A Tenbagger in stock investment refers to a stock that has increased in value by ten times its initial purchase price. For example, Amazon's stock experienced a tenbagger return for early investors who bought shares in the late 1990s and held onto them through significant growth phases. This type of investment highlights substantial capital appreciation driven by strong company performance and market dominance. Another notable example is Netflix, which transformed from a niche DVD rental service to a global streaming giant, resulting in its stock value appreciating more than tenfold over a decade. Tesla also qualifies as a tenbagger, as its shares surged dramatically due to breakthroughs in electric vehicles and renewable energy technology. These instances demonstrate how tenbagger stocks are typically characterized by innovation, market leadership, and sustained revenue growth.

Table of Comparison

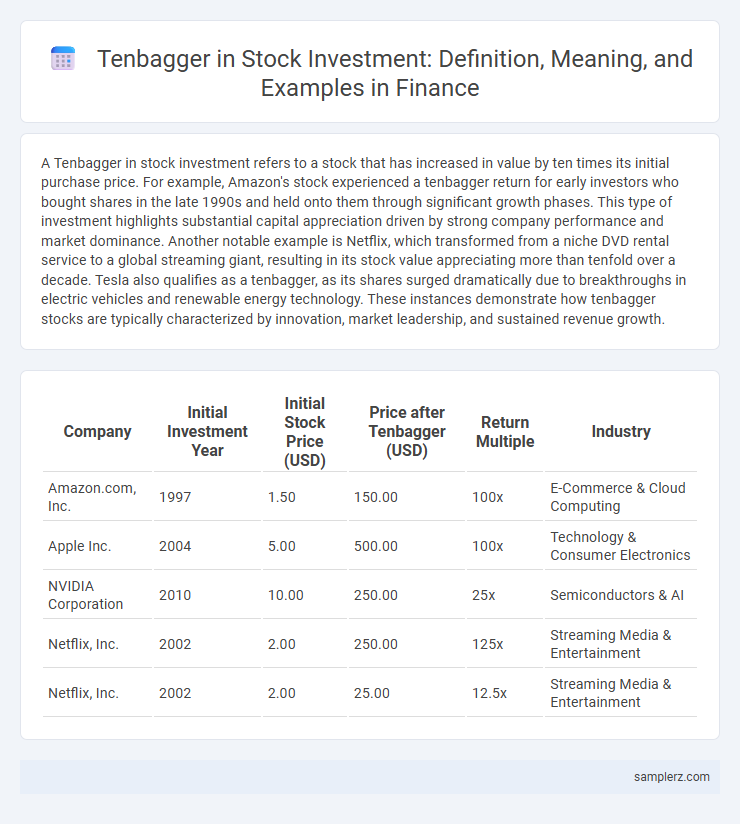

| Company | Initial Investment Year | Initial Stock Price (USD) | Price after Tenbagger (USD) | Return Multiple | Industry |

|---|---|---|---|---|---|

| Amazon.com, Inc. | 1997 | 1.50 | 150.00 | 100x | E-Commerce & Cloud Computing |

| Apple Inc. | 2004 | 5.00 | 500.00 | 100x | Technology & Consumer Electronics |

| NVIDIA Corporation | 2010 | 10.00 | 250.00 | 25x | Semiconductors & AI |

| Netflix, Inc. | 2002 | 2.00 | 250.00 | 125x | Streaming Media & Entertainment |

| Netflix, Inc. | 2002 | 2.00 | 25.00 | 12.5x | Streaming Media & Entertainment |

What is a Tenbagger in Stock Investment?

A Tenbagger in stock investment refers to an equity that appreciates to ten times its original purchase price, representing a 1,000% return on investment. Legendary investor Peter Lynch popularized the term in his book "One Up on Wall Street," highlighting its significance for long-term wealth creation. Identifying potential Tenbaggers involves thorough fundamental analysis, strong growth prospects, and competitive advantages within high-growth sectors like technology or healthcare.

