In fund distribution, a waterfall model outlines the priority of payments to investors and stakeholders in a structured sequence. The initial tier often involves returning the limited partners' (LPs) invested capital, ensuring they recover their principal before profits are shared. Subsequent tiers allocate profits based on predetermined ratios, commonly referred to as carried interest or promote, favoring the general partner (GP) after LPs receive their preferred return. Waterfall structures are essential for private equity and venture capital fund distributions, providing clarity on cash flow allocation among investors. Data points like hurdle rates, preferred returns, and catch-up provisions play critical roles in defining the waterfall tiers. Entities such as LPs, GPs, and fund managers rely on these models to align incentives and manage risk throughout the investment lifecycle.

Table of Comparison

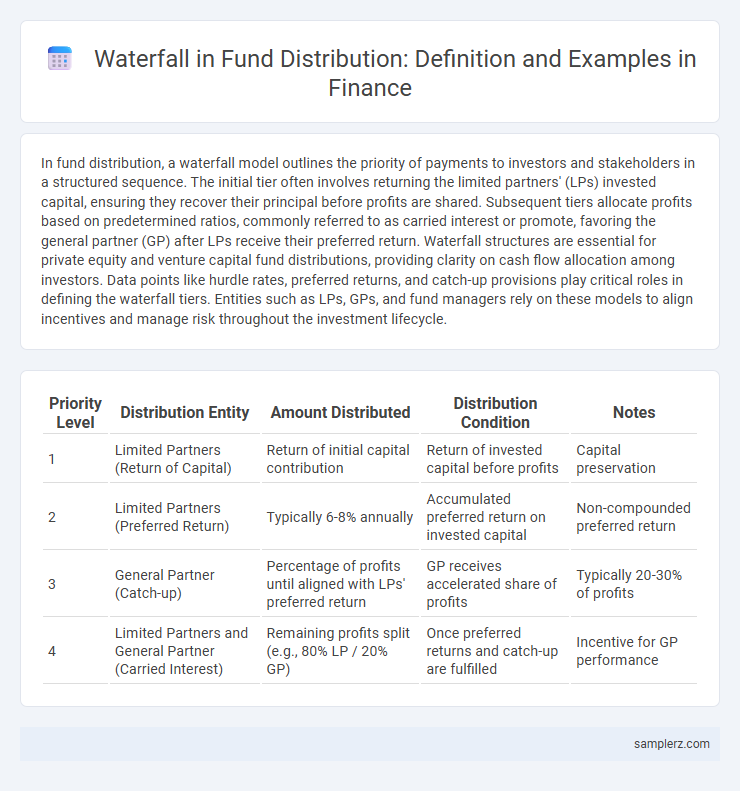

| Priority Level | Distribution Entity | Amount Distributed | Distribution Condition | Notes |

|---|---|---|---|---|

| 1 | Limited Partners (Return of Capital) | Return of initial capital contribution | Return of invested capital before profits | Capital preservation |

| 2 | Limited Partners (Preferred Return) | Typically 6-8% annually | Accumulated preferred return on invested capital | Non-compounded preferred return |

| 3 | General Partner (Catch-up) | Percentage of profits until aligned with LPs' preferred return | GP receives accelerated share of profits | Typically 20-30% of profits |

| 4 | Limited Partners and General Partner (Carried Interest) | Remaining profits split (e.g., 80% LP / 20% GP) | Once preferred returns and catch-up are fulfilled | Incentive for GP performance |

Introduction to Waterfall Structures in Fund Distribution

Waterfall structures in fund distribution allocate investment returns sequentially, prioritizing the return of capital to limited partners before general partners receive profit-sharing. This tiered approach ensures that early distributions cover initial investments and preferred returns, followed by carried interest allocations based on predefined hurdles. Understanding these tiers is crucial for transparent fund management and aligning incentives between investors and fund managers.

