tied to achieving milestones in portfolio company growth, fostering value creation and investor returns.

Criteria for Selecting a PIC in VC Investments

Criteria for selecting a Person-In-Charge (PIC) in venture capital investments include proven expertise in financial analysis, deep knowledge of startup ecosystems, and a strong network within industry sectors relevant to the fund's focus. The PIC must demonstrate a track record of successful deal sourcing, due diligence, and portfolio management to ensure effective capital allocation. Communication skills and an ability to align with both limited partners and entrepreneurs are critical for maintaining transparency and fostering strategic growth.

Notable PIC Structures in Leading VC Firms

Sequoia Capital employs a Special Purpose Vehicle (SPV) structure to pool limited partners' capital for targeted investments, enhancing deal-specific risk management. Andreessen Horowitz often utilizes Syndicate Funds, allowing strategic co-investors to participate alongside the main fund, increasing capital flexibility. Benchmark Capital's Partnership Investment Committee (PIC) model emphasizes collaborative decision-making, leveraging partner expertise to optimize portfolio allocations and maintain high-conviction investments.

Case Study: PIC Implementation in Successful Startups

In venture capital, a prime example of PIC (Portfolio Investment Committee) implementation is evident in the growth trajectory of Airbnb, where the committee's strategic oversight ensured critical funding during early stages. The PIC facilitated rigorous due diligence and risk assessment, enabling targeted capital allocation that accelerated product development and market expansion. This structured decision-making model contributed significantly to Airbnb's valuation surpassing $100 billion, demonstrating the efficacy of PIC in managing startup investments.

How PICs Influence VC Decision-Making

Portfolio Investment Companies (PICs) significantly influence venture capital decision-making by serving as critical benchmarks for assessing market potential and scalability of startups. Venture capitalists analyze PIC performance metrics such as revenue growth, customer acquisition cost, and burn rate to identify promising investment opportunities and mitigate risk. The strategic alignment and exit track record of PICs guide VCs in optimizing capital allocation and portfolio diversification.

Legal Considerations for PICs in Venture Capital

Private Investment Companies (PICs) in venture capital must navigate complex legal frameworks including securities regulations, fiduciary duties, and compliance with the Investment Company Act of 1940. Structuring PICs often involves ensuring proper registration exemptions, such as those under Regulation D, to avoid extensive disclosure and filing requirements. Legal counsel is essential to draft governance documents that protect investor interests and outline capital commitments and exit strategies effectively.

Challenges Faced by PICs in VC Environments

Portfolio Investment Companies (PICs) in venture capital frequently encounter challenges such as cash flow management and scaling operations amidst rapid growth demands. Navigating valuation fluctuations and securing subsequent funding rounds pose significant hurdles due to market volatility and investor expectations. Compliance with evolving regulatory frameworks and maintaining governance standards also complicate PICs' strategic execution in competitive VC environments.

Future Trends for PICs in Venture Capital

Payment-in-kind (PIK) securities are emerging as a strategic tool in venture capital, offering startups the flexibility to defer cash interest payments by issuing additional debt or equity. Future trends indicate increased adoption of PIK instruments in growth-stage financing, driven by their potential to preserve cash flow while aligning investor and company interests through equity upside. Advances in blockchain technology and smart contracts are also expected to enhance transparency, automate payment processes, and reduce risks associated with traditional PIK agreements in venture capital deals.

example of PIC in venture capital Infographic

samplerz.com

samplerz.com