A stub in a merger refers to the small portion of a company's shares that remain outstanding after the bulk of its assets and liabilities are acquired by another company. This residual equity often represents shares in a subsidiary or a remnant business unit that continues to operate independently. Stubs typically arise when the merger agreement specifies partial acquisition, leaving minority ownership interest with original shareholders. Investors analyzing merger transactions focus on stubs as potential value opportunities or risks due to their unique capital structure and uncertain future. Financial data related to stubs includes market prices, outstanding share count, and the underlying asset value of the remaining business unit. Understanding stubs is critical for accurate valuation and strategic decision-making during post-merger integration.

Table of Comparison

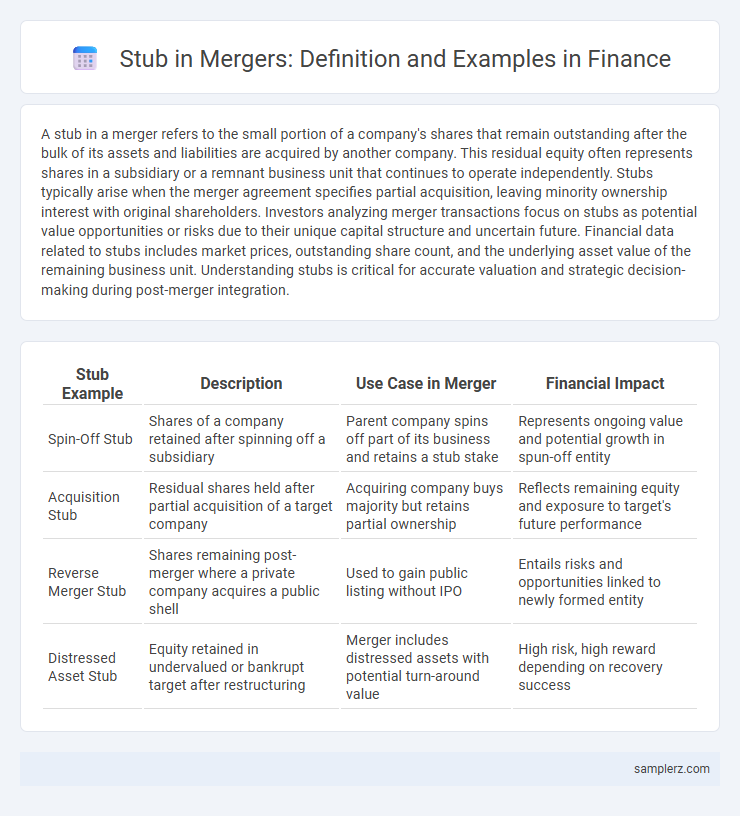

| Stub Example | Description | Use Case in Merger | Financial Impact |

|---|---|---|---|

| Spin-Off Stub | Shares of a company retained after spinning off a subsidiary | Parent company spins off part of its business and retains a stub stake | Represents ongoing value and potential growth in spun-off entity |

| Acquisition Stub | Residual shares held after partial acquisition of a target company | Acquiring company buys majority but retains partial ownership | Reflects remaining equity and exposure to target's future performance |

| Reverse Merger Stub | Shares remaining post-merger where a private company acquires a public shell | Used to gain public listing without IPO | Entails risks and opportunities linked to newly formed entity |

| Distressed Asset Stub | Equity retained in undervalued or bankrupt target after restructuring | Merger includes distressed assets with potential turn-around value | High risk, high reward depending on recovery success |

Understanding Stubs in Merger Transactions

In merger transactions, a stub represents the remaining shares of a company after most assets or business lines have been sold or spun off, often retaining residual value for investors. Understanding stubs is crucial for assessing post-merger equity value, as these shares reflect the leftover company that might hold strategic assets or liabilities. Analysts evaluate stubs to determine potential investment risks and opportunities based on the company's retained operations or cash reserves.

