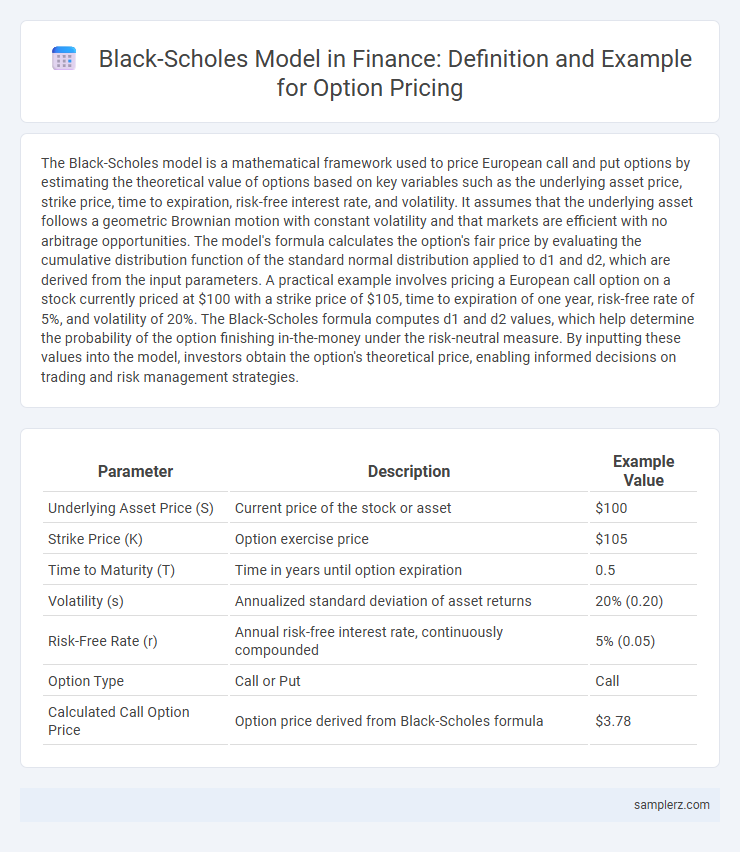

The Black-Scholes model is a mathematical framework used to price European call and put options by estimating the theoretical value of options based on key variables such as the underlying asset price, strike price, time to expiration, risk-free interest rate, and volatility. It assumes that the underlying asset follows a geometric Brownian motion with constant volatility and that markets are efficient with no arbitrage opportunities. The model's formula calculates the option's fair price by evaluating the cumulative distribution function of the standard normal distribution applied to d1 and d2, which are derived from the input parameters. A practical example involves pricing a European call option on a stock currently priced at $100 with a strike price of $105, time to expiration of one year, risk-free rate of 5%, and volatility of 20%. The Black-Scholes formula computes d1 and d2 values, which help determine the probability of the option finishing in-the-money under the risk-neutral measure. By inputting these values into the model, investors obtain the option's theoretical price, enabling informed decisions on trading and risk management strategies.

Table of Comparison

| Parameter | Description | Example Value |

|---|---|---|

| Underlying Asset Price (S) | Current price of the stock or asset | $100 |

| Strike Price (K) | Option exercise price | $105 |

| Time to Maturity (T) | Time in years until option expiration | 0.5 |

| Volatility (s) | Annualized standard deviation of asset returns | 20% (0.20) |

| Risk-Free Rate (r) | Annual risk-free interest rate, continuously compounded | 5% (0.05) |

| Option Type | Call or Put | Call |

| Calculated Call Option Price | Option price derived from Black-Scholes formula | $3.78 |

Introduction to the Black-Scholes Model

The Black-Scholes model provides a mathematical framework for pricing European call and put options by estimating the option's theoretical value based on factors such as the underlying asset price, strike price, time to expiration, risk-free interest rate, and asset volatility. It uses a partial differential equation to model the price dynamics of the option under the assumption of constant volatility and log-normal distribution of asset returns. The model serves as a foundational tool in modern financial markets for managing option pricing and risk assessment.

