A Yankee bond is a U.S. dollar-denominated bond issued in the United States by foreign entities, including corporations and governments. One notable example is Toyota Motor Corporation, which issued Yankee bonds to raise capital from American investors while avoiding currency risk associated with foreign currencies. These bonds allow foreign issuers to tap into the deep U.S. capital markets and benefit from liquidity and investor demand. Another example involves the Brazilian government, which issued Yankee bonds during periods of financial need to attract U.S. investors with attractive yields. These bonds are registered with the Securities and Exchange Commission (SEC) and comply with U.S. regulations, making them a viable funding option for international issuers. The issuance of Yankee bonds helps diversify funding sources and access the large pool of U.S. pension funds, mutual funds, and institutional investors.

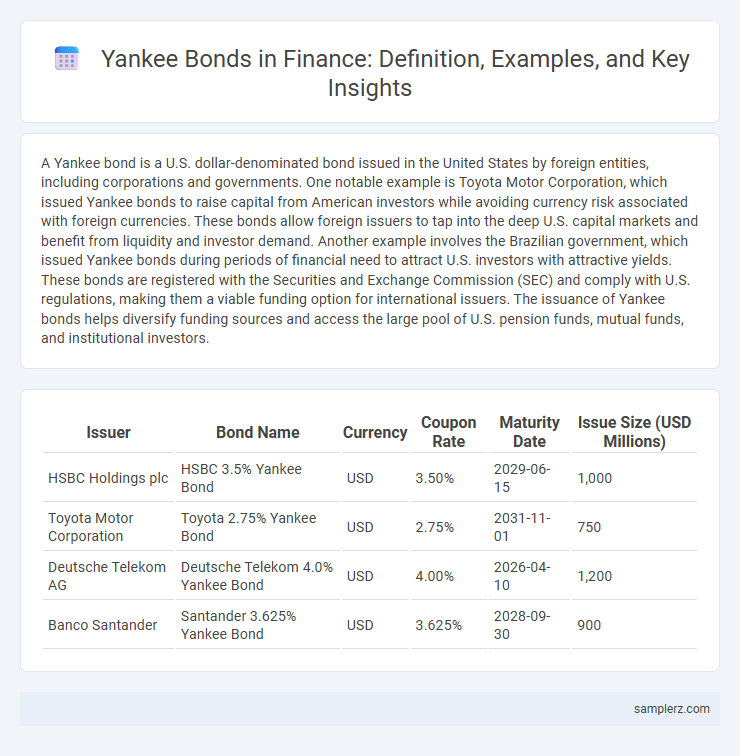

Table of Comparison

| Issuer | Bond Name | Currency | Coupon Rate | Maturity Date | Issue Size (USD Millions) |

|---|---|---|---|---|---|

| HSBC Holdings plc | HSBC 3.5% Yankee Bond | USD | 3.50% | 2029-06-15 | 1,000 |

| Toyota Motor Corporation | Toyota 2.75% Yankee Bond | USD | 2.75% | 2031-11-01 | 750 |

| Deutsche Telekom AG | Deutsche Telekom 4.0% Yankee Bond | USD | 4.00% | 2026-04-10 | 1,200 |

| Banco Santander | Santander 3.625% Yankee Bond | USD | 3.625% | 2028-09-30 | 900 |

Understanding Yankee Bonds: An Overview

Yankee bonds are U.S. dollar-denominated bonds issued by foreign entities in the United States to access American capital markets. These bonds offer investors higher yields compared to domestic bonds due to their increased credit and currency risks. Understanding the regulatory requirements and typical coupon structures of Yankee bonds is essential for investors seeking international diversification within U.S. financial instruments.

Key Features of Yankee Bonds

Yankee bonds are U.S. dollar-denominated bonds issued by foreign entities in the U.S. domestic market, providing access to American investors. Key features include high liquidity, fixed or floating interest rates, and compliance with U.S. Securities and Exchange Commission regulations. These bonds often offer attractive yields reflecting the issuer's credit risk and the advantage of diversifying currency exposure without foreign exchange risk.