Key Components of Fund Waterfall Models

Fund waterfall models in finance illustrate the sequential distribution of returns, prioritizing capital recovery, preferred returns, and catch-up provisions before profit sharing among limited and general partners. Key components include the return of contributed capital, hurdle rates that trigger incentive fees, and carried interest structures ensuring aligned stakeholder interests. This tiered distribution mechanism optimizes capital allocation and performance incentives in private equity and real estate fund structures.

Step-by-Step Example of a Fund Distribution Waterfall

A fund distribution waterfall outlines the sequential allocation of returns to investors and fund managers based on predefined tiers. Initially, capital contributions are returned to limited partners until fully reimbursed, followed by a preferred return, often around 8%, to the limited partners. Once preferred returns are met, remaining profits are split according to the carried interest arrangement, typically 80% to limited partners and 20% to the general partner, completing the step-by-step distribution process.

Preferred Return and Hurdle Rates Explained

In fund distribution, the waterfall structure prioritizes returning capital to investors before profits are shared. Preferred return is a specified minimum annual return, often around 8%, paid to limited partners before the general partners receive any carried interest. Hurdle rates define performance benchmarks that must be met for fund managers to earn profit shares, ensuring alignment of interests and incentivizing exceeding targets.

Catch-Up Provisions in Waterfall Distributions

Catch-up provisions in waterfall fund distributions allow general partners to receive a larger share of profits after limited partners achieve a preferred return, ensuring the GP catches up to an agreed-upon allocation. This mechanism typically activates once the LP hurdle rate, such as an 8% preferred return, is met, shifting the distribution split in favor of the GP until the predetermined catch-up percentage, often 20-30%, is reached. Catch-up tiers optimize alignment of interests by balancing risk and reward between limited partners and general partners during capital return phases.

Carried Interest and Promoter Share Allocation

In fund distribution, the waterfall structure prioritizes returning the limited partners' capital before allocating carried interest to the general partners, typically set at 20% of profits beyond the preferred return hurdle. Carried interest serves as a performance fee rewarding the promoter or fund manager for exceeding investment benchmarks, aligning their interests with investors. Promoter share allocation often includes both a promote percentage on gains and potential co-investment contributions to enhance alignment and incentivize superior fund performance.

Real-Life Case Study: Private Equity Fund Waterfall

A real-life private equity fund waterfall demonstrates how investment returns are allocated among limited partners and general partners through multiple tiers, starting with capital return and preferred return hurdles before carried interest is distributed. In the typical structure, the limited partners first receive their invested capital back, followed by a preferred return, often around 8%, ensuring early reward for risk. Once these thresholds are met, the general partner earns a portion of the profits, usually 20%, incentivizing performance and aligning interests between investors and fund managers.

Common Variations in Waterfall Structures

Common variations in waterfall structures for fund distribution include the American, European, and deal-by-deal waterfalls, each dictating different timing and conditions for profit allocation between limited partners (LPs) and general partners (GPs). The American waterfall allows the GP to receive carried interest on each deal after LPs recover their investment and preferred return, while the European waterfall requires LPs to be fully repaid across the entire fund before any carried interest is paid to the GP. Deal-by-deal waterfalls accelerate GP incentives but increase risk for LPs, whereas the European model offers greater capital preservation for LPs by aggregating returns fund-wide.

Best Practices for Modeling Waterfall Distributions

Modeling waterfall distributions in fund finance requires clear structuring of cash flow tiers to align with investor preferences and legal agreements. Utilizing precise tier thresholds and incorporating IRR-based hurdles enhances accuracy in predicting payout sequences and timing. Implementing scenario analysis alongside dynamic sensitivity testing ensures robustness in distribution models against market fluctuations.

Impact of Waterfall Structures on Investor Returns

Waterfall structures in fund distribution dictate the sequential allocation of returns, ensuring that investors receive their preferred return before the general partners participate in profits. This hierarchical payout system significantly impacts investor returns by prioritizing capital recovery and performance benchmarks, which enhances alignment of interests and incentivizes fund managers. Variations in hurdle rates and catch-up provisions within the waterfall can lead to substantial differences in net investor gains, influencing investment decisions and fund attractiveness.

example of Waterfall in fund distribution Infographic

samplerz.com

samplerz.com