Key Assumptions of the Black-Scholes Formula

The Black-Scholes formula assumes constant volatility, a risk-free interest rate, and a lognormal distribution of asset prices, which simplifies option pricing. It presumes no dividends are paid during the option's life and that markets are frictionless with continuous trading. These key assumptions enable the model to provide theoretical prices for European call and put options under idealized market conditions.

Essential Variables in the Black-Scholes Calculation

The Black-Scholes model fundamentally relies on several essential variables: the current stock price (S), the strike price (K) of the option, the time to expiration (T), the risk-free interest rate (r), and the volatility of the underlying asset (s). Accurate estimation of volatility, often derived from historical price data or implied from market prices, significantly impacts option pricing precision. The interplay of these variables within the Black-Scholes formula calculates the theoretical value of European call and put options under the assumption of lognormal price distribution and no arbitrage.

Step-by-Step Example of Black-Scholes Option Pricing

The Black-Scholes option pricing model calculates the theoretical value of European call and put options using inputs such as the current stock price, strike price, time to expiration, risk-free interest rate, and stock volatility. By computing the d1 and d2 variables, the model applies the cumulative distribution function of the standard normal distribution to estimate the probability-adjusted expected payoff. This step-by-step approach provides traders with a precise method to determine fair option prices, essential for effective risk management and arbitrage strategies.

Calculating the Theoretical Price of a Call Option

The Black-Scholes model calculates the theoretical price of a call option by incorporating factors such as the underlying asset price, strike price, time to expiration, risk-free interest rate, and volatility. It uses the cumulative distribution function of a standard normal distribution to estimate the probability-weighted expected payoff. This model provides a closed-form solution that helps traders assess fair value and make informed decisions in options trading.

Black-Scholes Example for a Put Option

The Black-Scholes model calculates the theoretical price of a European put option by inputting variables such as the current stock price, strike price, time to expiration, risk-free interest rate, and stock volatility. For instance, if a stock trades at $50, the strike price is $55, time to expiration is 6 months, the risk-free rate is 2%, and volatility is 25%, the model determines the put option's fair value by discounting the expected payoff under a risk-neutral measure. This formula assists investors in estimating the option's premium, facilitating informed decision-making in options trading and risk management.

Interpreting Black-Scholes Output: What the Numbers Mean

The Black-Scholes model outputs critical option pricing measures such as the option's theoretical price, delta, gamma, theta, vega, and rho, which quantify sensitivity to various market factors. Delta represents the rate of change of the option price relative to the underlying asset price, while gamma measures the acceleration of delta as the asset price changes. Theta indicates time decay, vega reflects sensitivity to volatility changes, and rho shows sensitivity to interest rate fluctuations, all helping traders in risk management and strategic decision-making.

Limitations of the Black-Scholes Example

The Black-Scholes model assumes constant volatility and interest rates, which often do not reflect real market conditions, leading to inaccurate pricing of options during periods of high volatility or market stress. It also presumes log-normal distribution of stock prices, ignoring potential for jumps or fat tails in asset returns that can cause significant mispricing. Furthermore, the model excludes considerations for dividends and early exercise features, limiting its applicability to American options and reducing its practical relevance in complex trading environments.

Practical Application of Black-Scholes in Real Markets

The Black-Scholes model is widely employed to price European call and put options by estimating the theoretical value based on variables such as stock price, strike price, time to expiration, volatility, and risk-free interest rate. Traders use the model to hedge portfolios, calculate Greeks, and identify arbitrage opportunities in equity, index, and commodity options markets. Despite assumptions like constant volatility and log-normal price distribution, Black-Scholes remains a foundational tool for risk management and option pricing in real-world financial markets.

Black-Scholes Model: Common Mistakes in Worked Examples

Misapplying the Black-Scholes formula often stems from incorrect input of volatility or time to expiration, leading to significant pricing errors in call and put options. Ignoring dividend yields or using discrete rather than continuous compounding can distort option valuations, affecting hedging strategies and risk assessments. Careful calibration of model parameters and consistent units are essential for accurate option pricing and effective financial decision-making.

example of black-scholes in option Infographic

samplerz.com

samplerz.com