Historical Background of Yankee Bonds

Yankee bonds emerged in the early 20th century as foreign companies sought to tap into the deep liquidity of the U.S. capital markets by issuing dollar-denominated debt. The first notable issuance occurred in 1903 when the Italian government issued bonds in the United States to finance infrastructure projects, setting a precedent for subsequent sovereign and corporate issuers. Over time, these bonds facilitated cross-border investment and expanded the global reach of American investors, reflecting the growing interconnectedness of international finance.

Notable Examples of Yankee Bond Issuances

Notable examples of Yankee bond issuances include Toyota's $2 billion bond offering in 2020, which attracted significant investor interest due to its strong credit rating and favorable interest rates. Another landmark deal was the $4.5 billion Yankee bond issued by Samsung Electronics in 2014, marking one of the largest offerings by a foreign technology company. These issuances demonstrate how multinational corporations leverage Yankee bonds to access U.S. capital markets and diversify their debt portfolios efficiently.

Advantages and Risks of Investing in Yankee Bonds

Yankee bonds offer U.S. investors diversification benefits by providing exposure to foreign issuers, often featuring higher yields compared to domestic bonds due to varying interest rate environments. These bonds carry currency risk and potential political instability linked to the issuer's country, which can affect repayment reliability and bond prices. Understanding credit risk and regulatory differences is crucial for managing investment exposure and achieving optimal portfolio balance.

Regulatory Considerations for Yankee Bonds

Yankee bonds, issued by foreign entities in the U.S. market, must comply with the Securities Act of 1933 and are subject to registration requirements unless qualifying for exemptions such as Rule 144A or Regulation S. The Securities and Exchange Commission (SEC) enforces strict disclosure obligations, including filing detailed prospectuses that outline financial statements and risk factors to protect U.S. investors. Furthermore, these bonds are governed by the Foreign Account Tax Compliance Act (FATCA), requiring withholding on certain payments to non-compliant foreign financial institutions, impacting issuers' structuring strategies.

The Role of Yankee Bonds in Global Finance

Yankee bonds, issued by foreign entities in the U.S. dollar-denominated market, play a critical role in global finance by providing international issuers access to deep and liquid American capital markets. These bonds enhance diversification opportunities for U.S. investors while facilitating efficient capital flow across borders and currency exposure management. The liquidity and regulatory environment of the U.S. bond market make Yankee bonds attractive instruments for multinational corporations and governments seeking favorable financing terms.

Comparison: Yankee Bonds vs. Other Foreign Bonds

Yankee bonds are U.S. dollar-denominated bonds issued by foreign entities in the American market, offering investors exposure to foreign issuers with reduced currency risk compared to Eurobonds or Samurai bonds, which are issued in foreign currencies. Unlike Eurobonds, which are typically issued in international markets and may have less stringent regulatory oversight, Yankee bonds must comply with U.S. Securities and Exchange Commission (SEC) regulations, providing greater transparency and investor protection. The prominent difference between Yankee bonds and other foreign bonds lies in currency denomination, regulatory environment, and target investor base, making Yankee bonds attractive for investors seeking dollar-based foreign investments with enhanced legal safeguards.

Recent Trends in Yankee Bond Markets

Yankee bonds, issued by foreign entities in the U.S. dollar market, have witnessed a surge in issuance driven by favorable interest rates and increased investor appetite for diversification. Recent trends highlight a growing participation from emerging market corporations targeting lower borrowing costs and broader capital access. Analysts note enhanced liquidity and a shift toward green and sustainable Yankee bonds, reflecting evolving investor preferences and regulatory frameworks.

How to Invest in Yankee Bonds: A Step-by-Step Guide

Investing in Yankee bonds begins with researching U.S. dollar-denominated bonds issued by foreign entities in the U.S. market, available through major brokerage accounts. Investors should evaluate credit ratings, maturity dates, and yield spreads to assess risk and return profiles. Finally, purchasing Yankee bonds involves placing orders via brokers, monitoring market conditions, and diversifying holdings to manage currency and interest rate risks effectively.

example of yankee in bond Infographic

samplerz.com

samplerz.com