Historical Overview of Tenbaggers in the Stock Market

Tenbaggers are stocks that have increased in value by ten times or more, with historical examples including Amazon, Apple, and Netflix, which delivered extraordinary returns for investors over decades. These companies demonstrated consistent innovation, market leadership, and revenue growth, transforming entire industries while generating significant wealth. Early investment in these stocks highlights the potential rewards of long-term holding strategies in the stock market.

Famous Tenbagger Stocks: Real-World Examples

Famous Tenbagger stocks include Amazon, which surged over 10,000% from its IPO in 1997 to recent years, exemplifying exponential growth. Apple also stands out, with its stock price increasing more than tenfold since the early 2000s, driven by innovation in consumer technology. Netflix transformed from a DVD rental service to a streaming giant, delivering investors tenbagger returns as it expanded globally and disrupted traditional media.

Key Characteristics of Tenbagger Companies

Tenbagger companies typically exhibit strong competitive advantages, such as a unique product or service, robust market share, and scalable business models that drive exponential revenue growth. These firms often demonstrate consistent earnings growth, high return on equity (ROE), and effective capital allocation strategies that compound shareholder value over time. Their management teams prioritize innovation and reinvestment while maintaining disciplined financial practices, enabling sustainable long-term performance.

How to Identify Potential Tenbagger Stocks

Identifying potential Tenbagger stocks requires analyzing companies with strong revenue growth, scalable business models, and sustainable competitive advantages such as unique intellectual property or dominant market positions. Key financial metrics include consistent earnings growth, high return on equity (ROE), and manageable debt levels, which indicate financial stability and operational efficiency. Investors should also scrutinize industry trends, management quality, and market potential to pinpoint stocks capable of delivering tenfold returns over the long term.

Case Study: Early Investors in Apple Inc.

Early investors in Apple Inc. experienced a classic tenbagger, achieving a 10x or more return on their initial investment as the company's stock surged from its 1980 IPO price of $22 per share to over $200 by the 1990s. Apple's innovative product launches, including the iPod, iPhone, and iPad, significantly boosted its market capitalization and investor wealth. This case study demonstrates the potential for exponential gains through long-term investment in disruptive technology firms within the stock market.

Lessons Learned from Tenbagger Success Stories

High-growth stocks like Amazon and Apple serve as prime examples of tenbaggers, delivering returns of ten times or more. Key lessons from these success stories include the importance of long-term investment horizons, rigorous research into company fundamentals, and patience during market volatility. Investors benefit from focusing on innovative companies with strong competitive advantages and scalable business models to maximize potential tenbagger outcomes.

Major Risks Associated with Pursuing Tenbaggers

Pursuing tenbagger stocks involves significant risks such as extreme volatility, where share prices can fluctuate wildly due to market sentiment or company performance. Investors face the danger of overconcentration, leading to substantial portfolio losses if the high-growth stock fails to meet expectations. Additionally, the speculative nature of tenbagger opportunities often increases exposure to corporate mismanagement, regulatory changes, or disruptive competitors that can erode the stock's value rapidly.

Strategies for Finding the Next Tenbagger

Identifying the next tenbagger in stock investment involves focusing on companies with scalable business models, strong competitive advantages, and consistent revenue growth exceeding 20% annually. Screening for stocks in emerging industries with low market capitalization allows investors to discover undervalued firms poised for exponential expansion. Emphasizing management quality, high return on equity (ROE) above 15%, and reinvestment in innovation supports long-term wealth creation through compounded returns.

Expert Insights on Long-Term Investing and Tenbaggers

A tenbagger refers to an investment that appreciates tenfold, a concept popularized by legendary investor Peter Lynch, who identified key traits in companies with high growth potential such as strong fundamentals and competitive advantages. Expert insights emphasize patience, thorough research, and understanding market cycles as essential for identifying and holding tenbagger stocks over the long term, often in sectors like technology or healthcare. Consistent reinvestment of dividends and tracking earnings growth are critical strategies aligned with achieving tenbagger status in stock portfolios.

example of Tenbagger in stock investment Infographic

samplerz.com

samplerz.com