Key Characteristics of a Stub in Mergers

A stub in mergers represents the remaining equity interest in a company after a significant portion of its assets or operations have been sold or merged, often resulting in a smaller, standalone entity. Key characteristics include a substantial reduction in market capitalization, retention of core assets or liabilities not included in the transaction, and potential volatility due to uncertainty about the stub's future profitability and strategic direction. Investors often view stubs as high-risk, high-reward opportunities because they may unlock hidden value or face significant operational challenges post-merger.

Real-World Examples of Stubs Post-Merger

A notable example of a stub entity post-merger is the Sprint Corporation after its acquisition by T-Mobile US in 2020, where Sprint's remaining assets were spun off as a stub to manage legacy liabilities and contractual obligations. Another real-world case involves the merger of Dow Chemical and DuPont in 2017, leading to the creation of stub companies retaining specific business segments during the corporate restructuring phase. These stubs serve critical roles in isolating risks, handling outstanding debts, and preserving shareholder value within complex merger transactions.

Stub Equity: Definition and Significance

Stub equity refers to the remaining shares of a company that continue to trade after a partial acquisition or spin-off during a merger. This equity represents a smaller portion of the original company's ownership and often holds unique risk and return characteristics due to the altered capital structure. Investors analyze stub equity to gauge potential value and assess strategic implications in post-merger scenarios.

Notable Stub Structures in Recent M&A Deals

In recent high-profile mergers such as the Disney-Fox deal, stub structures played a critical role by isolating specific assets like Fox's regional sports networks into a standalone entity to satisfy regulatory requirements. The AT&T-Time Warner merger also utilized a stub to separate WarnerMedia's debt obligations, facilitating clearer valuation and risk assessment for investors. These examples highlight how stubs serve as strategic financial instruments to streamline complex transactions and optimize capital structure during mergers and acquisitions.

How Stubs Affect Shareholder Value

In mergers, stubs represent the residual equity portion retained by shareholders after significant asset divestitures, directly impacting shareholder value by concentrating ownership in the remaining business operations. The valuation of stubs hinges on the market's perception of the underlying asset's future cash flows and growth potential, which can lead to price volatility and affect shareholder returns. Investors must evaluate stub risks carefully as these holdings can either unlock hidden value or expose shareholders to concentrated risks.

Tax Implications of Stub Shares in Mergers

Stub shares in mergers often generate complex tax implications, as they represent retained equity in the surviving company post-transaction. Tax treatment varies depending on jurisdiction, but generally, stub shares may trigger capital gains taxes when sold, while holding them could result in deferred tax liabilities. Proper tax planning and consultation with tax advisors are essential to navigate potential impacts on shareholder tax obligations and optimize after-tax returns.

Valuation Methods for Stub Entities

Stub entities in mergers represent residual portions of the original company after a spin-off or carve-out, often requiring specialized valuation methods such as discounted cash flow (DCF) analysis, comparable company multiples, and precedent transactions to accurately assess their worth. Accurate stub valuation focuses on projected cash flows, adjusted equity interests, and market conditions to reflect the entity's standalone value amid structural changes. Employing these methods ensures transparent evaluation, aiding stakeholders in making informed investment decisions regarding the stub entity.

Investor Considerations with Merger Stubs

Investors evaluating merger stubs must analyze the remaining equity's value, which often represents a small residual interest after a significant asset sale or spin-off. Assessing potential upside requires scrutinizing the stub company's balance sheet strength, cash flow prospects, and litigation risks associated with the merger. Understanding market sentiment and the likelihood of successful restructuring informs decisions on whether the stub offers an attractive risk-reward profile.

Case Studies: Successful Use of Stubs in M&A

In the merger between Amazon and Whole Foods, the use of a stub facilitated the seamless integration of the remaining independent assets, preserving shareholder value and enabling focused operational strategies on essential business units. Another notable case is the Time Warner and AT&T merger, where a stub entity allowed for the spin-off of non-core assets, enhancing clarity and efficiency in the combined company's portfolio management. These examples highlight how stubs act as strategic tools in mergers and acquisitions to manage remnants effectively, optimize asset value, and streamline complex transactions.

example of stub in merger Infographic

samplerz.com

samplerz.com